How do you get a snapshot of your business’s financial data at any given point in time? Your balance sheet. It details your assets, liabilities and the value of your shareholders’ equity. It shows the overall financial health of your business. That’s why it’s vital to understand your balance sheet. It’s called ‘balance sheet’ because your assets should always equal your liabilities plus your shareholders’ equity. It’s worth your time to familiarize yourself with your balance sheet. Interpreting it can alert you to any risks to your business’s financial viability including having a high debt to cash flow ratio or low cash balance. One important indicator of the company’s financial stability and future growth is the amount of retained earnings.

Where can I find retained earnings on the balance sheet?

Retained earnings are listed under liabilities in the equity section of your balance sheet. They’re in liabilities because net income as shareholder equity is actually a company or corporate debt. The company can reinvest shareholder equity into business development or it can choose to pay shareholders dividends. It is generally a sound financial strategy to prioritize accumulating retained earnings for any business that strives for long-term growth.. Below you’ll see a balance sheet showing an example of shareholder equity including retained earnings. Note that stockholders equity means the same thing as shareholders equity.

GET A FREE REVIEW OF YOUR BOOKS TODAY

What does the retained earnings line on the balance sheet mean?

Retained earnings are net profit (revenue and income streams minus expenses) remaining after dividends paid to shareholders and investors at the end of a reporting period. The way you manage your net profit over time – particularly retained earnings – is an important consideration for potential lenders and investors. Your statement of retained earnings is vital when applying for a loan or investment funding because it gives investors insight into how healthy your business is and what your business’s intentions are. Positive retained earnings indicate a commitment to overall growth whereas negative retained earnings are indicative of net loss and an accumulated deficit.

You’ll find the retained earnings listed under ‘shareholders’ equity’ also called ‘stockholders’ equity’. It’s in the balance sheet above.

So, what are retained earnings?

This is how we arrive at them. The difference between total assets and total liabilities is the shareholders’ equity. Once the debts have been paid, shareholders’ equity is the share of owners or the residual claim. The portion of the remaining net income that is not distributed as dividends constitutes retained earnings..

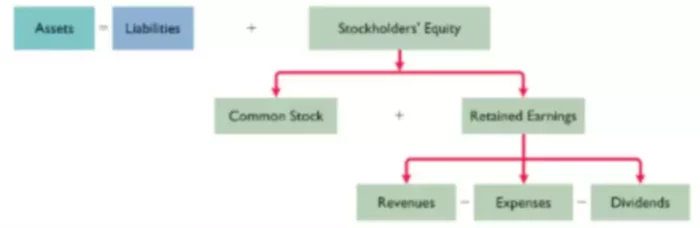

On the balance sheet in the equity section, you’ll find two categories: common stock and retained earnings. The equity, also called common stock, is what is held by the founders or shareholders’ initial investment in the corporation. Here’s a simple breakdown of the balance sheet:

Assets = liabilities + shareholders’ equity.

Shareholders’ equity = common stock + retained earnings

You can use the retained earnings to:

- Pay dividends

- Pay off debt or

- To generate revenue through business growth.

See the infographic below.

When your business makes a profit, you have a few options for how you can use those funds. You can pay your shareholders a cash dividend or keep the earnings to reinvest in your business – that means they become retained earnings. They’ll help you grow and develop your business. Retained earnings can help you:

- Expand your business

- Engage in research and development

- Fund marketing initiatives or

- Pay off debt.

The retained earnings line on your balance sheet shows investors and lenders that net income is being allocated for long term business growth.

You can also get important insights into business cash flow from the equity section of the balance sheet. Net income (profit) shows positive cash flow. Net income is your revenue figure minus expenses such as:

- Cost of goods sold (COGS)

- Operating costs

- Payment of debt

- Interest on loans and accrued from investments

- Extra income streams from asset sales or those of subsidiary holders

- Depreciation and amortization of assets and taxes (amortization means spreading payments over multiple periods).

A positive cash flow means your business has more cash coming in than going out. As cash comes into your business, you’ll pay your expenses, return money to shareholders and retain earnings for the future.

Returning to the equity section of the balance sheet, let’s look at the shareholders’ equity. It can come from investors’ or owners’ initial investment in the business or retained earnings when the net income is reinvested. The shareholders’ equity section of the balance sheet offers critical information about the company/corporation’s share capital including:

- Types of shares

- Their nominal value

- Number of authorized shares (maximum shares a company can issue)

- Number of shares issued and

- Outstanding shares.

Take time to understand how to read and interpret your balance sheet to maximize profit, grow your business as well as identify and eliminate risks or cash flow issues.

As a business owner, it’s hard to set aside time to interpret financial information, particularly if you’re not interested in ‘crunching numbers’. While you likely understand the importance of analyzing your financial statements in detail, your primary responsibility to providing better products and services to your customers should take precedence. Let us help you. We’re passionate about figures and creating personalized, easy-to-understand financial reports with essential information for businesses such as yours.

How are the retained earnings calculated on the balance sheet?

The formula for retained earnings is RE 1 = RE 0 + NI – D

- RE 1 – net income at the end of the reporting period

- RE 0 – net income at the beginning of the period

- NI – net income minus income tax

- D – Dividends paid

Retained earnings are cumulative. That means you’ll report them on your balance sheet in the equity section and carry the RE 0 from the previous reporting period’s ‘retained earnings’. Since retained earnings go under the shareholders’ equity, you’re increasing the retained earnings and at the same time, the liabilities side of your balance sheet. Shareholders’ equity is treated as a liability to your company/corporation. That’s because it indicates the company’s liability to the owners or shareholders.

Cash flow such as net income, as well as expenses or dividends paid can affect retained earnings. If a company decides to keep a larger part of its net income for reinvestment, then it will have less to pay in shareholders’ dividends and vice versa. The business owner’s or decision makers’ motivation and judgements are reflected in the financial statements. Outsiders can zero in on the net income and retained earnings to assess these motivations and decisions over time through the series of financial statements.

BooksTime can help you to understand your balance sheet and how your retained earnings are affected by your cas-hflow

BooksTime can help you understand your balance sheet and how your cash flow affects your retained earnings

Your BooksTime bookkeeper will help you manage your financial data, as well as understand and use that data to grow your business. We understand the daily demands of running your business, managing staff, processing orders, marketing to potential and current clients come first. The last thing you want to do after a long day is stare at your balance sheet or try to calculate changes to your retained earnings.

Accurately compiling and interpreting financial data is a necessary task you might wish to delegate to the experts. That frees you – as the business owner – to focus on growing your business. By tapping into the expertise of BooksTime, you’ll be supplied with:

- Monthly reports you can use for a clear and accurate picture of your finances

- Insights into trends you can track through customized visual online dashboards, and

- High-level financial guidance to build your financial leadership, help you create a sound financial strategy, assist you in preparing professional presentations that will impress potential lenders and investors as well as advise on merger and acquisition initiatives.

Why not also automate your bookkeeping through us? Have peace of mind you’ll never have to eat into your family and down time to keep your books up to date. Using the latest technology means we’re able to streamline many common bookkeeping tasks. You’ll get more value than other bookkeeping services – our rates are between 20% and 50% lower. In addition, you’ll have a dedicated bookkeeper with specialized knowledge in your industry. Ask us about our best price guarantee.

Want to learn more about our services? Book a free consultation with us. Fill in the form and we’ll be in touch within 24 hours.