Any business activity requires control over expenses, income received, and net profit. It is impossible to plan further work of the enterprise without controlling processes. For constant control, there is a special system called accounting. Accounting in an enterprise is a continuous process of monitoring and controlling the activities of an enterprise and its financial position.

Although accounting is strictly documented, every so often, the accountant and management traditionally ask questions whether everything is in order with the financial records, whether errors have crept in accounting and reporting. Thus, regular checks are necessary.

Bank reconciliation overview

Almost everyone is involved in some form of bank reconciliation. From households to large businesses, bank reconciliation is part of sound financial management. Basically, bank reconciliation is the act of taking the documentation issued by the bank and checking it against the records that were created by the bookkeeper to verify that the two sets match each other.

Bank reconciliations are performed to check whether a bookkeeper is doing a good job recording all the transactions correctly and catch any human errors as well as fraud and other undesired events. Nowadays, most businesses use online software for their financial records and other activities. Depending on the plan, the reconciliation can be done automatically or by accounting specialists working at the software company.

Process of preparing bank reconciliation

Although it can be very time consuming, the process is relatively simple and usually follows these steps:

- Gather information necessary to do the bank reconciliation – bank statements and accounting records (cash book).

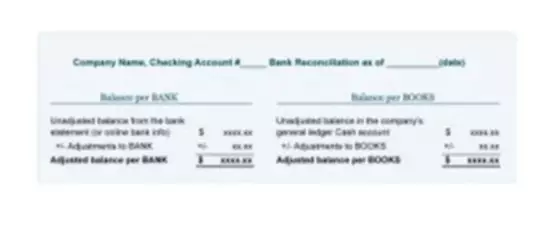

- Identify the difference between your own records and bank statement. If desired, use a template such as the one shown above to make the whole process faster and easier.

- Mark transactions found in the cash books that are also present in the bank documents.

- At this step, all items should now be ticked off in the bank statement. Once all of these areas have been covered, it is relatively easy to see how to correct the account balance information so that both sets of records coincide with the current account status. Adjust cash book with items that are in the bank records, but no in the cash book.

- Prepare the bank reconciliation report. The unresolved transactions need to be tracked down and corrected with an explanation for the errors. Entries in the accounting books to correct detected inconsistencies are usually made on a subsequent day or period, and not using past dates.

Here are some tips to make the process quick and efficient:

- The reconciliation task usually involves comparing line items on a bank statement and accounting entries from the same time period. Important items to check are the check numbers and amounts associated with each check number. This can often lead to the discovery of any small discrepancy between the amount shown by the bank and the balance shown in the business records.

- Along with the verification of the information, it is also important to compare any cash withdrawals and purchases made with a card linked to the bank account. Although private individuals often do not keep a record of all the transactions, such activities are important for business and it is usually a bookkeeper’s or business owner’s responsibility to keep a record of every single financial transaction.

- Another factor to consider when reconciling accounting records with a bank statement is any type of authorized withdrawal, such as monthly utility bills, rent payments, or insurance payments. By remembering to add these items to the book ledger every month, you can significantly reduce the burden of reconciliation, as the addition helps prevent any surprises when you receive your account statement.

Why do discrepancies happen?

Do not be alarmed if you find slight variations when preparing this report. Simple errors and the inability to record a transaction when it occurred often explain discrepancies and can be quickly reconciled. Other reasons include bank fees and fines, checks drawn and already issued to recipients, but not yet deposited, as well as those that were deposited but rejected by the bank due to low balance.

However, it is important to note that while bank statements are more likely to be correct than not, it is possible for a mistake on the bank side to happen. When a bank customer is unable to determine the cause of a discrepancy, it is always a good idea to contact the bank and schedule a time to go over the transactions together.