A business rests on its financial structure. Success requires sound management of finances, expert analysis, and informed strategy. Most people know this process has something to do with the fields of bookkeeping and accounting, but tend to incorrectly use the two terms interchangeably. Bookkeeping is really one function of accounting, while accounting encompasses many functions involved in overseeing a business’s finances. We listed the fundamentals of bookkeeping for startups that will assist you to build a stronger foundation for your company.

Let’s begin by looking at what bookkeeping even means. Bookkeeping is the field within accounting that encompasses everything related to how you record and organize all information pertaining to your finances: that means every transaction, tax form, bank statement, etc. The bookkeeper’s work moves on to the accountant, who prepares reports and other types of analysis tailored to boost your business. Your brainchild depends on the management of your books, so it is essential to do them correctly. Accurate numbers will equip you with reliable financial records, enable you to file taxes without any speed bumps, analyze finances, and develop a winning strategy.

Introduction to Debits and Credits

There are two basic accounting terms that you should learn in order to become proficient in bookkeeping for startups: debit and credit. These terms frequently appear on bank records. Debit simply denotes the left-hand side of a journal or ledger, and credit denotes the right-hand side. Any preconceived association with these words, which are often mentioned in connection with credit cards and accounts, should be forgotten. When doing your books, you have to stick to a few essential principles about debits and credits on financial statements. In order for a double-entry bookkeeping system to remain in balance, the total of debits must be equal to the total of credits. Dividends, Expenses, and Assets should increase with debits and Liabilities, Equity, and Revenue should rise with credits.

Journal and Ledger Basics

Your business will require a precise and consistent picture of every transaction to achieve success in business. That’s why you will need a system to organize every receipt, bill, invoice, and payment. When tracking your business’s dealings, you will need a trusted sidekick: this is a financial statement called the journal, and it creates a chronological list of every financial event that your business encounters.

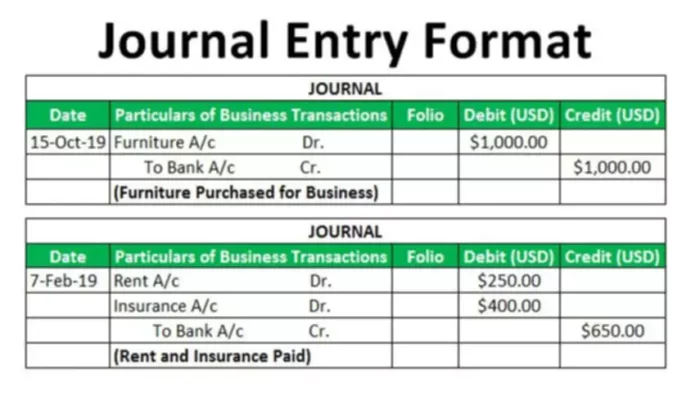

Journal entries include important information about transactions, including the date, the names of any accounts affected, and the amount moved to each account. Note that it is standard to address accounts that are debited before accounts that are credited. The sample financial statement below contains two journal entries: one for the purchase of furniture, and the other for rent and insurance.

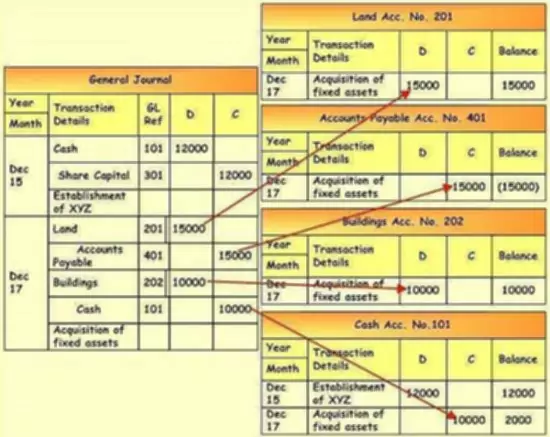

Like the journal, there is another type of financial statement that you should become familiar with. A ledger is an accounting tool that groups together all the transactions that concern a particular account. It also reports account balances. While the journal notes every event, the ledger instead only includes the portion of the transaction that influences the destination account. The sample below demonstrates how the ledger draws information from entries in the journal, which tracks receipts, bills, and invoices, to describe the state of specific accounts.

