Financial statements for non-profits slightly differ from what for-profit companies and organizations need to prepare. Today, we will review a report known as a Statement of Activities.

What is Statement of Activities?

The Statement of Activities is similar to the Income Statement in companies that work for a profit. This report shows your organization’s income less your expenses to equal what is called an increase in net assets, which basically means “Did you spend more than you received during a period?”. Assuming that you have created an effective chart of accounts and recorded transactions accurately, this report should not be very difficult for you to run.

Why Is It Important?

Being a non-profit, you still need to care about your finances. The financial records provide you with insights as to whether or not your non-profit organization possess the resources necessary to fulfill your mission. Statement of Activities will help you understand how the net assets have been utilized over time by the organization.

It is an important report to have on hand when you go to your funding sources or anyone else who needs to know about your organization’s overall health. It also helps you report the required information to the IRS (Form 990).

It will help you measure if your mission-based programs have enough resources for efficient operation and can be sustainable for your organization. You will be able to better plan for the future, whether it is cutting back on expenses or even discontinuing programs that are not justified, or maybe having more fundraising events to attract more sponsors and volunteers.

Statement of Activities Structure

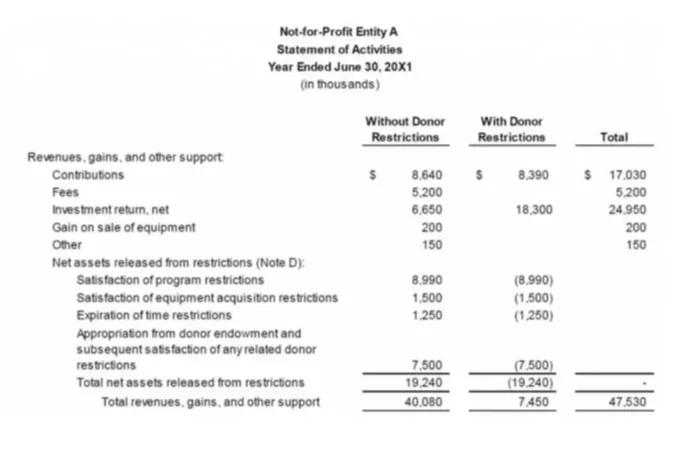

Unlike in the Profit and Loss Statement that for-profit organizations create, you will need separate financial activities by revenue classes. This is necessary to be able to identify which funds were received with donor (permanent or temporary) restrictions and which funds your organization received without restrictions by the donor.

The revenue section of your non-profit report will be broken down into its major sources. These might include donations, grants, membership dues, program fees, income from investment, and revenue that was release from donor restrictions.

Just like revenues, you would break down your expenses into categories based on specific functional areas. These can be supporting services, such as management, fundraising and other general services, and mission-based programs.

Note that if you use a software that is tailored for non-profits, your revenues and expenses will be categorized according to the specific requirements the non-profits have to meet. It will also automatically generate all the reports you need. Thus, when choosing software for your non-profit, you want to check the reporting capabilities before making a decision. Good software will also help you find the information you need and do it quickly.