Business cost planning can be characterized as a special decision-making process, in which information about the past financial and production activities of an economic entity is analyzed, potential resources are assessed and the organization’s goals for the future as well as the ways to achieve them are developed. The main form of enterprise cost planning is budgeting.

Planning and monitoring the performance of the organization became impossible without the formation of a budget as the main tool for flexible management of the organization, providing accurate, complete, and timely information to management. The budget of an economic entity reflects the results of planning and control in the form of planned, expected and actual data, and the deviation of actual indicators from planned ones. It serves as an important tool for achieving business goals.

Definition

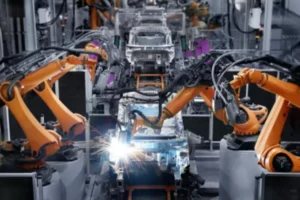

A flexible budget definition would be a budget that is adjusted for the actual volume. It is usually prepared for several different volume levels within a relevant range. Moreover, the flexible budget separates the fixed and variable cost, where the latter provides for that flexibility in the flexible budget. An example of this type of budget is seen above.

Unlike a static budget (where all costs are projected based on a certain level of productivity/sales, which remains unchanged until the end of the planning period), in a flexible budget, variable costs are calculated based on the norms per unit of production and the level of goods/services sale. In other words, a flexible budget allows the anticipated variable costs to be adjusted according to the actual revenue level.

Advantages and Disadvantages

To effectively manage a company, top managers must quickly find out the reasons for the deviation of the company’s financial and economic indicators from the planned ones established in the financial budgets. However, many of these indicators are directly interrelated and not static. For example, the volume of the company’s activities (planned revenue) may change significantly under the influence of not always predictable external factors.

In order to correctly assess the impact of such changes on the implementation of budgets, flexible budgets are used, which are the link between the planned budget and the actual results achieved. When creating a flexible budget, money (costs as well as prices) are taken as planned, and volumes are taken as actual. This type of budget would be created if management knew the future actual sales with certainty, but these are unknown and this is where a flexible budget comes in.

When analyzing planned versus actual, it is incorrect to compare the amounts of variable costs because these costs are related to different sales volumes. This problem is solved by a flexible budget – in it, the income and expenditure budget indicators are recalculated depending on the actual volume.

A flexible budget will be useful for companies where most of the costs are closely related to the level of business activity. It can also be used to simulate the likely financial results at different sales levels. This makes flexible budgets a powerful performance measurement tool. At the same time, one of the main disadvantages of this approach is that companies might misuse the flexibility, which might lead to worse results instead of advantages.