Profit and loss statement, better known as an income statement, measures the business’s performance and shows its historical record of the trading over a specified period. It reflects the profit or loss made by the business, which is all the earnings less firm’s total costs. The statement can be compiled on a quarterly or yearly basis.

The income statement is vital because every single person who is thinking about investing in a stock and every person who is thinking about starting a business would want to know what it is. It helps to evaluate your investment and understand whether or not the investment you will make is going to drive the profit.

If a business owner wants to take a loan, s/he can show them that a business is actually profitable, so the lender will be willing to lend them money. P&L statement also helps to manage your business. You will manage the report components and identify the areas that you need to focus on receiving a profit. At some point, you may decide to sell the business. This report will help to measure the value of a particular business.

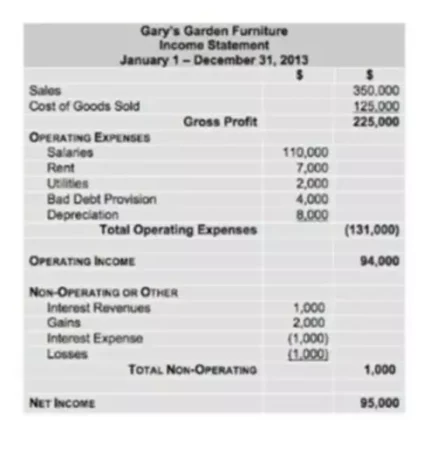

Income Statement Example

The income statement example is shown below. Most will show the last three or five years to give the viewer reference to look at and be able to analyze the trends and make appropriate decisions.

If revenue is bigger than expenses, a business makes a profit. If expenses are bigger than revenue, a business is at a loss and unable to fully cover its expenses, make an interest payment on taxes and debt, pay employees, etc.

Common Size Income Statement

Even though we can view trends immediately when looking at the regular income statement, it does not give us a complete representation of the true financial trending of an establishment. Yet, this is what we would really want to look at when analyzing financial statements. Turning these historical income statements with dollar amounts into percentages.

Common size income statements show each part of our income statement as a percentage of net sales. They are very useful in helping us create pro forma projections for financial statements. To convert the dollars to percentages, we would take the dollar amount of a chosen account (e.g., rent, office supplies, advertising) and divide by total revenue, which is the 100% line in that statement.

Single-Step Income Statement

As the word single suggests, to arrive at the Net income, we need to complete only one action or step. Basically, we make all our revenue, and we subtract all our expenses, and that will give us our net income.

There are two reasons for using this format instead of the other ones. The first one is that the company does not realize any profit until total revenues exceed total expenses. The second one: the format is simpler and easier to read.

Multi-Step Income Statement

The problem with the single-step version is that we just laundry listed all our sales and all our costs. We did not take the time to break them into categories, which might be informative and tell us which types of expenses are likely to recur in future periods. For example, if you have one time gain or loss on the sale of an item, you might not expect that to recur the next year. If you have revenue from a sale, that would be expected to recur year after year.

Thus, the multi-step version divides the income statement into subcategories. Its distinguishing features include the requirement of several steps to determining net income and distinguishment between operating activities and non-operating. A multiple-step income statement would look like an example we showed above.

- The first thing we notice is the Sales component that gives as a Net sales amount. Then, we compute the Gross profit. This is the first section of the multiple-step report.

- The second section is the Operating expenses, which lists all expenses associated with main business activities. Then, the difference between the total of these expenses and gross profit will be an Income from Operating expenses.

- Next, we will have a Non-operating expenses section. Here, we will list anything that has to do with business non-operating activities. This means that the company might have other sources of money or other sources of expenditures.

- It might be bringing in more cash or spending money on something other than the business. For example, it can have revenue from interest, dividends, rent, or gain from the sale of fixed assets. Expenditures would include interest expenses, loss from sale, strikes, or casualties.

- Finally, earnings from operations plus income from non-operating activities will give us the final amount, which is called Net income.

Comparing the Balance Sheet vs. the Income Statement

Comparing the balance sheet vs income statement, both statements play an important role because each has its focus and purpose. For instance, the balance sheet is the equivalent of a snapshot or a photo of a company at one point in time (usually the 31st of December of one year). Its purpose is to show how values are distributed in the business at that point in time.

A balance sheet is always shown in two parts: Assets (what the enterprise has) and Liabilities and Equity (where the finances come from). As the term “balance” suggests, the total of one side should match the total of the other.

