Definition

One of the main tasks of the business owners, especially in the current conditions, is to preserve the financial capabilities of the enterprise – to pay wages, vacation and other payments to employees, taxes to the budget, and solve other primary tasks in terms of the functioning of the business. To do this, each company tries to optimize its costs as much as possible, without violating the law.

Depreciation of property, plant, and equipment accounts makes up a significant portion of these costs. Each asset must be depreciated individually. For certain types of fixed assets, depreciation is calculated on the basis of the total volume of products (services) made for the entire period of its operation in the appropriate units of measurement (units of manufactured products, hours worked, distance traveled, etc.). This is known as the units of production method of deprecation calculation.

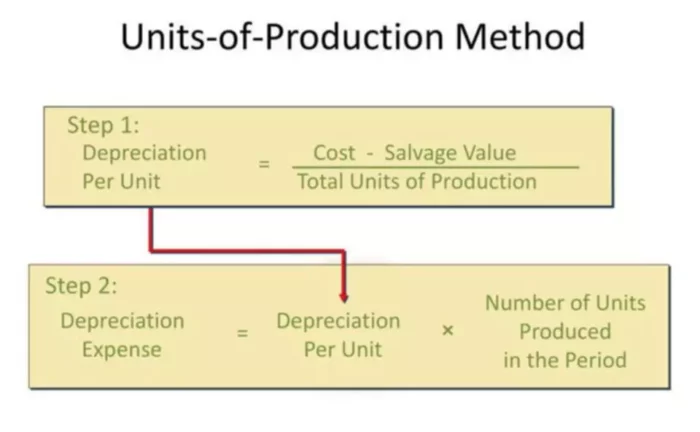

The monthly amount of depreciation is determined based on the actual monthly volume of products (services) made and the rate of depreciation. The rate of depreciation is calculated as the ratio of the value of a fixed asset and the total volume of production (services) that the enterprise expects to produce (perform) using this item during the entire useful life of that specific fixed asset.

The value of an item that is depreciated is the initial cost less its residual value. The monthly amount of depreciation is determined by multiplying the depreciation rate by the actual volume of units for the reporting month.

With the help of this method, it is easier to ensure the even distribution of the value of the fixed asset between the types of manufactured products (work or services performed). In addition, it should be noted that its use is economically justified in relation to those objects of fixed assets that are directly involved in the production, for example, machines, equipment, vehicles.

To be able to apply the units of activity method, as it is also known, the enterprise must have data on the planned/expected output of products (services) using a specific item of fixed assets. Unfortunately, there are situations when, due to various factors, it is quite difficult to determine the expected volume of products (services) that can be made using a specific fixed asset.

Example

The initial cost of the manufacturing equipment is $80,000, which can be scrapped for $6,000 at the end of its useful life. The amortized cost is $74,000. (80,000 – 6,000). The useful life is three years. The total volume of products (services), which is planned to be produced (performed) using the asset is 200,000 units.

Based on the data provided, we can say that the production depreciation rate is $0.37 per unit of production (i.e. $74,000/200,000units). During the first three months of using these fixed assets, 7,000, 8,500, and 9,500 units of production, respectively, were produced.

Calculation of depreciation charges using the units of the production method according to the data given in the example gives us $2,590 (7,000 units x $0.37 for the first month, $3,145 (8,500 units x $0.37) for the second month, and $3,515 (9000 x 0.37), for the third month. Thus, based on the results of three months, the depreciation amount is $9,250, and the residual value of the asset is $70,750.