Keeping of accounting records begins with an Opening Entry. If you are embarking on a new venture, these entries capture everything with which you are starting your business. On the other hand, if you already own an established business and are transitioning from one accounting period to another, the opening entries in the new journal carry forward the balances of various assets, liabilities, and capital appearing in the balance sheet of the previous accounting period. The opening entries will be different for each business, depending on the items on the balance sheet.

Opening Entry Example

Perhaps your widget manufacturing company has been keeping records using a single entry basis. This was an acceptable practice when you ran your small operation out of your garage, with only a few customers, an occasional sale, and few expenses. Assume now that your company has grown in employees, customers, orders, and inventory. You have outgrown your single-entry bookkeeping system, and it’s time to upgrade to a more robust double-entry accounting system. When you initiate your new ledgers, you will need to create an opening entry that reflects the final balances from your old system. For example, after reviewing your bookkeeping records, you extract these balances for assets and liabilities from your old ledger system:

Closing Assets | |

Account | Amount |

Cash | 750 |

Supplies and Equipment | 16,000 |

Account Receivable | 4,300 |

Prepaid Expenses | 1,300 |

Total | 22,350 |

Closing Liabilities | |

Account | Amount |

Accounts Payable | 2,500 |

Loans Payable – Equipment | 10,000 |

Total | 12,500 |

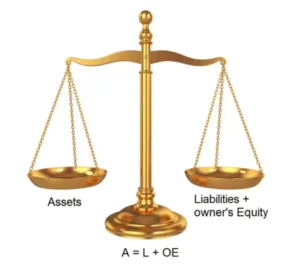

If you want to ensure you create accurate open entries, apply the Accounting Equationto the balances. According to the balances above, the Accounting Equation yields:

$22,350 (Assets) = $12,500 (Liabilities) + X (Owner’s Equity)

The question remains: What is the Owner’s Equity, i.e., the value of X? Using simple algebra, X is the difference between $22,350 (Assets) and $12,500 (Liabilities). X (Owner’s Equity) is therefore $9,850.

That’s good news. You are in the black. The next question is: How much of that equity did you pump into the business to begin with, and how much has the business earned since then? Another equation helps you figure out your Retained Earnings, i.e., your net profit.Assume you spent $5,000 cash of your own money to get the business up and running. How much more has your business gained in equity (earnings) since you got started?

$9,850 (Owner’s Equity) = $5,000 (Capital) + X (Retained Earnings)

You can now calculate Retained Earnings (profit).

$4,850 (Retained Earnings) = $9,850 (Owner’s Equity) – $5,000 (Capital)

Congratulations! You made money during the previous accounting period. You are starting out this new accounting period with more equity than you started the business with. That is the definition of success, and your accounting system tells you how much of a success you are.

Opening Balance Journal Entry

With the reconciled balances from your old journal, you can record the opening entry in the new general ledger journal. The opening balances will serve as the beginning balance for each account. Transactions in the current accounting period will increase or decrease these balances, depending on the type of transaction.

Opening Entry in General Ledger | ||

Account | Debit | Credit |

Cash | 750 | |

Supplies and Equipment | 16,000 | |

Accounts Receivable | 4,300 | |

Prepaid Expenses | 1,300 | |

Accounts Payable | 2,500 | |

Loans Payable – Equipment | 10,000 | |

Capital | 5,000 | |

Retained Earnings | 4.850 | |

Total | 22,350 | 22,350 |

The Accounting Equation

Business transactions affect the financial position of the organization by increasing or decreasing assets, liabilities, or equity. If done correctly in the double-entry accounting system, offsetting increases and decreases in related accounts do not disrupt the balance sheet equation. Using the above example, this would look as follows:

Opening Entry Accounting Equation | |||

Account | Assets = | Liabilities | Owner’s Equity |

Cash | 750 | ||

Supplies and Equipment | 1,600 | ||

Accounts Receivable | 4,300 | ||

Prepaid Expenses | 1,300 | ||

Accounts Payable | 2,500 | ||

Loans Payable – Equipment | 10,000 | ||

Capital | 5,000 | ||

Retained Earnings | 4,850 | ||

Total | 22,350 = | 12,500 | + 9,850 |

New Business Opening Journal Entry Example

An opening entry for a new business looks quite different from an opening entry for an established company. When you start out, all you have is what you put into the business. To create a new example, suppose you put up $20,000 cash to start a new coffee stand in a corner of the parking lot of your local supermarket. Before you ever brew your first cup and make your first dime, the opening entry reflects an increase in Cash and an increase in Capital from zero to the amount you put in.

New Business Opening Entry in General Ledger | ||

Account | Debit | Credit |

Cash | 20,000 | |

Capital | 20,000 | |

Total | 20,000 | 20,000 |

Popular Double-Entry Bookkeeping Examples

Now that you know about the opening entry in accounting, you might be interested in other accounting entries used by businesses that employ the double-entry bookkeeping system, such as:

- What Is a Journal Entry and How to Write It

- Adjusting Entries

- Deferred Revenue Journal Entry

Have questions about Open Entry for your business? Contact us at learn.more@bookstime.com for a free consultation.