Overview

Revenue is the simplest metric for assessing the health of a company. Each leader analyzes its size, calculates other absolute and relative performance indicators on the basis of this value, and forms a development strategy. Revenue is the main source of financing for the enterprise, bringing material benefits and working capital that the business entity needs for further activities and active development(s). Revenue is also known as sales or top line (as it is reported at the top of the Profit and loss statement).

Sales revenue is the sum of all financial resources that you received during the reporting period from the sale of products or the provision of services. In this case, both the products that were manufactured by the company itself and the items that you purchased for the purpose of resale are taken into account. This indicator can be expressed both in cash and in volume, although this is not typical.

It is this accounting value that is taken as the basis for calculating income, various types of profits from the company’s core activities. It does not include expenses or receipts from non-operating activities. If the proceeds from sales of products show an increase from year to year, this is a good sign because the more the company sells, the more it grows. The decline in sales revenue means that these are not the best times for business.

Related concepts

An important accounting concept to remember when calculating this revenue is the revenue recognition principle. Thus principle tells us that revenue is journalized when earned (services performed or sold items delivered) not when the customer actually pays you. For this, we are going to use a special bookkeeping account.

A sales revenue account is where you record an explanation of why money or the promise of money came into a business. It is an Owner’s equity type account and is actually in a sub-category of Owner’s equity accounts called Revenue accounts. The amount recorded in the journal entry for the sales is the fair value of the asset received in exchange. Usually, that would be cash, but not always.

Another concept you should know to be able to properly calculate and record sales revenue is sales discounts. Many companies offer sales discounts to buyers to encourage buyers to pay early. Most buyers choose to take advantage of such propositions. The terms of the discount are typically specified in the invoice, and you would see something like 3/10, N60. What this means is that the buyer will get a 3% discount if they pay within 10 days, otherwise, the net amount is due within 60 days.

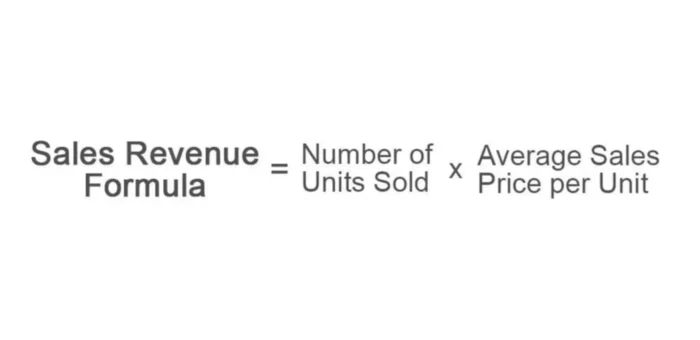

Formula

The calculation is very simple – information on sales volumes and unit cost are taken and multiplied. If during the reporting period the price has changed, sales revenue is calculated by multiplying the average price by the number of units sold. Note that you are including only income from sales and any other income that you might have received from other activities is not taken into account.

This is a basic formula that will give you gross sales revenue. Gross sales represent the total amount of revenue earned from selling products. As you can see, you are not deducting any expenses associated with the production of these goods. However, there is another sales revenue value that managers, investors, and other parties are interested in. This would be net sales revenue. This is the amount of sales the company expects to be paid for the goods or services.

The formula for its calculation is slightly different. Actually, you would take the gross sales revenue and account for all the returns, allowances, and discounts by subtracting them from this value. After all, you would want to know the true amount of sales money the company earned. We already discussed the sales discounts. When it comes to sales returns and allowances, they represent the amount of cash refunds for returns and allowances, such as partial cash refunds or exchanges from current period sales.

Example

For example, on April 1, your company sold 50 units of your product for $200. The sale terms were 2/15, N30. Your gross sales revenue will be 50 units multiplied by $200 or $10,000. To record this transaction, you would want to journalize the sales revenue at the net discount amount because most customers do take advantage of the discount. To do this, you would debit the Accounts receivable, while the Sales revenue is credited for $9,800 ($10,000 x 2% = $200 discount; $10,000 – $200 = $9,800).

If the buyer pays you within 15 days, then you will debit the Cash and credit the Accounts receivable for $9,800. However, you might come across a situation when the buyer for some reason chooses to pay later and cannot get the discount. In this case, your journal entry will reflect the full amount received or $10,000 under Cash, $9,800 under Accounts receivable, and to balance that, you will need to credit another account, which is typically called Sales discounts forfeited, for the difference (possible discount amount) of $200.