Definition and Formula

The method of accounting for the allocation of costs of any physical or tangible asset during its useful life is known as depreciation. These costs arise due to:

- Use

- Wear and tear

- The passing of time

- Obsolescence.

The definition of straight-line depreciation is, accordingly, a technique used when an asset’s worth will decrease in value by the same fixed rate or amount each year. One does not just guess this depreciation expense amount. A special formula is used in the bookkeeping process to calculate and record depreciation for each tangible fixed asset.

Straight Line Depreciation Example

What does straight-line depreciation really mean? Imagine that you are a farmer. You owe a whole bunch of tangible fixed assets, which are physical things that help you out on the farm for more than one year. As time passes, these assets wear down and are not worth as much as they were when you bought them.

A farmer, let say, bought a hay baler for $450K and expects to get 12 years of use out of it. After that, the farmer will probably sell it for scrap for about $90K. The salvage price is usually determined based on the price comparable used assets and takes into account any costs the business might incur to sell or get rid of this tangible fixed asset at the end of its useful life.

Let’s depreciate it using the straight-line method formula above.

- In order to find out how much the asset is going to be depreciated by each year, you need to first write down what you know. You know that this asset is a bay haler that you will depreciate using a straight-line method. The cost of an asset is what you initially paid for it – $450, 000. The salvage value (residual value) is what you will receive when you get rid of it in the end – $90,000. Finally, the useful life is how much you expect this asset will last you – 12 years.

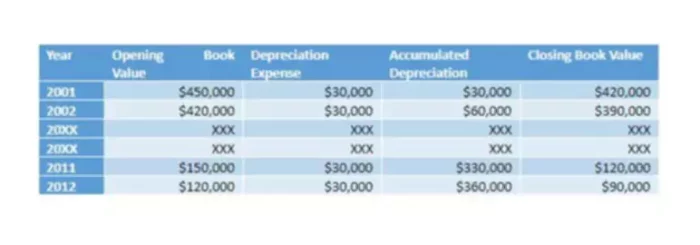

- Next, you would build a depreciation schedule and calculate values. To calculate depreciation expense for each year, you would subtract $90K from $450K and divide it by 12. You will get $30,000. The accumulated depreciation will be $30,000 for year one and you will add to the total every year. The closing book value will be your opening value minus the depreciation expense or $450K – $30K = $420K. The opening book value for the following years will be your last year’s closing book value.

In your bookkeeping records, you will write off $30,000 as a depreciation expense to your Income Statement each year for the rest of your asset’s useful life. You might notice that after 12 years, the closing book value of your hay baler is $90,000. This matches the salvage value that we assumed earlier. This is a good check to ensure that you did not make any mistakes during the calculations.