Definition

Equity is the residual interest in the assets of a business after deducting all of its liabilities. It represents the claims of the owners on the assets of the company. Equity capital includes funds directly invested in the company by the owners, as well as profits reinvested over time. Equity may also include items of profit or loss that are not recognized in the company’s Statement of Profit and Loss.

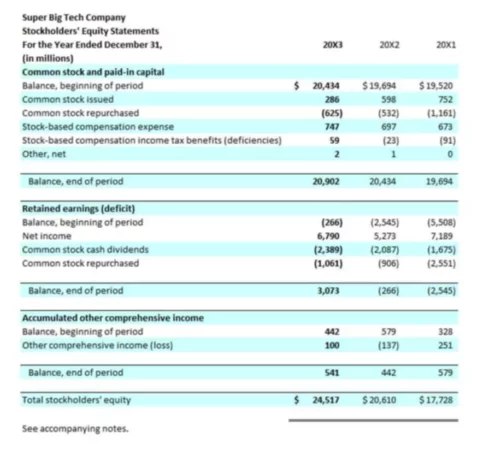

The Statement of Stockholders Equity summarizes the changes in the components of the stockholders’ equity section in the Balance Sheet. It discloses information about transactions affecting stockholders’ equity that occurred during the year.

Equity components

In accounting, stockholders’ equity usually has six main components. The first five components listed below relate to equity attributable to owners of the parent company. The sixth component is equity attributable to non-controlling interests (minority owners).

1. Common stock

This is the amount invested by the owners in the company. The ownership of the company’s shares is confirmed by issuing common stock. Common stocks may have par value or stated value or may be issued as shares with no fixed par value (subject to local issuance regulations). In jurisdictions with par value requirements, the par should be disclosed under equity in the Balance Sheet.

Authorized shares are the number of shares that a company can sell to investors in accordance with its charter. In addition, the number of issued (shares already purchased by the investors) and outstanding (shares that are traded on the secondary market and, therefore, available to investors) shares must be disclosed for each class of shares.

2. Preferred shares

Preferred shares are classified as equity or financial liabilities based on their characteristics rather than legal form. Preferred shares grant rights that take precedence over the rights of holders of common stock. Typically, these priority rights are associated with the receipt of dividends and the receipt of assets upon liquidation of the company.

3. Treasury shares

Treasury shares are shares in a company that have been repurchased by the company and are held on the Balance Sheet as treasury shares. The company can sell (i.e. re-issue) these shares. Companies often repurchase their shares when management considers the shares to be undervalued, when it needs the shares to exercise stock options or wants to limit the impact of capital dilution resulting from the exercise of options.

If issued shares are bought back, it reduces equity by the value of the redeemed shares and reduces the total shares outstanding. Their dollar value is recorded in the treasury stock contra account. If treasury shares are subsequently reissued, the company does not recognize any gain or loss on the reissue in the Income Statement. Treasury shares do not have voting rights and do not pay dividends declared by the company.

4. Retained earnings

The definition of retained earnings is an accumulated amount of recognized profits not paid to the owners of the company as dividends.

5. Total comprehensive income

The term total or accumulated comprehensive income refers tot the sum of:

- net profit, which is recognized in the Income Statement and reflected in retained earnings, and

- other comprehensive income, which is not recognized as part of net profit.

6. Non-controlling interest

Non-controlling interest, or minority interest, is the ownership interests in the subsidiary that are held by owners other than the parent.

Format and Example

From the example above, you can see the basic format of this financial statement. As usual, it starts with the company name, financial statement title, and period for which the report is prepared. First, you will see an opening balance, which is taken from the prior period’s Balance Sheet. Then, the equity components are listed in the order described above. For easier analysis, you would total each section as well as provide the total for stockholders’ equity at the end of the report. In the example above, the reports for three years are combined for a more comprehensive analysis.