Definition

Assets are all business and attracted resources that are used by the company for the purpose of making a profit. These include financial, material, intangible resources.

Current assets are funds that the company expects to receive during one financial year. Current assets include cash, short-term securities, accounts receivable, work in progress. They do not include items acquired for long-term use and included in fixed assets. Unlike long-term assets of a company, current assets are not intended for long-term use.

Short-term assets, in fact, are a combination of material assets of the organization that are contributing to the preservation of the company’s activities and the timely settlement of short-term liabilities during the calendar year.

Asset types and classification

Assets can be divided into several categories. For example, according to the degree of their liquidity:

- assets with the highest degree of liquidity (cash, securities);

- relatively quickly convertible assets (inventory, working capital, accounts receivable with a short maturity);

- low liquidity assets (long-term receivables);

- hard-to-sell assets (fixed assets, intangible assets, other non-current assets).

The assets can also be divided into operating and non-operation. The operating assets group includes materials, stocks, finished products, cash directly involved in the production processes. Non-operating assets are indirectly involved in the production cycle. They are typically classified as long-term ones, for example, intangible assets, fixed assets.

On the basis of the above classifications, we can conclude that current assets are more liquid than their fixed counterparts. The liquidity of current assets is the ability of short-term resources to be converted into cash, with an exception of the Cash account itself.

All funds are reflected in the financial statements in order of the increasing level of their liquidity. Due to the fact that current assets are short-term in terms of conversion into cash, they are characterized by the greatest degree of ease and speed of conversion into cash. To calculate the liquidity level, the current liquidity ratio is used, which shows the organization’s ability to use liquid resources to pay for short-term liabilities that have arisen.

Example

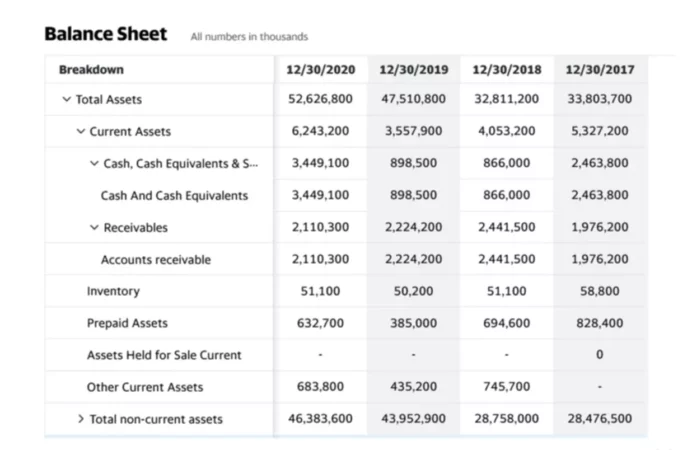

Above, you can the Balance Sheet of McDonald’s company. Let’s review its current assets section.

- The first item you see under the Current Assets of McDonald’s is Cash and Cash Equivalents. Cash does not require any further explanation. By cash equivalents, it is meant that a company has some treasury bills or notes, commercial papers, cash management pools, certificates of deposit, and so on. Its Cash has significantly dropped during the years of 2018 and 2019 but has picked up in the amount significantly in 2020.

- Accounts receivable is a set of documented debt obligations of individuals or legal entities to a company. Many organizations provide services or deliver goods to their customers without prepayment, but on terms that they will receive monetary compensation in a fixed time frame. Also, this concept means an overpayment of tax payments, the issuance of loans to the company’s employees, among other things. We can see that McDonald’s accounts receivable have not changed much during the period presented in the Balance Sheet.

- Inventory is a term that refers to the goods and materials that a business holds for the goal of resale (finished goods) or production (materials and unfinished goods). In the manufacturing industry, inventory represents not only the final goods, but also raw materials used in the production (e.g. flour, oil, raw meat for McDonald’s) and semifinished goods (e.g. frozen food) in the warehouse or on the factory floor. In the service industry, since there is no real exchange of inventory, it is mostly intangible in nature. Although McDonald’s inventory has somewhat dropped in 2018, it stayed relatively on the same level afterward.

- Prepaid assets are all the things that McDonald’s has already paid for but have not yet used or received. For instance, it can be an insurance premium paid a year ahead. McDonald’s might have also paid ahead its supplier ahead of time. Prepaid assets were significantly lower in 2019, but returned to about the same level they were in 2018.

- Other current assets account can hold anything that does not fit into the categories listed above but still falls under the current assets. Just like the prepaid assets, this category of the current assets has also fluctuated over the years.

Why does classification matter?

Every month, quarter, or year, in addition to preparing financial statements, accountants also work on drawing up management reports. These reports are not regulated by regulatory authorities or the law and are prepared at intervals and in a format determined by management. The purpose of the management report is to provide operational financial indicators and performance results to managers, directors, and owners for making business decisions.

Even if separate management reports are not compiled, correct classification in reporting can undoubtedly influence decision-making for many reasons. What financial indicators can be affected by incorrect classification of assets and liabilities, or lack thereof? Here are just a few possible outcomes:

- Liquidity indicators are calculated as the ratio of current or certain current assets and liabilities (depending on the liquidity that you calculate). For example, if you forgot to re-qualify a part of a long-term loan into a short-term one, then the liquidity ratio will be overestimated.

- Working capital is the portion of current assets that remains after deducting current liabilities. Such an important indicator for operational management will undoubtedly be distorted if misclassified. There is also a risk of making the wrong decisions about working capital. For example, an overestimated share of short-term liabilities or an underestimated share of short-term assets may indicate that an enterprise has a working capital deficit. This can lead to unwise decisions to address this deficit.

- With asset/liability turnover, incorrect classification will lead to distortion of these indicators if the analysis is carried out for specific types of assets/liabilities. For example, the current accounts payable turnover ratio will be clearly overestimated if you forgot to reclassify part of the accounts payable as short-term.

Undoubtedly, the list of potential distortions can be expanded depending on what financial indicators are calculated by the company. Yet, the concept remains the same, even an insignificant error can lead to incorrect reporting and thus to incorrect decisions. The accountant who prepares the reports, the management who analyzes these reports should consider the potential impact of a particular indicator on the decision-making process.