Before we try to explain the unearned revenue, let’s see what revenue means. Revenueis funding in cash or another form received by the business as a result of its economicactivities. There are three different revenue recognition situations:

- Accrual revenue – revenue is recognized at the time of the provision of services,performance of work, or transfer of goods. It does not depend on payment, whichis usually received later. This is the most common way and aligns with theaccounting principles.

- Deferred revenue – this is when the cash is received before the revenue isrecognized. This is considered a liability until the product or service is delivered,and the revenue can be identified.

- Same time revenue – this is the most accessible form of revenue, as payment ismade at the same time as the goods or services are provided, and it does notrequire any adjustments in accounting records.

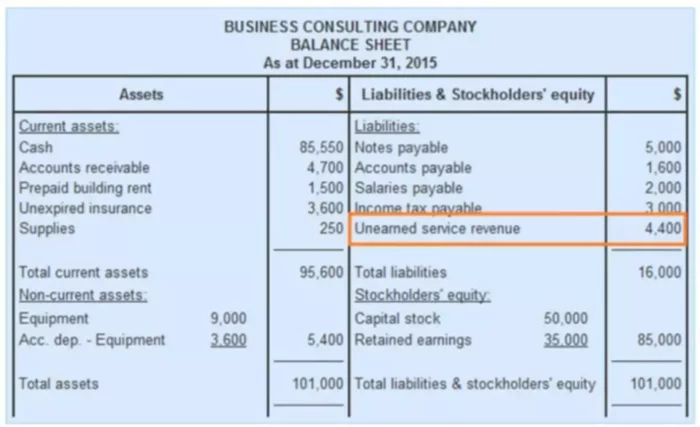

Unearned revenue is an essential concept because many businesses come across thisitem regularly. So, what is unearned revenue? Unearned revenue, also known as deferred revenue, is the amount ofmoney a company has collected but have not provided the goods or services being paidfor at the time it received the payment. Is unearned revenue a liability? Only when the company has fulfilled itsobligation — earned money — is the liability removed and the money is recorded asrevenue and included in the income statement.

Airline carriers, for example, will have unearned revenue when they sell tickets beforethey deliver the service. A magazine or newspaper subscriber will also pay for themagazine issues in advance, and the publisher will have unearned revenues on theirbalance sheet until the subscription period has ended. Once they will “earn therevenues,” the companies can recognize the deferred revenue as “revenue earnings” in an Income statement account.

Companies greatly benefit from getting that money upfront. First of all, unearnedrevenues mean that the company does not have to have significant capital in the firstplace because it can cover the expenses associated with goods production or servicedelivery with the payment made by the customer. However, companies should keep inmind that they have not yet earned that money, and it is a liability, not an asset that theycan freely use for any of their needs.

How Unearned Revenue is Reported

The unfulfilled promise to the customer to deliver a product or service must be reportedin some way. There are two ways to report unearned revenue – a liability method andan income method. Suppose on March 15, 2015, Example Company received a$24,000 advance payment for the maintenance services it will provide during half of thismonth and in the following month. Lets’ review how one transaction will have differentjournal entrees depending on which method is used.

Liability Method

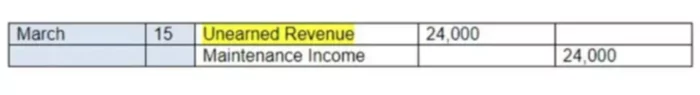

When the liability method is used, the unearned revenue is considered a liability. Thereasoning behind this is that the company still has to perform some actions, and thecustomer has not received the good or service he or she paid for it. Thus, the companyowes something to the customer, and it is reflected in the records as follows:

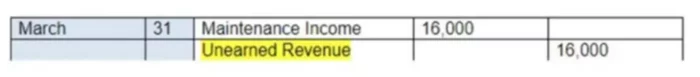

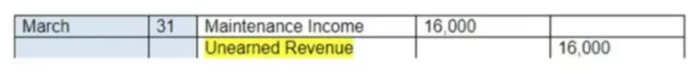

At the end of March, the company will make an adjusting entry to record the revenuethey earned for the half of the month of maintenance services and note a decrease inshort-term liabilities. The adjusting entry will look like this:

