The financial statements of companies are a kind of guideline for investors and an essential aspect of financing and the economy as a whole. After all, the financial condition of the largest national companies of any country is, first of all, the balance and prosperity of the entire economy of the country. For a small business, however, financial statements are just as important.

Any company regularly generates standard financial reports: balance sheet, income statement, cash flow statement, and statement of shareholders equity. These statements are usually accompanied by an extended version of the shareholder’s equity statement – statement of retained earnings.

Relationship Between Financial Statements

Let’s consider the purpose of the leading financial statements and how they relate to each other.

The balance sheet of the company provides information on the financial position of the company and is required to assess the financial state of the company, the structure of sources of financial resources and the liquidity of the assets of the enterprise and solvency. The retained earnings account and dividends amount are the same as ending retained earnings and dividends paid in the statement of retained earnings.

The income (profit and loss) statement provides information on the results of the enterprise for a specified period. It allows assessing the profitability and efficiency of resource use and business activity. The net income value from this report is used in the preparation of the statement of retained earnings.

The cash flow statement provides information on changes in the financial position of the enterprise and is required to assess the operational, investment and commercial activities, the ability to create cash and cash equivalents and the company’s needs in cash.

The statement of shareholder’s equity shows the total change in the capital of the company due to changes in assets and liabilities. It is required to assess changes inequity, the dividend policy of the company, changes in the capital due to additional money from the revaluation of fixed assets and share premium and assessment of thecompany’s policies in the distribution of profits.

Preparing Retained Earnings Statement – Example

The statement of retained earnings example. Although the statement of retained earnings is not as important for example balance sheet and cash flow statement, it is valuable for several reasons, so knowing how it is prepared and what makes up the retained earnings statement is essential even if you are not a bookkeeper.

Statement of retained earnings will tell the owners and investors how well a company is doing. Investors will be able to decide whether to sell, keep, or buy company shares. Owners will be able to see how much-retained earnings have accumulated and how they changed from the previous year.

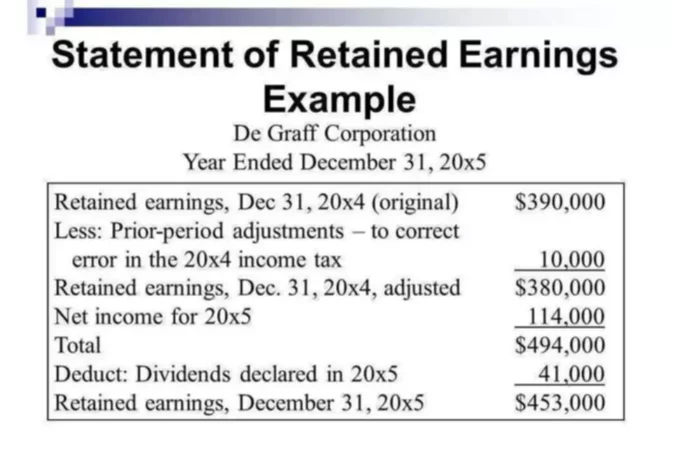

De Graff Corporation. Year Ended December 31, 20×5. Retained earnings, Dec 31, 20×4 (original) 390,000. Less: Prior-period adjustments – to correct. error in the 20×4 income tax 10,000. Retained earnings, Dec. 31, 20×4, adjusted 380,000. Net income for 20×5 114,000. Total 494,000. Deduct: Dividends declared in 20×5 41,000. Retained earnings, December 31, 20×5 453,000.

Heading

The first thing that you will write when preparing the retained earnings statement is the heading. The heading will include the report name, company’s name, and the period for which the report is ready. In our case, this is Statement of Retained Earnings, De GraffCorporation and Year ended December 31, 20×5. This is the most natural part of the statement of retained earnings preparation.

Beginning Retained Earnings

To be able to prepare your statement of retained earnings, you will need a value for beginning retained earnings. This number can be found by looking at the retained earnings report from the previous year. It will be the ending retained earnings value in the prior year that is carried over to the current year.

Another place to look for beginning retained earnings is the balance sheet for the previous year. It will be included in the shareholder’s equity section under retained earnings. This is the first number that will be included in our statement and ending retained earnings calculation.