Another crucial topic in bookkeeping for startups is payroll, which is the system for tracking labor and paying your workers. If you employ one person or more, you will be required to consistently keep up with payroll; that means overseeing employee personnel files and other records on a recurring basis. You should also oversee all payroll forms, such as W-2s (for employees) and 1099s (for independent contractors.) You can delegate some of the more tedious tasks to payroll software; still, you will still need to keep careful track of all payroll records in order to ensure that your company is on the right path.

Like payroll, invoices need to be thoroughly tracked and supervised. These are records that represent the payment a customer owes after you have provided them with promised goods or services. Convenient software can reduce the tedium and assist you in streamlining and automating invoice tracking, whether a customer pays by credit card, check, or cash. Invoices are a key ingredient in your performance. Regular invoicing and careful tracking of invoices will make sure that customers are paying for your services, which helps guarantee that your business is able to bring in numbers that help it thrive.

Common Bookkeeping Mistakes

We put together a list of common financial mistakes among business owners. When you do your own books without professional help, you run the risk of making the following errors:

1. Having No Idea How Bookkeeping Works

Handling your own books without sufficient knowledge or experience can directly impact your business’s health and performance. You may be familiar with the basics of the process, but that doesn’t mean that you’re ready to handle such delicate procedures without assistance. There are many potential pitfalls that might cost you money and stress, and you might miss them without a professional to lead you through the minefield. Cooperating with a professional is one of the best ways to invest in your company and secure your future. They will take excellent care of your books, including by reviewing them periodically to ensure that your financial statements and other information are correct.

2. Not Setting up a Bank Account for Business

One common mistake among business owners is mixing professional finances with personal ones. A blurry line between business and personal accounts and credit cards needlessly complicates bookkeeping for startups; even worse, you might be held personally liable in a legal dispute if it can be proven that you use your accounts interchangeably. Instead of leaving yourself exposed, we recommend that you create a separate bank account for the exclusive use of your business, as well as a dedicated credit card for company use. This way, you always know where your bank statements belong and will be able track your professional finances with ease.

3. Utilizing Cash Rather than Accrual Accounting

On its face, cash accounting may give the impression of being an intuitive and straightforward approach to managing finances. While undeniably simple, this method actually makes it more difficult to attain a clear picture of your performance. A far superior alternative is the accrual method of accounting, which recognizes revenue at the moment that it is earned and expenses at the moment when they are incurred. This method is considered best practice because it offers more meaningful analysis of your performance.

4. Not Setting up the Chart of Accounts Properly

Helpful accounting software exists to assist with all the number crunching and data management, including options ideally suited to simply bookkeeping for startups. The software is convenient, but there are some notable caveats that you should know before trusting it blindly. For example, most applications will use a default list of accounts to begin your books. This list will be long and confusing; therefore, we suggest that you do not use these defaults. Instead, it is much better for your business and future to enlist the help of a tax specialist or accountant who will establish your books using only the types of accounts that are appropriate for your business’s needs.

5. Not Doing Books Regularly

We all procrastinate occasionally. It is tempting to put off data entry, but this will only result in more stress. You can make costly mistakes when rushing to catch up with accounting entries. Instead of stressing as tax time nears, we suggest that you manage your records in a deliberate and timely way; this involves saving and organizing credit card information, invoices, and bank statements on an ongoing and consistent basis. Don’t wait until tax time to update your entries! Protect your bottom line by filing and maintaining reliable records.

6. Not Reconciling Properly

Accounting software can simplify and rationalize reconciling your books. While useful, these are not fool-proof tools. You must still track and check every single bank account to verify that the date that it is reconciled matches bank records. Since bank statements do not always come through correctly, we advise that you take a look yourself and reconcile the business banking accounts with the books. This ought to be a monthly maintenance task. You must also reconcile your credit card statements. It is common for credit card fraud to fall under the radar, so close management is especially important if your company uses a shared credit card. Reconciling can uncover any errors that are worth a second look.

7. Not Thinking about Taxes

Bookkeeping for startups is about more than just record keeping. It is essential to taxation. Financial statements are the basis of your tax return, and you only do your business a disservice by giving short shrift to your books. Don’t run the risk of a stressful tax filing (and a litany of other problems!) Protect your business and your bottom line by carefully tracking your bank statements, credit cards, and other statements. Set yourself up for success at tax time and get the deduction you deserve.

8. Not Backing up Your Data

Tech problems are inevitable. Unfortunately, many companies leave themselves vulnerable by failing to back up their data regularly. When (not if) their system crashes, they are at risk of losing all of their bank statements, invoices, credit card information, and other financial statements. It is incredibly important to protect your data by backing everything up to an external hard drive or the cloud. A backup system safeguards your precious accounting records and protects your access to your financial statements, so you’ll be able to track your numbers no matter the situation.

