Overview

Businesses need a plan not only to understand the goals and ways to achieve them but also to substantiate the profitability and the possibility of implementing investment projects. When doing project calculations, management is faced with the concept of fixed and variable costs. What is it and what is their economic and practical meaning for business owners and management?

Costs are the sum of resources used in the activities of the business for a certain period of time. Costs are measured in monetary terms, i.e. cost is the monetary value of the resources used. Variable cost is a cost that can change over time. These costs vary based on the use of the products or services, and they can vary based on any number of factors. For example, an increase in vehicle use results in a corresponding increase in variable fuel and vehicle maintenance costs. Likewise, if more employees work in the office, variable electricity and other expenses may increase.

The main feature of variable costs is their disappearance when the business stops operating. Variable costs are completely different than fixed costs, which tend to remain the same regardless of whether a business is providing services or not or manufacturing any goods at the moment. For example, fixed costs such as a mortgage or rent remain the same for the entire term of the loan or lease. Together, these two types of costs can tell us the total cost of the product or service.

Typical variable costs for small businesses are the cost of various materials that go into the making of the goods, as well as office supplies, hourly wages, and other operating expenses. As with personal finances, in a small business, it will help to plan for variable expenses as well as have a savings account with money set aside to cover higher than usual expenses. With the right planning, even highly volatile spending shouldn’t disrupt business plans and activities.

Some costs cannot be attributed with complete certainty to either fixed or variable costs; such costs are classified as semi-variable costs. This cost element contains both a fixed and a variable cost component. An example of such costs can be electricity costs (lighting in the workshop – fixed; for the operation of equipment – variable). Such costs are analyzed not as a whole, but as their individual constituent components and accounted for in the group of fixed and variable costs.

Examples of variable cost

All resources that are spent on the production of products can be attributed to variable costs:

- materials

- components

- wages of employees

- electricity consumed by equipment and machinery.

At the same time, we need to understand that for one company some costs will be variable costs, while for another they may be constant or fixed. For example, buying pens and pencils for resale would be a variable cost. But another company periodically buys pens and pencils for their own needs, for them, this is a fixed cost.

Moreover, these costs vary among different types of businesses. For a manufacturing company, for instance, they include raw materials and supplies, packaging, piecework costs for shop personnel, and shipping and handling costs. The cost of all the necessary resources that need to be spent to produce a certain amount of products is also typically variable. These are all material costs, the wages of workers and maintenance personnel, the cost of electricity, water spent in the production process, as well as the costs of packaging and transportation. They also include the cost of creating inventory, raw materials, and components.

For a retail company, variable costs will be the cost of purchasing goods for resale, wages for sales managers, and so on. For a company providing services, variable costs most often include wages and, less often, consumables. But the use of such materials should be related to a specific service, and when services are not provided, such materials are not consumed.

Calculation

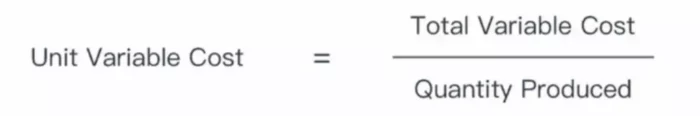

There are two ways to calculate the variable cost. First, the management might want to know this number for each type of product and service on a per-unit basis. Why? This allows the company not only to better manage its costs but also to properly set the price at which it wants to sell the product or provide the service. We can also change the formula around and calculate the total variable cost. Such a figure is also valuable and necessary for various business decisions and analyses. The formula would look as follows:

Analysis

There is no single recommendation for the best cost structure, even within the same industry. An ideal ratio depends on the specific operating conditions of the business and influencing factors, including the long-term trend and annual fluctuations in the level of sales, etc. Nonetheless, assigning costs to variable and fixed costs helps to solve a number of management tasks:

- Find out where the money is going;

- Allocate resources between products;

- Determine the required minimum production (break-even point);

- Calculate the margin of financial strength for your company.

A relationship between an increase in variable costs and an increase in production volumes can vary. The cost increases proportionally when the relative change in costs is equal to the relative change in volume. Progressive costs rise faster than production increases. The degressive variable cost grows more slowly than production. The regressive ones are declining in absolute terms, despite the growth in production.

If a business has large variable costs, then the company can be significantly dependent on the costs when setting prices. In the event that competitors reduce product prices, it is likely that the company will become uncompetitive. Therefore, we need to constantly think about what else can be done to reduce costs in order to feel more confident in the market for goods and services.

To explore fixed vs variable costs in detail, check out our new article about their differences.