The profit and loss statement is different. It is more like a film that shows the history of what has happened to the company over a period of time (usually one year). Its purpose is to calculate the results that this business entity has achieved within the year of operations. Some companies use the terms revenue, expenses, and profit for the income statement sections. Others refer to them as sales, costs, and earnings or income.

Income Statement Structure

The income statement components differ depending on the company, the industry, what products or services the business sells, etc. However, we can distinguish a few components typical for most companies. These components are as follows:

- Revenue from operations. Every statement starts with this section. Typically, it reflects only a business’s profit by selling products or services.

- Cost of goods sold (COGS). The cost of goods sold reflects the total costs to produce the product. COGS includes costs related to purchasing raw materials, shipping costs, wages/salaries paid to employees, etc.

- Gross profit. Subtracting the cost of goods sold from the company’s total revenue leaves you with gross profit. However, if a business spends more money to generate goods than it gets in revenue, the company gets a gross loss.

- Depreciation and amortization costs. These are non-cash expenses recorded by an accountant each year. Accounting for depreciation enables businesses to record assets’ value accurately.

- Marketing, advertising, and promotional costs. Typically, all businesses have some marketing campaigns. An accountant should reflect expenses to run such campaigns in this section.

- General and administrative expenses. This section should include all expenses incurred when running a business, for example, the manager’s salary, office rent, travel costs, etc.

- EBITDA. It stands for Earnings Before Interest, Tax, Depreciation, and Amortization. Use gross revenue (or loss), and subtract marketing and administrative expenses.

- EBIT (or operating income). It stands for earnings before interest and tax. Use EBITDA to subtract depreciation and amortization expenses.

- Interest. It’s the amount of money a company must pay on its liabilities.

- EBT. Calculate earnings before taxes by subtracting interest expenses from operating income.

- Taxes. The amount one has to pay depends on your income, state, and other factors.

- Net income. Use EBT to deduct taxation expenses to get your company’s net income.

The statement is quite detailed and offers an invaluable analysis of a company’s wellbeing.

Who Can Use An Income Statement?

It is one of the three most valuable financial statements that records a business’s state during a given accounting period. As it provides important data, it may be of great value to two main groups of people:

- Internal users, such as management, shareholders, owners, etc.

- External users, such as investors, creditors, other institutions, etc.

Internal users require the information from the statement to analyze the business’s state. If the business isn’t generating income or could get more revenue than it does, the management or board of directors can change the strategy.

Investors often use an income statement to decide whether to invest in a company. Typically, they compare income statements of different businesses. Creditors need this document to verify whether the company can repay its liabilities.

How To Read An Income Statement?

The last part of an income statement is net income. The easiest way to interpret the statement is to look at the net income. If a business’s total expenses are higher than its revenue, then the net income is negative. It states that the business isn’t generating money.

However, you shouldn’t immediately jump to the conclusion that the business is failing. It’s OK if the company is operating at a net loss if it was recently launched and is still trying to attract capital.

The Importance Of An Income Statement

This statement enables the company’s management to figure out whether the business can make money by decreasing expenses, generating more revenue from selling goods or services, or both. However, the statement is important for business owners for a few other reasons:

- Get an overall analysis of the company’s state.

- Receive reports more frequently to adjust the strategy.

- Forecast future expenses by analyzing an income statement. The company’s accountant can highlight typical expenses and account for these costs when planning the budget.

Moreover, preparing an income statement is a must if you want to attract more investors. They want to learn about your business’s state before investing their money.

How To Build An Income Statement In A Financial Model

Several models use an income statement as one of the key parts. Businesses can consider a three-statement model that consists of:

- income statement;

- balance sheet;

- cash flow statement.

The three-statement model links these essential parts to create a dynamically-connected financial model. Businesses can use this model as a foundation to build more advanced models, for example, a merger model, a leveraged buyout model, a discounted cash flow model, etc.

This financial model requires using Excel. According to this model, it should be easier to prepare future statements. here are a few steps to get started:

- Add the company’s historical financial information to Excel.

- Determine what assumptions will drive a financial forecast.

- Forecast the income statement.

- Forecast financing activity.

- Forecast capital assets.

- Forecast the balance sheet.

- Prepare the cash flow statement.

This financial model requires planning for the future and outlining potential revenue. With its aid, you can plan for income statement preparation at the beginning of each fiscal year.

Learn more about the income statement accounts in our blog.