One of the characteristic features of a market economy is the competition of most companies among themselves. The most important economic indicator showing the effective operation of a company is retained earnings. The positive dynamics of this indicator, along with other economic indicators, may indicate a positive activity of the company. You will learn in this article what retained earnings and retained earnings normal balance are, where it is reflected in the balance sheet and where it is recorded in other financial statements.

What do retained earnings mean?

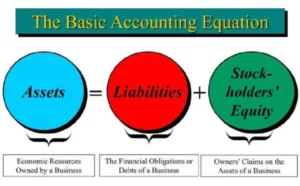

Retained earnings is an amount of net income remaining after all expenses, debt, taxes, etc. have been paid and after the distribution of shares among the owners. This concept is closely intersected with net profit. If the company has no deferred tax liabilities and dividends have not been accrued during the year, then these figures in the annual accounts coincide. However, retained earnings represent the resulting figure for the reporting year and the entire period of the company’s existence, while net profit – only for the reporting period.

Only the owners of the company can dispose of this profit. It happens at the general meeting of shareholders based on the stipulated provisions in the constituent documents. The actions for eliminating profits are recorded in the minutes of the public meeting, and this serves as the basis for the accounting department to form entries for the use of benefits.

After dividends are paid to shareholders, the remaining net profit is considered to be retained earnings for the reporting year, which are then added to the retained earnings from the previous period. Retained earnings are included in a balance sheet and also have their statement of retained earnings.

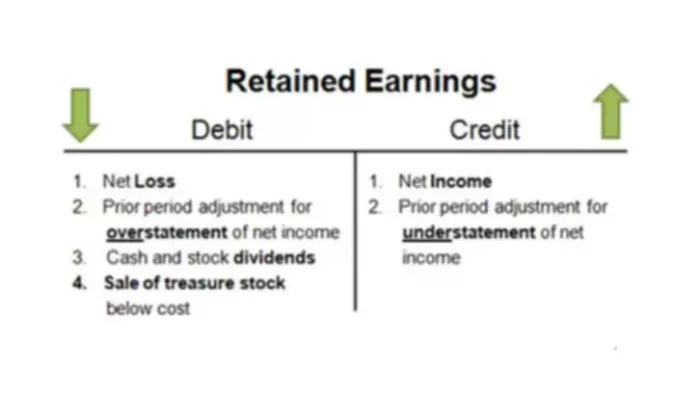

Retained earnings increase when errors are found in the financial statements that led to an overstatement of expenses. Also, they grow in the case of unclaimed dividends by shareholders, if more than six years have passed since their payment date. Accordingly, errors that created an increase in revenues will reduce the amount of retained earnings accumulated. These corrections are reported in the retained earnings statement adjustments to the previous retained earnings and are, consequently, reflected in the balance sheet.

The components of retained earnings are not always funds in the form of cash or on a current account. For example, devaluation of fixed assets increases profits but does not add money. This should be considered when conducting an economic analysis.

What is retained earnings formula?

A retained earnings formula will allow answering better the question: “What are retained earnings?”. You can also determine any part of it, such as beginning retained earnings, when you have the other values. Here is the equation that you will use for calculation of the amount of retained earnings:

It is quite simple to calculate the retained earnings of a business that will be included in the balance sheet as well as become a part of the statement of retained earnings when you have the equation on hand.

Retained earnings calculation

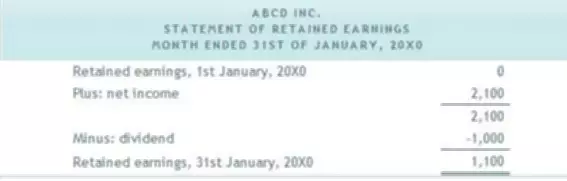

Let’s do the calculation together using the following example of the statement of retained earnings.

First, you take retained earnings from the Balance Sheet of a previous reporting year. This will be your beginning retained earnings. If a company just started operating, this number will equal to zero. Negative retained earnings are also possible in the case of previous year company performance. Next, you will take net income from the Income Statement for the current period and add it to the beginning retained earnings.

Then, you will need to calculate the number of dividends paid to the shareholders in the current period. This is declared by the board and can only include a price per share. Thus, you would multiply the price per share by the number of shares. Subtract the dividends paid from the total amount of retained earnings plus net income. As a result,you will get the ending retained earnings.

The ending retained earnings on the balance sheet will represent all the retained earnings for the period that the company existed and will be included in the Balance Sheet for the current period under the Owner’s Equity. To get retained earnings only for this period, you would skip adding the beginning earnings to the net income. It should also be noted that you might need to add or deduct any adjustments to the retained earnings if necessary (an error was made in previous reporting year).

Why do retained earnings matter?

This is another question many ask along with “What are retained earnings?” and“How to calculate retained earnings?”. When summarizing the operations of a business, the most important financial indicator is profit. Its positive dynamics, along with other economic indicators, demonstrate the efficiency of the business entity. Further development is influenced by choice of ways to distribute profits, which remains in the hands of the owners of the company.

Management decisions in this matter will determine the strategy and objectives for at least the next year. Annual bonuses to employees, dividends, the size of the share capital and the reserve fund – all this will depend on how the profit is distributed after covering all the required payments.

How are profits generally distributed?

If the company has one owner, then there are no problems associated with the use and distribution of profits. But if there are many owners (for example, in a JSC or LLC), issues arise. The fact is that in such cases, it is much easier to make a profit than to divide it.

Some investors, say, shareholders, want to expand production, i.e., reinvest the money. Others wish to claim their dividends. One group sees the point in increasing the value of their securities, while others want good money to be paid each year. When different groups of people have diverse and even conflicting goals, they seek compromises.

If you invest all profits received in the reporting year in additional capital, this will be a decision in favor of those who want to reinvest. If you allocate all the earnings for dividends, then there will be no profit, the company will not be able to increase its economic power. Therefore, collective owners assume that part of the benefit for the reporting year, which remains after distribution of dividends, may be claimed by the owners not following the results of this year, but following the results of economic activities in future reporting periods.

What are retained earnings affected by?

From the point of view of financial analysis, retained earnings reflect the dynamics of the company’s development at the expense of its funds (savings, investments). The value of the indicator difference under the impact of the change in the following items:

⮚ Net profit. If the company did not pay dividends in the current year and did not have deferred tax liabilities, accounting standards do not imply a difference between distributed and net income.⮚ Dividends paid. Organizations that increase reserve funds or face urgent expenses are forced to reduce the number of dividend payments, which increases the amount of retained earnings.⮚ Taxes. The increased tax burden on business or contrary favorable conditions affects the amount of income left after taxes are paid and in turn, the available funds for the retained earnings.⮚ Change in business strategy. Acquisition of new land plots, production facilities, vehicles, change of the organizational and legal form can increase the tax burden and change the efficiency of work.