Prior-Period Adjustments

Although financial statements are prepared with utmost attention to accuracy, mistakes, and even fraud do happen, and adjustments are necessary to make corrections. Prior period adjustments can be made if the company under or overestimated its expenses, made simple mathematical mistakes or mistakes in applying accounting policies.

Another case when an adjustment to the beginning retained earnings would be necessary is when a company realized income tax benefits. If no corrections are required, this line is excluded from the retained earnings statement.

Net Income

Net income is a profit that is received after paying taxes on it. The company’s net income is calculated before dividends are paid, as the difference between the gain from the sale of a service or product and the money spent on production, depreciation, business expenses, payment of wages and other expenses, including tax expenses.

To calculate ending retained earnings, net income value is required. As we mentioned earlier, several financial statements are prepared at the end of the reporting year. An income statement is one of them. Thus, you can get the number required for filling the net income line in the retained earnings statement from the income.

Alternatively, you can calculate net income yourself. Net income = gross revenue -(fixed costs + variable costs) – tax payments. To find out net income, you need to subtract the total amount of expenses from the total amount of income. The higher the difference between them, the better. If the resulting figure is less than zero, then over the past time, the organization received a net loss, which will be noted in the statement of retained earnings by placing the number in parenthesis.

In the retained earnings statement, net income is being added to the beginning balance of retained earnings because retained earnings are the portion of income that a company set aside in previous years after paying dividends, if necessary. A subtotal amount will be indicated underneath.

Dividends

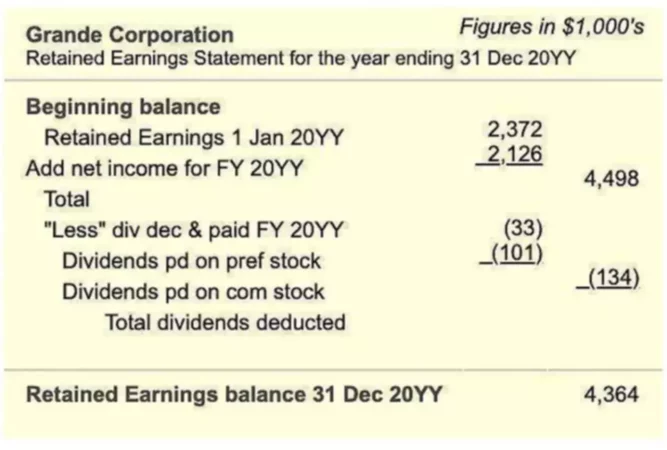

Dividends are part of the corporation’s profits to be distributed to shareholders. Dividend payments reduced retained earnings. Each shareholder receives assets, usually cash, in proportion to the number of their shares. Declaring dividends is the power of the board of directors only.

Dividends can be paid quarterly, every six months, annually or at other times by decision of the board of directors. In most countries, the board cannot declare dividends above retained earnings. When profits over retained earnings are reported, the company pays out to the shareholders a portion of their equity.

Such dividends are called liquidation dividends and are usually paid when the company ceases to operate, or its operations are reduced. However, the presence of a significant amount of retained earnings is not in itself a basis for the distribution of dividends. A business entity may not have sufficient cash or assets in any other convenient form for delivery. In this case, to pay dividends, it will have to take a loan. Most board directors try to avoid this.

The Declared cash dividends account is a temporary shareholder’s equity account, which is closed at the end of the accounting period by debiting the Retained earnings account and crediting the Declared cash dividends account. Thus, retained earnings are reduced by the total amount of dividends declared in this accounting period.

In some companies, dividends are not paid often. This is because the company either does not make a profit, or the benefit is used for other purposes, possibly to expand production. Investors investing in growing companies expect to receive income on their investments in the form of an increase in the market value of their shares.

However, if it is decided that dividends will be paid this year and dividend payment was declared officially, then the amount of dividends paid is subtracted from the subtotal we receive by adding net income to the beginning retained earnings. As you can see from the retained earnings statement example (retained earnings normal balance) above, there are several types of dividends being paid. In an earlier retained earnings statement example, this section was not expanded and just had a Dividend declared line. Both versions are acceptable.

Ending Retained Earnings

After subtracting dividends, you will get the ending retained earnings balance or in other words, a total balance of earnings at the end of the year. This is the number that will show under the retained earnings account and in the balance sheet. It is also the number that will be used for the beginning retained earnings value in the next year’s retained earnings statement. Thus, it is essential that this value is calculated correctly.