Bookkeeping – a word that inspires dread in many business owners. Keeping track of a company’s finances can seem overwhelming. But the good news is that it doesn’t have to be this way. Once managers learn the basic terms and concepts, the subject becomes a lot less intimidating.

It’s important to keep accurate books because it’s the only way for managers to be in complete control of their ships. They’ll know when to pay the bills, what they can and can’t purchase, and exactly where their operations need to improve. On the other hand, neglecting a company’s books is a sure path to failure. If a manager can’t keep track of their cash flow, how can they make informed decisions about their business?

Bookkeeping 101: A Beginner’s Guide to Bookkeeping

For the uninitiated, there might be some confusion between what it is exactly that a bookkeeper does for a business or an individual. Do they file taxes, respond to audits, provide financial guidance? In short, what is bookkeeping? Bookkeeping is simply another word for record-keeping – specifically, keeping records of all the financial transactions of a company or individual. This means things like sales, purchases, wages, bills, rent – basically all movements of money, in and out.

There are many advantages to keeping accurate books. Managers will be able to catch any mistakes they’re making, such as paying too much tax, for example. Another advantage is that banks are more likely to give businesses a loan if they can show accurate financial records.

There are two keys to good bookkeeping: being organized, and knowing the right vocabulary.

Single vs. Double Entry Bookkeeping

There are two types of bookkeeping system. Single-entry is an incomplete system in which the bookkeeper only records one side of a transaction. This system amounts to a list of all transactions and is only suitable for very small businesses.

Double-entry is a complete bookkeeping system which records both sides of all transactions – that is, the effect on both accounts. Because all the transactions have to be balanced, mistakes are extremely easy to spot, making the double-entry system virtually error-proof. This system is suitable for all types of business.

Balance Sheet Basics

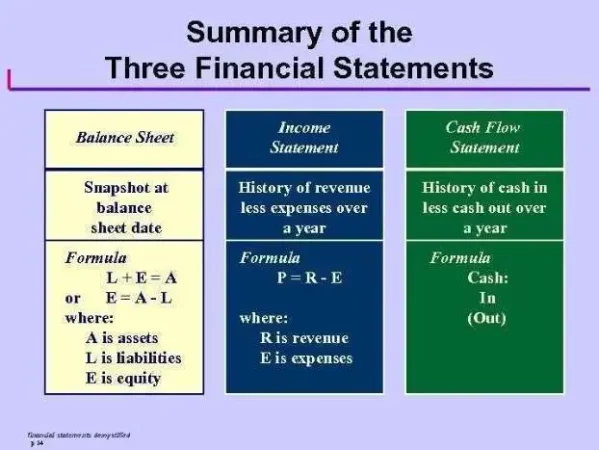

A balance sheet is a statement showing the exact financial status of a business. That means its assets, its liabilities, and its equity.

Balance sheets have three main components:

- Assets – resources used by the company to operate

- Liabilities – debts held by the company

- Owner’s equity – share of company assets owned by the owners/shareholders.

These three components have to balance – hence the name balance sheet. The statement is based on a simple business equation: assets = equity + liabilities.

Income Statement Basics

An Income Statement, sometimes called a profit and loss statement, is a report that shows how much money a company spent, and how much revenue it made, during a given period, usually a month or a year. Basically, it tracks the following items:

- Total revenue – all income for services rendered and products sold;

- Total cost of goods sold (COGS) – expenses directly related to generating sales revenue, such as raw materials;

- Total expenses – things that have to be paid for in order to keep a business going (administrative costs, wages, taxes, equipment costs, etc.). Together, these three data points allow a manager to calculate net income, or how much money they have left to reinvest in their business and/or take home.

This is why it is important to keep track of every revenue stream and every expense. Only then will there be a complete picture of a company’s net income.

Cash Flow Statement Basics

If a manager asks themselves “why doesn’t the balance in my bank account match the amount of money I made?”, the cash flow statement is where they’ll find the answer. They don’t need to know how to prepare one, but they should know how to read them. They indicate sources of revenue, what that cash was used for, and the resulting change in balance over time.

Cash vs. Accrual Basis Accounting

The difference between cash vs. accrual basis accounting methods is in the timing – in other words, when transactions are recorded.

Cash-based accounting is a very intuitive system with which revenue and expenses are only recorded when money changes hands. It is similar to the single-entry data system described earlier. This system is simple to operate, but it only focuses on cash.

Accrual accounting records all transactions at the time they are made, which is often before money has actually been exchanged. Because it covers every aspect of business operations – accounting for cash, credit and advances – it is a far more complex and accurate system, and requires the use of the double-entry system. Accrual accounting is the accounting system required by the GAAP.

Bookkeeping Software or DIY system?

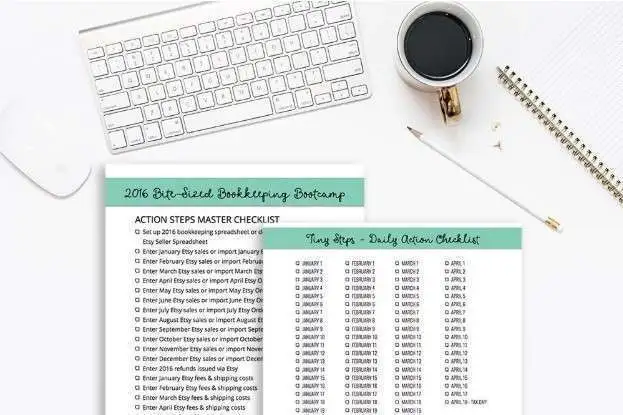

Managers can make their own free spreadsheets to keep track of all their company’s transactions, but that will be a big job. It will require a lot of data entry and substantial bookkeeping knowledge. Accounting and/or bookkeeping software will do the job a lot more efficiently, so it could be a worthwhile investment.

Prices vary, but many of the better systems are capable of generating invoices, paying bills, and automatically generating financial statements. It is important to research well before purchase – accounting software has to be compatible with the specific needs of the business (for example, importing data from an Etsy store).

Bookkeeping Best Practices

- Open a new bank account

Business owners should set up a separate bank account, and credit card, specifically for their business. It can even be a personal account – they just have to make sure that they use it solely for the company. Keeping business and personal finances separate makes it easy to balance books, but more importantly, reduces stress during tax season.

- Collect payments ASAP

It’s important that a company makes sure that its customers pay their bills on time. They should be creating clear invoices to send to customers and reminder notices if they are late with payment. Payment methods should be convenient for clients to use too.

- Keep cash in the bank

Bills should be paid on time, but there’s no need to rush! Even if a company has spare cash, it is recommended to wait until the last few days before bills are due before paying them – more money in the account means a wider safety net in case of emergencies such as early wage payments or vital repairs.

- Track employee paychecks

Business owners should keep a detailed record of all payments made to employees. These details should show the date of payment, to whom the payment was made, and of course the correct amount. Tax deductions should also be displayed on the check. Hiring a payroll services company will simplify the process, but companies still need to keep track for bookkeeping purposes.

- Review financial statements

Financial statements show the action going on behind the scenes of a business. Business owners need to keep on top of their statements if they don’t want to miss out or get taken advantage of. Services are available to help business owners create and understand their reports, such as professional bookkeepers and the CFA.

- Outsource bookkeeping

Owning a business isn’t like working a job – owners need to know what their weaknesses are and hire other people to pick up that slack. Bookkeeping is no different. The good thing is that they don’t need to hire a full-time bookkeeper – there are many services that can do the work remotely, for a fraction of the cost of a full-time employee.