What is Inventory?

Inventory refers to any goods or materials that you carry in your business for further selling. So, if you want to sell it to earn revenue, it is part of an inventory. Both traders and manufacturers have inventory. The first one buys goods and sells them without any further processing. The manufacturer, though, needs materials from which he will make the finished product. Both can use accounting software for easier management of their inventory.

Types of Inventory

The main types of inventory include:

- Raw materials – elements that can be converted into components or products (e.g. silver is converted into jewelry).

- Work in progress – items that are in the process of being converted into your finished product.

- Finished goods – the product you get after finishing all your manufacturing processes, which is ready for sale or consumption.

- Maintenance, repairs, and operating items – items that are not directly part of your production chain, like tools and office supplies.

We can further break down the inventory into the following categories:

- Current demand stock – inventory that is ready for immediate use.

- Transit inventory – inventory that is on the route from one location to another.

- Anticipation stock – used if your business has limited capacity to produce inventory during peak season.

- Safety stock – a safety buffer for any uncertainties you might encounter in supply and demand.

A Guide Periodic vs. Perpetual Inventory Accounting

The perpetual accounting method continuously updates a business’s inventory account as goods are bought and sold on a unit by unit basis. With a periodic inventory accounting method, you would update inventory account at regular intervals. This is usually triggered by a physical inventory count that happens at the end of each month, quarter, or financial period. To guide you through the accounting process for each system, we will use an example.

Let’s say you have a book shop. At the end of June, you have 300 books that cost you $8 per unit to buy. In July, you buy another 500 books at the same price and you sell 450 books for $15 a unit. So, what is your Cost of Goods Sold in July?

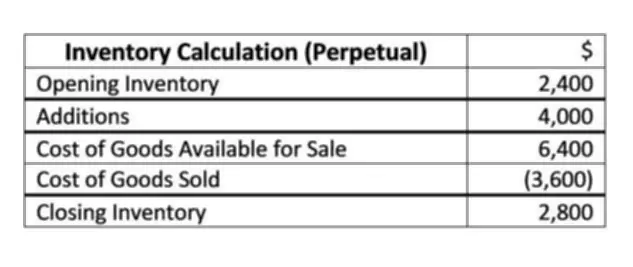

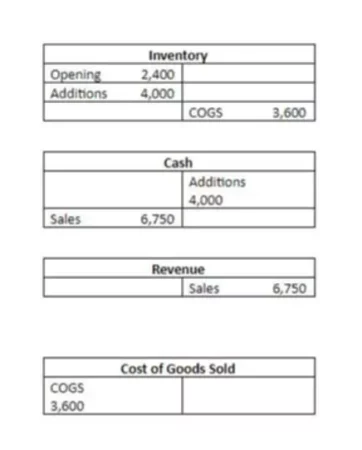

Since you closed in June with 300 books costing $8 per unit, your ending balance for June was $2,400. This balance will be your opening Inventory balance for July. Next, under the perpetual method, you would record additions to your Inventory account. In July, you bought 500 books for $8 per unit, which is $4,000. Depending on how you paid for the books, you would also record a credit to Cash or A/P. The following step is to recognize Revenue and COGS as sales take place. You sold 450 books for $15, making $6,750. The COGSs will equal 450 x $8 = $3,600.

Finally, you can easily calculate a closing balance in July, which will equal $2,800.

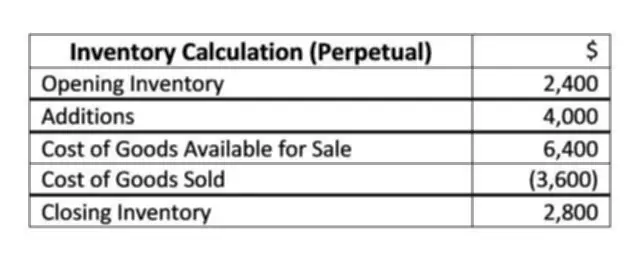

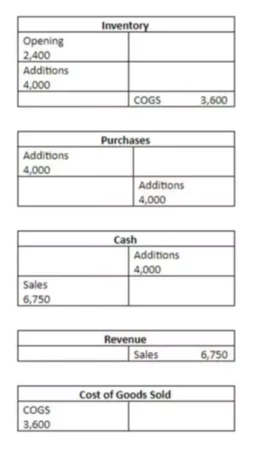

The calculation of the opening balance in the periodic system is the same. Next, you would record additions in your Purchases account and your Cash or A/P account. The following step is to recognize revenue as sales take place. To find a closing balance and COGS in a periodic system, you need to clear total purchases to your Inventory Account, by crediting Purchases and debiting Inventory, which might seem weird if you only made one purchase during the period.

Now, you need to physically count all your books in the warehouse and update your closing Inventory and calculate COGS. You counted 350 books, which cost you $8. So, your closing balance is $2,800. By rearranging the calculation, you would subtract Closing inventory from the Cost of goods available for sale to get your COGS, which will equal $3,600. To record this in your books, you would debit the COGS and credit Inventory.