Definition

When we assign a cost to a product, we can use job costing if it is a unique product or a service and we can assign the costs directly. In some cases, though, it is going to be too time-consuming. When a manufacturing process involves the continuous production of identical units rather than distinguishable job lots, there can be no job orientation.

When there is no obvious start or finish because the manufacturing process is endlessly repetitive, the management turns to a process costing system to accumulate and allocate manufacturing costs. As opposed to the other costing techniques, process costing is a method where the cost of products is determined on the basis of different levels of production. It is used where standardized, homogeneous goods are produced.

Types

The process costing method has its advantages and disadvantages. It is easy to use, flexible, and less expensive. At the same time, it provides less financial accuracy, cannot measure each department, among other shortcomings. When using this method, the accounting department can choose one of the process costing types based on what is most suitable for the situation.

- Activity-based costing: focuses on the allocation of indirect overhead costs of the process.

- Weighted average: total costs of a process are directly apportioned over the total units produced.

- FIFO: incomplete units are finished before the new units are added to the process.

Example

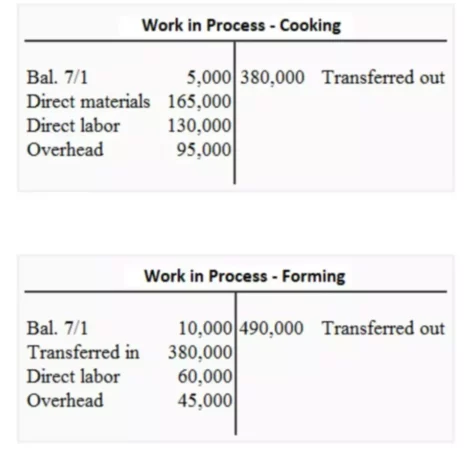

Let’s take a look at a candy factory as an example. Obviously, the candy-making process is far more complicated than what we will describe here, but let’s assume that there are several stages that candy has to go through to become a final product. These are the cooking process, forming process, cooling process, and wrapping process.

So, we will take raw materials (sugar, milk, butter, cocoa, flavorings, etc.) and bring them into the cooking department. Here we will add labor and manufacturing overheads. Once we are done with the candy mixture preparation, we will move on to the forming, then cooking, and finally the packaging.

When the candy is going through these stages, it is really work in process (WIP). Ultimately it will go to finished goods and then the cost of goods sold in our accounting records. With process costing, we will have a WIP account for each process (department) where we will record all the costs that go into making the candy during that process.

As we move from process to process, we will decrease the WIP account of the cooking process and increase the WIP account for the forming process, and so on. Having separate WIP accounts is an important, distinguishing feature of this costing method.