Credit sales are very popular in the consumer market and quite common even in small businesses, often exceeding cash sales. This is because, with this method of trading, the buyer receives the goods immediately and pays for them for several months or years, which is very attractive to consumers. In this article, we will consider the accounting for transactions on the sale of goods on credit from the seller’s point of view.

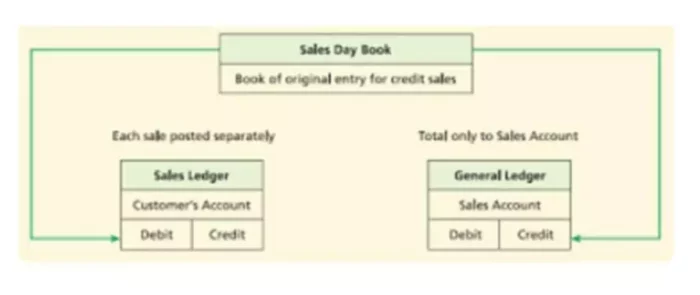

Sales Day Book also referred to as Sales Journal, is used to record business’s credit sales of goods. It is a list and summary of invoices the business sends to its credit customers. This is a Book of Prime Entries, which means that the transaction entries are not part of the double-entry system.

Sales Journal does not have a debit or credit side/column or records of cash sales, returns, and transactions other than credit sales. An accountant would debit an individual posting to the customer’s account. The accountant posts totals to the Sales account periodically.

Information Listed in the Sales Journal

The Sales Journal includes specific information about each sale transaction, which can vary slightly from company to company. The company extracts this information from the company’s sales invoices and usually consists of the following items:

- The date the transaction has taken place

- Invoice number column (sequential numbers)

- A Folio column for the ledger reference number

- Credit customer name and specifics of goods sold in the Details/Customer column

- Invoice amount (net, sales tax, gross)

- Any other extra information

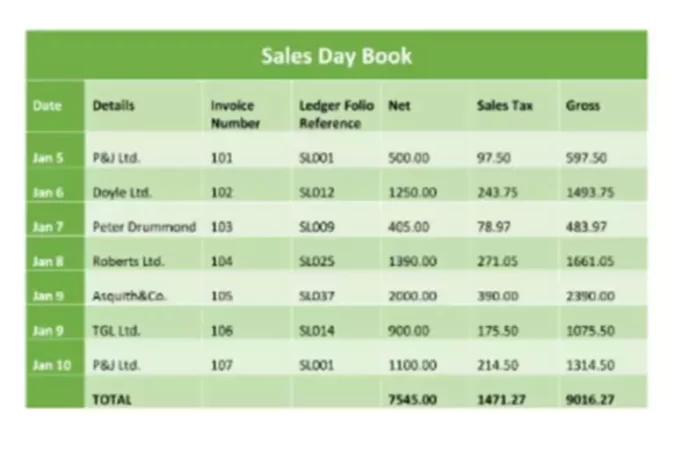

In the illustration below, you can see a typical format of the Sales Book.

As you can see, this company has three columns for the amounts. Other companies might have one and, instead, have another column for delivery charges to a customer. In any case, the company will always have the “Other” column in addition to the primary columns to record any information that does not fit into other categories.

The Invoice number is specific to order, while the folio number (LF) is specific to the customer (e.g., P&J Ltd. SL001). The total amounts can also have a cross-reference number to General Ledger.

Sales Journal Example

The image above illustrates how the sales transaction is posted. Let’s review it step-by-step using an example. For instance, the accountant has the following information on credit sales:

- Invoice 213 –C. Daley on March 18 for $200.

- Invoice 214 –B. Johnson on March 22 for $700.

- Invoice 215 –L. Jones on March 15 for $500.

- Invoice 216 –P. O’Reilly on March 5 for $1500.

- Invoice 217 –P. O’Reilly on March 29 for $2500.

- Invoice 218 –T. Smith on March 1 for $1000.

The accountant will record this data in three stages:

1. Sales Day Book

First, he/she enters the data from the sales invoices into the Sales Day Book. Given the information provided to the accountant, it will look like this.

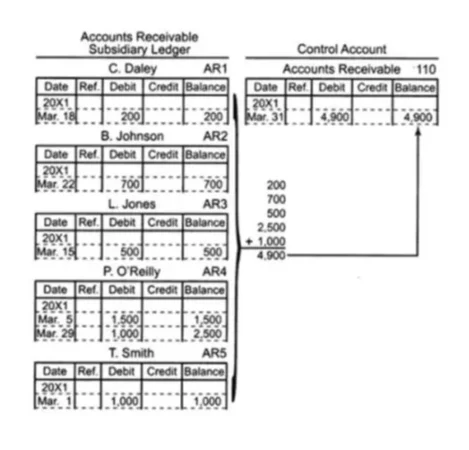

2. Accounts Receivable Ledger

The Accounts Receivable Ledger includes independent accounts for each customer purchasing credit. The credit sales are posted, one by one, to each customer’s account in the Accounts Receivable Ledger.

Since the credit sales increase the Accounts Receivable and it’s an asset account, you will debit the amount. The reference column will contain a page number in the Sales Journal where the sale was initially recorded (we leave it blank). The ledger, in our case, is not involved in the double-entry accounting method, so the debits and credits do not have to balance. The postings will look as follows:

3. General Ledger

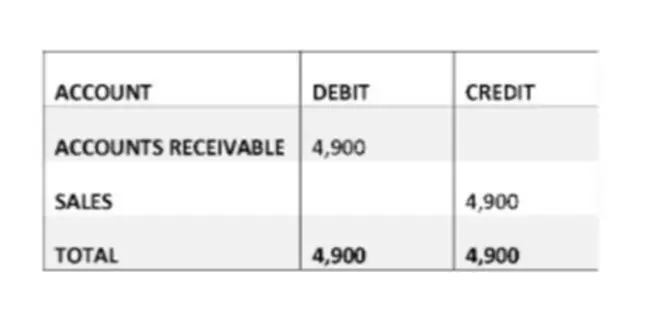

The totals from the Sales Journal will also be posted to the Accounts Receivable account in the Main Ledger (GL). So, rather than doing the six individual debits and credits for each customer, the accountant will post the sum of those six into the GL. The debit value will show how much the customers owe to this particular business, and the credit entry will reflect what portion of the sales was made on credit.

Sales Journal Proof of Postings

The possibility of selling goods on credit allows retailers to “increase” the number of solvent population and, accordingly, increase sales. Buyers, in turn, have the opportunity to purchase expensive durable goods with deferred payment or installment payments. Keeping correct records of sales on credit will ensure that the business knows who owes it and what amount.

Thus, proving is essential for every business because it gives it a mathematical proof that the accountant is doing things correctly and that the business is on track. To check whether the accountant transferred the data from the sales journal to the main ledger correctly, you would check these two items:

- The subsidiary ledger controlling account balance in the main ledger must equal to the balances of individual subsidiary ledger accounts add up together. You can see this in the illustration for Step 2.

- The balance in the main ledger controlling account must equal all the individual customer account balances in the respective ledger added up together.