9. Failure to Hire an Experienced Bookkeeper

Bookkeeping for startups requires a lot of concentration, calculation, and time. As your company matures, it will encounter more transactions that you will then need to oversee. As scale increases, it only becomes more difficult to keep a handle on your information and books. If you balance your own books, you will have to devote a significant amount of your time sorting through payroll, reconciling books, or tracking endless bank statements. You’d probably rather spend that time working on your business and growing your operations. So, don’t struggle through this process yourself, and delegate to an expert instead! Outsourcing to a trained bookkeeper is a far more timely and cost-efficient option, empowering you to return to work on operations and growing your business; moreover, you will protect yourself from mistakes that experienced bookkeepers know how to avoid. Expert guidance will safeguard you from unwanted expenses and penalties, as well as any missed opportunities to save money.

If you own a startup and are curious about how professional accounting services can help you achieve success, visit BooksTime! We are dedicated to strengthening the foundations and boosting the performance of your startup. Our team of dedicated bookkeepers will do your books with precision and confidence, which helps you grow your business while saving you valuable time and money.

How to Do Bookkeeping for Startups

A winning business needs a sound foundation. Before going into operation, your company will require a business structure, a budget, a dedicated business bank account, and software appropriate to its needs, and a reliable bookkeeping system. In theory, you may be able to manage these fundamentals on your own in some situations. For some smaller businesses, it can be possible to track your own financial statements by maintaining a journal, ledger, and other statements. Helpful accounting software will simplify and streamline these tasks if you do decide to handle your books on your own.

The do-it-yourself approach may appeal to an entrepreneurial spirit, but doing your own books can have serious drawbacks, even with the software on your side. As your business grows, it will encounter more transactions, generate more data, and necessitate more documentation. The burden of record-keeping will grow, as well, and the risk only increases that you will overwhelm yourself and make costly mistakes. Without expert advice, you will also miss out on critical insights into your financial situation. It’s nearly impossible to craft a winning strategy without the guidance of an expert. That’s why delegating your bookkeeping is the smartest way to get the most out of your business.

Outsource to seasoned professionals who will balance your books with precision and confidence. Find out more about BooksTime professional accounting services to see how we remove the guesswork and secure your company’s future.

Why Is Accounting Important for Startups?

You probably didn’t launch a career in business because you wanted to crunch numbers and file documents, but you will need a robust accounting system if you want to see your business thrive. Your company’s future depends on careful management of expenses, bank statements, income, payroll, taxes, and other financial pillars of the enterprise. This is an ongoing undertaking that keeps the business functioning from day to day and equips a trained expert to analyze your numbers, make meaningful observations, and anticipate your company’s future. These insights then allow you to craft a business plan, anticipate risks, evaluate opportunities for financing or investment, and bolster every part of your enterprise for years to come.

Bookkeeping Options for Your Startup

Business owners can opt for a rudimentary do-it-yourself system to compile information and balance books, at least while the company is at a manageable scale. The software helps make the process more efficient for those who want to handle their own finances, including documenting transactions and drafting financial statements. Even with software, though, doing your own books leaves you vulnerable to errors, penalties, and lost money. You will simply not be able to maneuver through the many risks and obstacles without professional experience on your side; that’s why the best strategy is to delegate your books to trained experts. One option is to bring in-house accountants into the fold. Given the overhead and payroll costs, this is far too expensive for many entrepreneurs. That’s why outsourcing is the ideal option for a business with limited resources. Accounting services like BooksTime offer accurate and timely bookkeeping for startups, which puts your business on the path to success at a significantly reduced cost.

Do Startups Need In-House Accountants?

Startups tend to be lean operations with limited resources. While some larger companies easily manage the salaries and overhead spending that come with in-house accountants, most startup owners will find that these options are just too expensive. Thankfully, there is no reason to have in-house accountants when budget-friendly and effective remote services exist. For most startups with accounting needs beyond their means, outsourcing is the best solution. It provides you with the expertise of an accounting professional on your side, and at a minimal cost. Visit BooksTime to find out more about what our professional services can do for your business. Our team is dedicated to helping steer you through the maze of opportunities and pitfalls that is bookkeeping for startups, and we’re ready to join forces to bring you professional success.