What is an expense report?

A typical definition of an expense is a form that employers require their employees to fill out to show the expenditure they had during a business trip or any other event for which they are requesting reimbursement. To ensure that all expenses have actually taken place, the form has been accurately completed, and expenses meet the reimbursement requirements, many employers also ask to attach the receipts to the form as proof.

Depending on reimbursement rules at a particular company the expense report will be reviewed right away or at the end of the month. Afterward, the employee can write a check or make a deposit to the employee’s account for the amount requested. In addition, the company can add the reimbursement amount to its bookkeeping records, so this business expense is accounted for when calculating business profits, based on which taxes are paid.

Besides the meaning just described, the expense report can play a different role in a business. This is a document that your accountant will use to record the business expenses in bookkeeping records. Accordingly, these records will then be used to prepare an Income statement and calculate the amount of taxes you owe to the government. The expense report and all the details presented on it will help you determine if any of the expenses can be deducted from your taxable income and can serve as proof in case of an audit.

In addition, this is a good tool for management purposes. You can compile an expense report for a month, a quarter, or even a whole year. Then, you can go through such expense reports and analyze the totals and the trends. For example, you might notice that your business is spending too much on entertainment or airfare. Accordingly, you might want to change the way you entertain your investors or customers and maybe better plan for events your employees attend to cut down the associated costs.

Keeping track of expenses

There are numerous software and mobile applications that can help business owners and employees save valuable time. With their help, you can forget about tedious expense reports. Most mobile applications offer a simple feature that allows one to just take photos of their receipts and the data will be automatically imported into the right expense category.

Moreover, users can use the software to get expense reports automatically generated for them. It will categorize and group all the expenses in such a way that it is easy to read the report and analyze the numbers. If your business does not have expense tracking software, you can simply use numerous expense report templates that you can adjust for your specific business needs and have your employees complete one when necessary. Alternatively, you can use Microsoft Excel, which is an easily accessible program for most business owners, and create your own customized expense report template.

Template

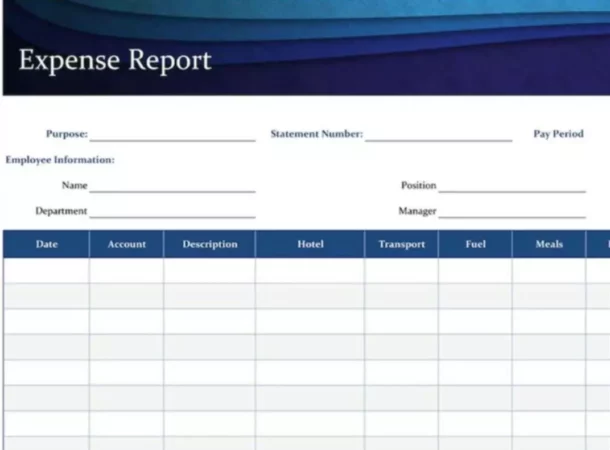

Above, you can see a sample template presented by Microsoft Office that employees can complete when requesting reimbursements. As you can see, at the top, it asks for some basic information where the employee will write what event took place during which these expenses were incurred, their name and position as well as the date.

Next, they will list all the expenses that they would like to get reimbursement for and their respective amounts. An expense description is an important part of the expense report as it allows you to not only have a detailed record for tax purposes but also helps you understand the nature of expenses your employees had and whether they should get reimbursement for them. For convenience, you can add columns for common expense items your employees might come across.

The account column is primarily necessary for your bookkeeper who will want to have a record of where each expense should go in their books. In other words, this is an account in your company’s chart of accounts under which the particular expense will be recorded. Finally, you might also want to have subtotals for each column/category and, obviously, the total amount of expenses claimed in the expense report.