The United States of America is a large, diverse country, with many regions differing significantly in socio-economic and cultural terms. In general, the local population has a good standard of living, and a stable wage for the average American is considered one of the main indicators of well-being and confidence in the future. The country has complex tax and labor legislation and this must be taken into account whether you are an employee or an employer.

Minimum Wage

As the name suggests, the minimum wage represents the lowest amount of money employers may legally pay to their employees. Today, minimum wage laws exist in pretty much all developed countries. The U.S. law provides for the establishment of a minimum hourly wage in the country at the federal and local levels. The employers are required to follow the indicator that is currently higher. The federal minimum wage in the U.S. in 2020 is $7.25 an hour. The rate has not increased since 2009.

The Fair Labor Standards Act identifies certain categories of workers who are not guaranteed a minimum wage of $7.25 per hour. For example, this applies to students at American universities and other educational institutions who earn extra money during their studies in the service, retail, and agricultural sectors, as well as workers with mental or physical disabilities that affect labor productivity. In addition, there is no federal hourly minimum wage in the United States for the following professionals:

- Babysitters (in some cases)

- Individual caring for the elderly

- Federal investigators

- Fishing specialists

- Couriers employed in newspaper delivery services

- Mariners employed on foreign ships

- Agricultural workers employed on small farms

- Seasonal entertainment staff.

Young professionals under the age of 20 can be paid $4.25 an hour for the first 90 days of employment. At the end of the 3 months, or at the age of 20, whichever comes first, the worker must earn at least $5.85 an hour. Today, about 20.6 million wage earners in the United States have incomes almost at the level of the minimum wage.

Overtime Pay

What is overtime work?

Along with the minimum wage, the Fair Labor Standards Act created a 44-hour, later revised to 40-hour, workweek. Employees who work more can be eligible for time-and-a-half pay for all hours over the 40 hours. Overtime pay is based on the standard wage rate, which is what you normally earn for the work you do. The definition of the standard wage rate refers to various types of pay such as hourly wage, salary, freelance work, and commission payment. Under no circumstances may the standard wage rate be lower than the applicable minimum wage.

Typically, the number of hours used to calculate the standard wage rate cannot exceed the legal maximum, which in most cases is 8 hours during the work day and 40 hours during the workweek. This indicator for each employee also depends on the number of working days per week. The alternative method of defining and calculating overtime based on an alternative weekly work schedule that provides four ten-hour or three twelve-hour work days per week does not affect the standard wage rate. In this case, it can also be calculated based on the forty-hour workweek.

Who gets extra pay for overtime work?

Not all categories of workers are not entitled to the overtime pay. First of all, additional pay is not allowed for employees performing managerial functions or representatives of highly qualified professions. For example, you make management decisions and supervise the work of employees, or work in an organization as a doctor or lawyer, then you cannot count on your employer to offer you additional money for working overtime. Management assignments are those that require specialized or technical knowledge to direct the activities of two or more subordinates. Occupations related to creative activity or requiring knowledge on the basis of education beyond the usual higher education are considered professional.

How can you determine if you are eligible for overtime pay?

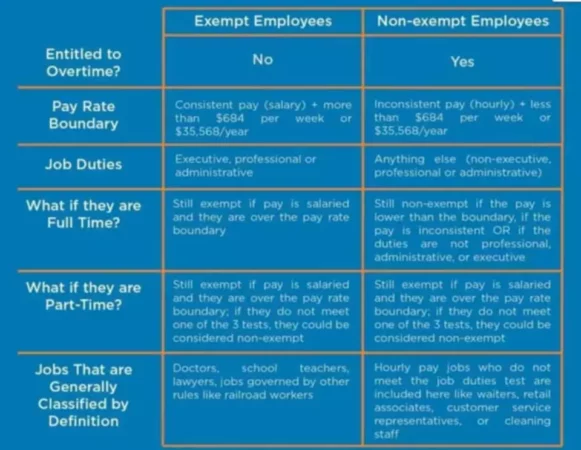

The answer to the question depends on the company in which you work. Namely, if the annual income of the business is less than $500 thousand, then no matter what work you do, the overtime requirement does not apply to you. Further, even if your company is subject to the minimum wage laws, this does not mean that it is required to pay for the overtime hours. According to the new rule of the Department of Labor effective January 1st, 2020, employees making up to $35,568 per year or $684 per week are now eligible for overtime.

A table below will help you determine whether you can claim that extra money.

Which groups of workers are not affected by the overtime pay rule?

For example, salespeople who spend most of their time off-site selling products or services or taking orders. They are not entitled to additional payment. Neither can independent contractors, computer technology specialists (e.g. programmers, system analysts, and computer engineers), media workers, transport workers, agricultural workers, temporary workers (e.g. in the entertainment field and amusement parks or cinemas), and some other categories of workers. Thus, if you work as a programmer, as in the example above, then most likely your employer is not obliged to pay for the time you worked over the established 40-hour week.