Gross Margin

The goal of any company is to generate money. This income of funds can be calculated and analyzed using different financial and accounting indicators. There are such concepts as revenue, net profit, and gross profit. Gross profit (margin) is one of the main indicators characterizing the results of the company’s business activities. This indicator allows you to highlight promising areas of business and redistribute financial flows to obtain a more effective result.

Gross profit is revenue less costs. It is determined by subtracting the costs of goods (works, services) production (provision), or purchase from the proceeds from their sale. Revenue includes all amounts received from operating activities. The cost of the manufactured (or purchased) product includes all costs incurred for its production (purchase). If a company provides services (performs work), then when calculating their cost (and subsequently gross profit), all costs associated with their provision are taken into account.

Gross profit is usually determined at the end of a month, quarter or year, but it can be calculated at any time interval and at any time – it all depends on the goals and objectives of the company, as well as the specifics of its management accounting.

Gross margin ratio

A definition of gross margin ratio can be written as follows: it is the ratio of gross profit to revenue. In other words, it shows the amount a company earns per dollar of sales. For example, a ratio of 40% means that it saves 45 cents for every dollar generated from sales to be spent on expenses as well as payments to shareholders.

There is no single standard for determining how strong a company’s gross margin is compared to the general economic market. The ratio is specific to each industry sector because companies have to compare their ratios with companies with similar business structures.

While any company can use the gross margin ratio analysis, it is primarily used by manufacturers and sellers who use the gross margin ratio to find out if they have priced their products correctly to recover all business costs. Thus, gross profit margins can vary significantly from one industry to another, but they should cover the costs of managing the organization and the sale of goods and, in addition, bring the company a profit.

Based on the above, the gross margin ratio shows how well the company’s management is able to manage the costs associated with the production of goods. For the gross margin ratio to grow, it is necessary to manage production and the associated costs wisely.

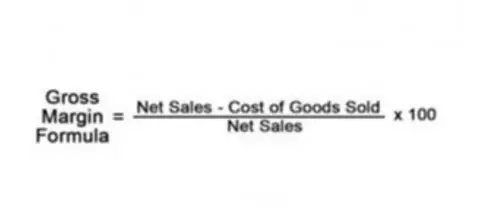

Formula

If you want to calculate this profitability ratio, you can just use the formula above. If you already know your gross profit, you can use it for your numerator. After dividing the gross margin by sales, you will multiply the result by 100, which allows you to get the results in a percentage form. All the information necessary for the calculations can be found in the business financial statements.