Taxes are something everyone has to deal with not only once a year when paying income taxes, but also on a more regular basis. People in the US who work, make their living as employees, and even those who are self-employed and pay themselves wages have to deal with a withholding tax. Businesses that have salaried/wage employees working for them are required to take income tax from the monthly salary and pay it to the tax office for them.

Have you ever wondered how tax is calculated on your paycheck? Maybe you are a business owner who has hired employees and needs to figure out how the whole process works. In any case, it is important to know how to calculate withholding tax to ensure that you are subtracting the right amount from the pay. After all, you do not want too much tax or too little tax being withheld from the paycheck.

You do not want either case to happen because if you give more than you need to, it means your money is trapped with the IRS and you cannot get it back until you file the return. Yes, you will receive a refund later on, which is the money you just let the IRS borrow from you just like that, without paying interest to you. If you do not pay enough, you will get into trouble and owe more money than you initially had.

Of course, you can use a calculator provided by the IRS to estimate the amount to be withheld. It will ask you general questions about how much you are earning, filing status, how many dependents you plan to include on your return, and how often you receive a paycheck. The accounting department or person in charge of bookkeeping would typically calculate these without any problems. However, you can do it yourself without any calculator just by following our simple step-by-step guide.

Calculation with example

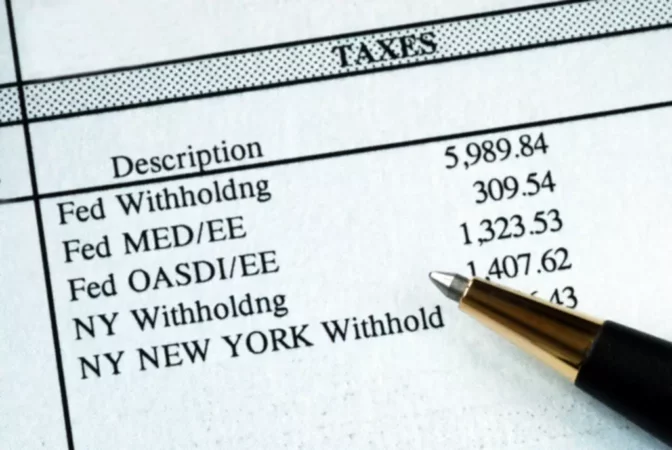

First, let’s make it clear, the federal withholdings mean income taxes only and you do not take care of the Medicare and Social Security here because these are completely different deductions. Moreover, the withholding tax applies only to the amounts earned by the individual above the minimum level. To help you understand the withholding process, we are going to use an illustrative example and walk you through it step by step.

If you are an employer, you would need to make sure you have the employee’s W-4 form with you. This form provides the details that you would need to know to accurately calculate this federal tax. In fact, this confusing piece of paper every employee has to fill out when being hired ultimately impacts how much federal income taxes the business owner would take from each and every one of your paychecks to give directly to the government, which tries to ensure that it secures at least some amount of taxes they are supposed to receive to function properly. Now, let’s get our hands dirty.

Percentage Method

Kelly is a single woman who works one job and earns $82,000 a year. Her employer makes a deposit every week.

- Your first step is to determine whether you are calculating this amount for a month or if the paycheck is written on a weekly or biweekly basis. In our case, this would be weekly. So, Kelly’s weekly wage comes out to be $1,577 ($82,000 / 52 weeks).

- Next, look at all the allowances you are claiming, which the employee specifies in the W-4 form. It is a required piece of information to have on hand. The amount of allowance is subtracted from the wage for the period a paycheck is written. You are assuming Kelly does not have any allowances based on the info given.

- Now, you need to pull up Publication 15, which can be found on the IRS website, and look for the percentage method tables sections.

- Looking at the standard withholding rate schedule for single individuals, you can tell that she earns at least $1,010 but less than $1,883, which means the rate you would use for our calculation would be 22% of the amount that exceeds $1,010 or $567 ($1,577 – $1,010). So, you would multiply $567 by 22% to get $124.74 in taxes for this portion of the income.

- In column C, you can see you need to add $88.84 to the amount you got. A simple calculation gives us $213.58. This is the amount that the employer would be actually taking out of Kelly’s paycheck.

- If you subtract $213.58 from the weekly wage of $1,577, you will get the amount that the employer is actually going to deposit into her bank account. This would be $1,363.42.

Wage Bracket Method

Now, let’s say there is another employee who is also single, but this time Amanda has 1 allowance and is paid $780 every other week.

- Just like with the first example, you want to get the information on the frequency of payments (biweekly) and the amount paid for this pay period.

- Next, you would navigate to Publication 15 on the IRS website. You will use the tables provided to determine how much tax to withhold. Make sure you find the right table by checking that the marital status and pay period match what you have determined in step one.

- Once you find the right table, you will simply look for the line with a range that corresponds to the wage that Amanda earns. You see a line that says at least $760, but less than $780. This tax bracket cannot be used, and you would need to look for the next bracket $780-800.

- Since Amanda has one allowance, you look for a column that says 1. Where the two lines intersect, you can see that $65 will be withheld from her paycheck.

As you can see, this method might be somewhat simpler for many as you do not need to learn much to know how to calculate withholding tax. At the same time, the previous method also did not require any complicated mathematical calculations.