How important is accounting in a business? Do you own a construction, manufacturing, or any other project-based company and wonder if you hired the wrong bookkeeper? The only way to start right is to make sure you bookkeeping us set up right. First, you need to understand the basics and the difference between project accounting and regular accounting.

What is Project Accounting?

Project accounting monitors the financials of individual projects related to managing a project including costs, billing, and revenue. Since it focuses on resources and money that go into the project, you might sometimes see it referred to as cost accounting. Project accounting is useful because a project might require work across a variety of different departments within a business, making tracking the different transactions and progress more difficult.

Financial Accounting vs. Project Accounting

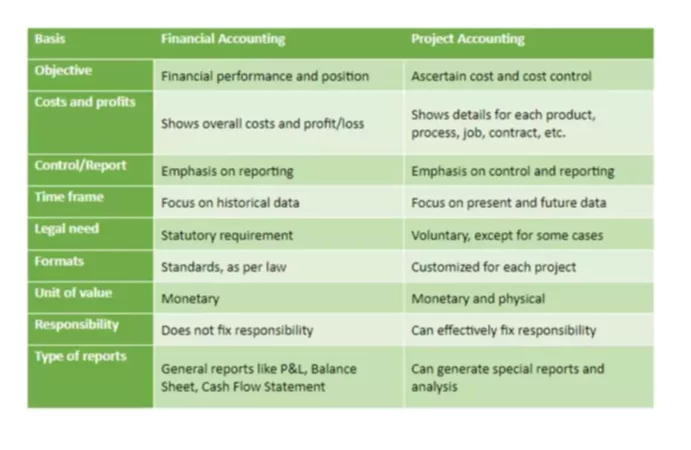

Both, the financial accounting and project accounting use the same accounting equation. Yet, financial accounting and project accounting have a completely different end goal. Let’s look at some of the differences between the two.

Project Resource Management Basics

When we talk about project resource management, we should look at what resources are required for the successful completion of the project and then acquire these resources and manage them throughout the project lifecycle. Under resources, we mean human resources, technology resources, and anything that is required for the project to be done. One can divide all the resources into three categories:

- Materials

This is an obvious category of resources, although some projects might have nothing in this category (e.g. professional consulting projects). The materials needed for the project and their volume vary greatly from one project to another. The accountant would need to track the cost of these materials, including how much they were purchased for and how much was spend on delivery, preparation, storage, and installation.

- Human resources

This is a resource that is used in every single project. The number of individuals working on the project and their expertise can vary, but what accountants care about is being able to accurately calculate and record the cost of this resource. One of the challenges that arise when there is a large number of workers working on the same project is that they can not only be in different locations, but they also get paid for their work differently. For example, some workers might be paid an hourly wage, which might include overtime hours, while others receive a monthly salary. The project might also need professional services on a one-time or ongoing basis for which there will a set fee and may be additional charges that might vary based on the work performed.

- Time

Time is an important factor in each project. The management needs to provide a way for workers to accurately track the time they spend on the project. The accountant would record this data and present it to the management in a meaningful way so the management can adjust the process accordingly and prevent the project from missing the deadlines and costs getting out of control.

Do You Need a Software for Project Accounting?

The answer to this question can be either a yes or a no, but there are some signs you should be on the lookout that will tell you that you might be needing the help of modern technology in addition to a professional accountant.

- Limited accounting system. Your current accounting system supports only the basics and does not support project accounting or provides limited functionality.

- Cannot work on the go. You cannot access project financial data and other information when you are not in the office.

- Multiple systems. You need to use different programs and systems to plan and manage the project.

- Out of date project status. Management does not have access to the up-to-date information on your project, whether it is the budget or the milestones.

- Inaccurate expenses. Your expenses are not reflected accurately because your team cannot submit them in an easy and simple way. There are often receipts missing and, as a result, you cannot accurately calculate your revenue.

- Unruly timesheets. The staff submits hours worked randomly, so your bookkeeper has a hard time planning for the payroll expenses and preparing paychecks.

- Projects overrunning. You are not able to tell why your project costs are higher than you expected and why it takes more time than you planned. This will definitely not make your customers happy.

- Limited project finances. The money you can spend on the project is limited, so each penny spent needs to be accounted for and analyzed.

- Lengthy project meetings. The meetings are not as effective and are time-consuming because you are not able to generate the necessary reports quickly.

Haphazard invoicing. Your invoicing all over the place – you do not know which invoices have been sent and which have been paid. Your customers are also not able to quickly and conveniently pay them online.