The cash flow statement is a report that gives the movement of money (cash, cash equitable, marketable securities, bank balance) during the period under consideration. It shows the amount and various sources of money generated and used by a business during this period. The report also explains the reasons for the changes in the cash position of the company. It is different from a profit and loss account in that it concerns cash flow, not accounting profit.

How Does a Cash Flow Statement Work?

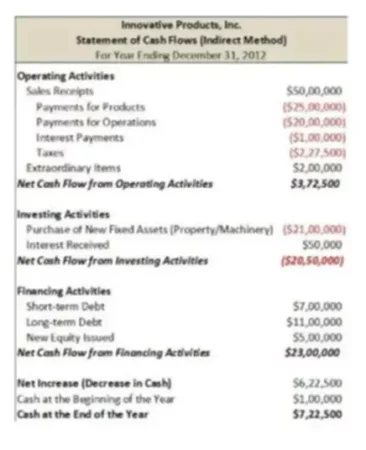

Transactions that increase the cash position of the business entity are called inflows of cash, and those which reduce cash are known as outflows. You can easily see this reflected in the following example.

This statement is divided into three sections:

- The first is the cash flow from the operations, which are influenced by a business’s net income very much. So, this section is directly related to business operations, and all the earnings type transactions would go here.

- The next section is the cash flow from investing activities. These are investments in the company, such as stocks or bonds. However, usually, you will see fixed assets, such as equipment. So, these are investments that will generate the company money in the future. If these investments are sold, an increase in cash will be seen.

- The last one is the cash flow from financing. Since we would finance a company through liabilities or owners, this section summarizes cash transactions that involved raising, borrowing, and repaying capital. Examples would include owners investing in the company or taking a loan from a bank. If the loan is paid off or dividends are paid to the owners, then you will see a reduction in cash in this section.

At the end of this report, you will see a summary of all the cash flow to show whether there is a net increase or a net decrease in cash. So, to get a net change in cash, you would take a beginning balance of cash and add the cash flows from the three sections.

Why Do Cash Flow Statements Matter?

The statement of cash flows is often overlooked. If you want to find out business cash balance, you could just look in the balance sheet. There, you will be able to see if the cash position has gone up or down. However, this way, you won’t see the sources that bring in money and uses to which the cash has been put.

It is the cash flow statement where you can find whether a company does a good job managing its cash and how it spends it. The information it presents is of special interest to current and future investors. This report helps to assess the amounts, timing, and uncertainty of future cash flows. High and improving cash flows are attractive to investors because it indicates that the business has sufficient funds to meet its debts and liabilities, fund its day to day cash requirements. This statement will alert you if your sales or services aren’t generating enough cash to cover expenses. Yet, even a negative cash flow can be fine if the company invested that cash into something that will bring greater profits.

Learn more about the Cash Flow Indirect Method assets in our blog.