Knowing all the rules for tax payments in your own country can be stressful. Fulfilling your responsibilities before the U.S. tax services as a foreigner requires even more diligence and might make some reconsider their decision to receive any insignificant income from the United States.

Do you work directly with a customer of IT services from the USA, or through various platforms (Steam, Oculus Rift, Google Adsense, etc.), receive dividends or income from another source from the United States while not living there or being a citizen of this country? If yes, your income is subject to U.S. income taxes, unless you can certify otherwise.

Form W-8 plays an important role in the United States tax system. It is required by U.S. financial institutions and FATCA compliant foreign financial institutions. Let’s find out what this form is all about in more detail and who is required to complete it.

What is a W-8 Form?

Within the framework of international agreements concluded with foreign countries and US tax legislation, non-US residents — foreign citizens and organizations that receive income from sources in the United States should complete W-8 Form. You can check the official I.R.S.’ website to see if your country concluded such an agreement with the United States and obtain the W-8 form. You can also get the documents through a local tax office.

In most cases, foreign taxpayers are subject to 30% withholding on U.S. source fixed or determinable annual or periodical (FDAP) income. A payor of income is primarily responsible for tax, including for withholding the tax and paying it to the Internal Revenue Service. At the same time, the foreigner would submit this form to the income payor instead of the IRS, which often confuses some.

Let’s say a foreign national owns stock in a U.S. company that decides to pay a dividend of $10,000. Due to the 30% withholding tax, instead of paying this foreign taxpayer this $10,000 dividend, the payer (the corporation) actually would have to send 30% of the $10,000 to the IRS or $3,000. The remaining $7,000 would go to the foreign taxpayer. If the company failed to withhold the 30% withholding tax, the tax liability would fall on the company, not the foreign taxpayer.

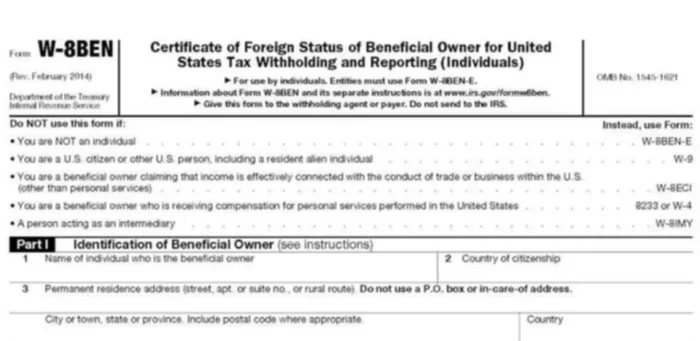

Form W-8BEN

The W-8BEN Form is a tax form used by foreign persons and corporations to certify they are not citizens of the United States and establish their taxpayer’s status. This would include disregarded entities owned by foreign individuals. For example, a Canadian citizen that is resident in Canada owns a U.S. LLC that is a disregarded entity (e.g. single-member LLC) that owns a rental property. In this case, it is as if the Canadian owner owned the property directly.

Individuals must provide their name, contact details, date of birth, U.S. SSN or ITIN, if any, and foreign TIN. The information disclosed is used to determine withholding tax requirements. There is also a section that individuals can fill out to claim reduced income tax withholding normally taxed on American citizens under a U.S. tax treaty.

Form W-8BEN-E

The W-8BEN-E Form is a tax form used by foreign entities to certify their foreign status for withholding tax purposes. This would include disregarded entities owned by foreign individuals. Similar to the example above, if the Canadian corporation owns a U.S. LLC that is a disregarded entity that owns a rental property, this would be the correct form to use.

This form also provides the entity’s FATCA classification, which is very important in determining if the entity is a passive non-foreign institution or an active non-foreign institution or if the entity is a foreign financial institution and if so, what kind. To confirm your FATCA classification, you might need a help of a professional tax advisor.

The information such as the entity name, entity type, FATCA classification, contact details, country of formation, U.S. EIN, if any, foreign TIN, and GIIN, if any, would need to be provided among other data. The entities can also claim reduced withholding under a U.S. income tax treaty. Just like in the W-8BEN, there is a section for this.

Other Versions of Form W-8

- W-8ECI — for foreign individuals or entities to certify that income is effectively connected with a U.S. trade or business, including by disregarded entities owned by foreign individuals. It eliminates withholding tax and the taxpayer becomes responsible for paying the taxes.

- W-8EXP — for foreign governments or international organizations to claim withholding tax exemption.

- W-8IMY — for intermediaries and foreign flow-through entities. It allows claiming withholding tax exemption under some conditions.

Note: No matter which type of Form W-8 you fill out, make sure to that you know what exactly each field is asking for, so you can enter all the required information correctly. Also, some sections might not apply to you, so do not add any information there. It is also important to note that not submitting this form on time can mean as much as 30% in penalty fines. If you are not sure about any portion of the W-8 Form, we encourage you to seek professional help to avoid any undesired consequences.