A merchandising firm just buys inventory and then sells inventory that is already put together. A manufacturing firm, on the other hand, has a completely different accounting process for its inventory. Work-in-process inventory, sometimes called work-in-progress inventory or simply WIP, account is an inventory account we typically think of when we think of manufacturing accounts. The other two would be the raw materials inventory account and the finished goods inventory account.

Work-in-process refers to the materials that have started the production process but is not fully done yet. For example, in a car manufacturing firm, there will be raw materials like steel and glass because this is what is placed on the manufacturing line to actually make that car. When the firm does some work to this steel (or any other raw material) but it is still in process and the car is only partially finished, this material is no longer referred to as raw material because it is not just sitting there. Now, it will be considered a work-in-process inventory.

Work-in-Process Accounting

The work-in-Process inventory account is where a lot of activity is going on. The materials are actually in the process of becoming a product during a manufacturing process.

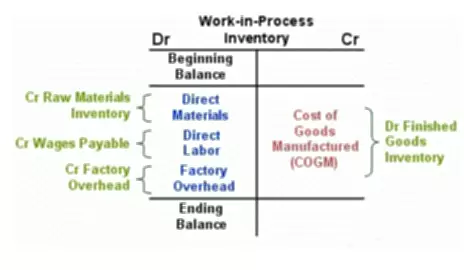

The work-in-process is an Inventory account on the Balance Sheet or rather a component of this asset account. The financial accounting of everything that is happening in the Work-in-Process Inventory will start with a Beginning Inventory Balance. Then, we have three items (costs) that are typically added. One would be the Direct Materials that are used. These have been requisitioned out for the Direct Materials account, brought over to this manufacturing line, so the costs now are to be accounted for in this inventory account. A credit balancing entry will be made to the Raw Material Inventory account.

The Direct Labor will be added in as well as something called Factory Overhead. Wages Payable and Factory Overhead accounts are the respective accounts associated with these two. All three items add together to become Total Manufacturing Costs Incurred. This number will be added to the Beginning Balance to get the Total Work-in-Process to account for.

The goods that become a finished product are subtracted out and moved from the Work-in-Process Inventory account to the Finished Goods Inventory account. Accounting entry for this would be a debit to the Finished Goods Inventory account and a credit to the Cost of Goods Manufactured account. The management responsible for keeping up with the manufacturing process wants these to be subtracted from the total so they are no longer accountable for those items.