In pursuit of achieving the best results, a modern financial manager needs not just ideas for business development, but it is desirable to calculate and evaluate different aspects of the company’s activities, directing the results towards increasing profits and business growth. The result of studying financial documents is an assessment of the state of the enterprise, its assets and liabilities, the profitability of the resources used, and much more. For this, managers often use horizontal and vertical analysis.

The analysis of the financial and economic activities of enterprises is associated with the processing of a huge array of information characterizing various aspects of the functioning of a business. Most often, the necessary data is concentrated in financial reporting documents and accounting records. One of the ways to get valuable information from these reports is to do horizontal analysis, which we will explain below.

Definition

Horizontal analysis compares (in absolute or relative form) the main items of the Balance sheet, Profit and loss statement, and Cash flows statement for two or more accounting periods. Simply put, this type of analysis consists of comparing the indicators of the accounting reports with indicators of previous periods.

What sets horizontal analysis apart from the vertical analysis is that you do not have to calculate the numbers for every single item on the financial statement. You can just look at the changes in revenue, or inventory, or short-term liabilities, or any other item over two or more accounting periods. This allows you to understand in detail the changes over the period. These changes can also be compared with expectations.

Explanation

The analysis methodology is quite simple. You would need to have data for at least two periods to be able to do the horizontal analysis. The periods can be months, quarters, years, etc. For example, the Income statement data at the beginning and end of the year are displayed sequentially, then you will calculate the absolute differences in the value of each item and determine the percentage change of every single item.

In other words, the analysis of the profit and loss report is prepared by calculating the percentage increase or decrease of each item on that report in comparison to the previous year that is taken as a base year, or by dividing the amount of each item by the corresponding value in the base year. A similar analysis is carried out for all the other business reports.

Example

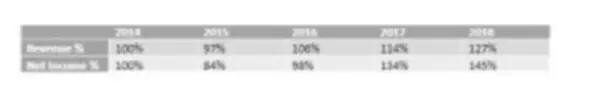

Let’s look at examples of vertical analysis of revenue and net income. Looking at the data presented above, we can tell that the base year for trend analysis here is 2014. By looking at just the numbers, we can tell that, in general, the corporate revenue and net income grew, except for the year 2015 when it dipped. What grew faster, revenue or net income? What does that tell us? To answer these questions, we would need to convert the numbers into percentages. In other words, we will need to do a horizontal analysis of the data.

The base year during the horizontal analysis will always be positive and equal to 100%. The revenue for the year 2015 will be $14,150/14,600 or 97%. For the year 2016, it will be $15,470/14,600 or 106%. We would do the same math, dividing each item by the base year for that line, for the remaining years as well as for the net income.

So, what is growing faster – revenue or net income? The horizontal analysis of the financial information shows us that the net income percentage is higher than the revenue percentage. What conclusions can management come to after seeing these results? This information can tell us that the revenue is growing at a faster rate than the corporate expenses are, which is obviously a great thing and means that the business is on the right track. Analysts often graph this information to make it easier to see how the values have changed over time and analyze why this happened.