Definition

Stockholders’ equity shows what funds the investors who purchased the company’s stocks own in the company. This is a financial indicator that characterizes the amount of funds owned by members of the organization. Equity and net assets are essentially synonyms. You can see their value in a certain Balance sheet line, or you can calculate it using a special formula.

For any business, the value of Stockholders’ Equity is extremely important, being the foundation on which the financial stability of the company is based. Having this value, you can calculate many other indicators and ratios to evaluate your business or company you are considering investing in. They will show how successful the business is.

When analyzing the financial condition of an organization, the dynamics and volume of the Stockholders’ Equity are of the greatest interest. Just like turnover, these parameters are often mentioned in public reports and press releases of companies. An increase in Equity is often perceived as a positive signal, a sign of the company’s success and gaining of competitive advantages. Subsequently, the growth of Equity capital leads to an increase in the price of the company’s shares. It becomes more attractive for potential investors, and the level of trust among creditors grows.

In addition to the external effect, changes in Stockholders’ Equity have a tremendous impact on internal financial characteristics. The level of profitability, liquidity, and overall financial stability of the company directly depend on this figure. Thus, it will never hurt to know not only what it means, but also how to calculate stockholders’ equity, and how to use the results to make decisions and correct conclusions about the business.

How to calculate Stockholders’ Equity

In practice, two methods are commonly used. The first one is very simple. Its essence is to look for the figure indicated in a certain line of the Balance sheet as the value of the Stockholders’ Equity. To apply the first method, you need to know where the company’s own funds are reflected in the Balance sheet.

Typically, this is the right side of the Balance Sheet and the bottom section. You will see the total of the Stockholders’ Equity section listed right before the total of Liabilities and Stockholders’ Equity. The number in this line is the sum of different items, which usually include:

- Paid-in capital and additional paid-in capital, which are the funds raised by the business from equity, and not from ongoing operations. It includes different types of stock, including common stocks, which can be further subdivided into different categories, and preferred stocks, which have their advantages but also cost more to acquire;

- Reserve capital, which represents the funds a company sets aside in case of future losses or other unplanned and unexpected situations that might arise;

- Retained earnings (uncovered loss), which is essentially the company’s net income that it has acquired over the whole period of its existence less any dividends it paid to the stockholders;

- Own stocks repurchased from stockholders, also known as stock buybacks or treasury stock, which can be purchase for a price higher than the company initially sold them for (a loss for the business) or lower (gain for the business).

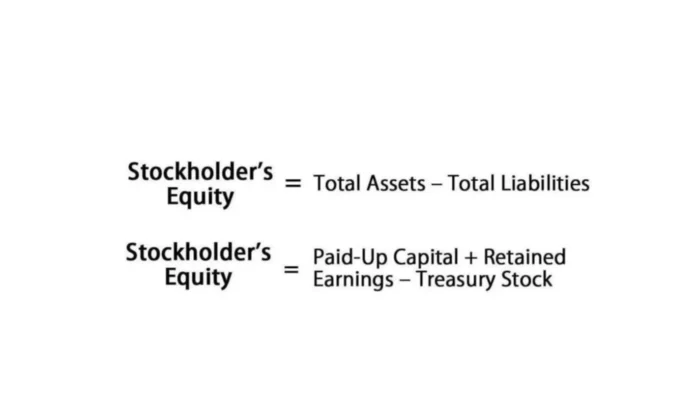

You can also see the Stockholders’ Equity section also presented as a separate financial report with a little more detail than you would typically see in a Balance Sheet. Accordingly, if you have numbers for each component of the Stockholders’ Equity, namely the paid-in capital, retained earnings, and treasury stock, you can calculate this figure by doing some simple math.

The second method is a little more complicated. You would need to have either the totals for the company’s Assets and its Liabilities on the same date or have access to bookkeeping records to be able to calculate these totals yourself, which will obviously be very time-consuming and requires more knowledge of what goes into each category. Once you have the values for both figures, you will use the first formula above, which is simply a rearranged accounting equation that most are familiar with, to find the Stockholders’ Equity amount.

Factors Affecting Stockholders’ Equity

There are four main factors affecting the Stockholders’ Equity structure:

- Industry risks. The higher they are, the less the amount of debt a company has, which is optimal.

- Tax status of the company. Since payments that relate to borrowed funds are usually deducted from taxable income, the higher the level of the tax rate (specifically – on profit), the more profitable it will be for the company to use debt financing. However, taking on more debt instead of using the company’s internal resources might not always be the best way to go.

- Planned issuance of stocks. A financially stable Balance sheet is required to obtain funds in the stock market. This factor reduces the optimal amount of borrowed capital.

- Borrowing policy (conservative or aggressive). This factor relates to management’s attitude towards borrowing. Some business owners tend to borrow more money than others. Although this factor does not affect the optimal capital structure, it is still significant in other aspects.

The concept of its financial structure is associated with the formation of Equity. The financial structure of capital is the ratio of equity and debt of a company. The financial structure of Equity determines many aspects of the activities of the company and significantly affects its results. It affects the level of return on assets and equity capital, the level of distribution costs, the level of financial stability and solvency of the enterprise, the level of economic risks, and, ultimately, the success of a company as a whole. Therefore, the formation of the optimal Equity structure at each company should be given serious attention.

The formation of the financial structure of the Stockholder’s equity is influenced by many factors. One of the key factors is the stability of the sale of goods because the more stability, the higher and safer the use of borrowed capital becomes. The structure of the assets also plays a role. The better the ratio of fixed and working capital, the share of net assets, and other indicators are, the more opportunities a company has to attract and use borrowed capital.

Growing businesses in the early stages of their life cycle, with a high level of competitiveness in their segment of the consumer market and within the established market niche, can attract a large share of debt capital for asset financing. On the other hand, with high rates of profitability, the company has the opportunity to capitalize on most of its profits, thereby reducing the need for borrowed capital.

At the same time, since the payment of interest on the loan used reduces the amount of Retained earnings, then with a high level of taxation, the use of borrowed capital becomes more efficient. Depending on the state of the financial market and other factors, the cost of attracting borrowed capital increases or decreases, which affects the volume of its use by business owners.

Finally, the management’s attitude about acceptable levels of economic risks, in this case to the risks associated with the financial stability and solvency of a company, is no less important. The more acceptable to them the possibility of a high level of risk to achieve higher profit margins, the greater the share of borrowed capital they can use in the course of business and vice versa. In our blog, you can also read about what stockholders equity is.