At the end of April, the company will make another adjusting entry to recognize theremaining income they earned this month. The adjusting entry will look as follows:

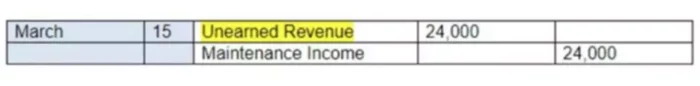

Income Method

The same payment from the customer will be recorded differently if the company usesan income method. This accounting method implies recording the advanced payment asincome. The following journal entry would reflect it like this:

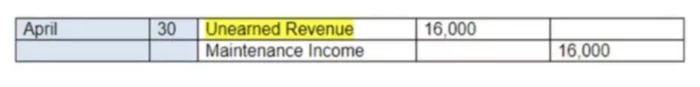

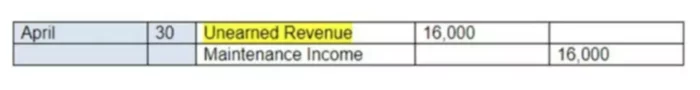

At the end of March, since $16,000 of income are still unearned, this income will beconverted into a liability. The corresponding journal entry will look as follows:

Accordingly, on April 30, another journal entry will be added to reflect the earnedincome for this month.

This method, however, makes it easier to make a mistake and overstate the revenue ifthe accrual method of recognition of deferred revenue is not followed correctly.

Unearned Revenue in Bookkeeping Records

Generally Accepted Accounting Principles require businesses to use the accrual basisof accounting. This means that no matter when the company receives the payment forgoods or services provided to customers, it has to record the transaction when thesegoods were sold.

For example, if a company sold electronics to a customer but he will pay for them onlyin the next month, it will still need to record the sale on the date it occurred and notwhen it will receive the payment. In this case, the income from the sale is filed underpayments receivable.

If the customer, on the other hand, has paid for a service or goods, let’s say rent for aquarter ahead, the company will record the payment as liabilities because the customerdid not yet get the full period of the lease. Let’s review more examples to make thiseven more explicit:

Example 1. Revenues for Same-Period Earnings

Since the company owes gods or services to the customers, the unearned revenues areconsidered liabilities. In most cases, the deferred revenues are classified as short-termliabilities because the obligations are typically fulfilled within less than a year. A greatexample of unearned revenues for the same period is airline tickets. Let’s take a closerlook at how this type of deferred revenue would be accounted for by the carrier.

A person buys an airline ticket on May 3, 20XX for a flight on June 25, 20XX. Since theGAAP requires to record the sale transaction when it occurred, the airline companycannot register this income as revenue yet. Thus, it is filed under liabilities on thebalance sheet in the Unearned Revenues account. Since the payment is expectedwithin the same reporting period, the transaction would fall under short-term liabilities.

To balance the accounting records, the bookkeeper will also make a record in the Cashaccount under assets. The transaction will increase both the Cash and UnearnedRevenue accounts. On June 25, 20XX, the Unearned Revenues account will decreaseby the amount equal to the ticket cost and the Revenues account under assets willincrease by the same amount. If the person decides to cancel the flight or it is canceledby the airline, the refund amount will be debited to the Unearned Revenues account willbe debited for a corresponding amount.

Example 2. Revenues in a Later Period

If advance payments are made for services or goods due to be provided 12 months ormore after the payment date, then they will be recorded as long-term liabilities on thebalance sheet. For example, a real estate company accept payment of property rent for18 months in advance. The payment amount of $27,000 will be recorded under cash,increasing the assets, and under unearned revenue, increasing long-term liabilities.

As with Example 1, the payments are recorded only in the balance sheet at first, and thetwo sides of the equation are balanced with respective entries. After each monthpasses, the unearned revenue account is reduced by $1,500, and the revenue isincreased by the same amount to maintain the balance and recognize the earnedrevenue. Only when the revenue is recorded in the balance sheet, this transaction isthen also reflected in the income statement.