Financial statements differ based on whether you have a for-profit business or operate as a non-profit organization. Today, you will learn about financial documents that nonprofits need to prepare instead of standard reports that for-profit businesses have. These statements form a complete picture of the organization. Assuming that you have created an effective chart of account and had the transactions accurately recorded, preparing these reports should not be difficult.

Statement of Financial Position

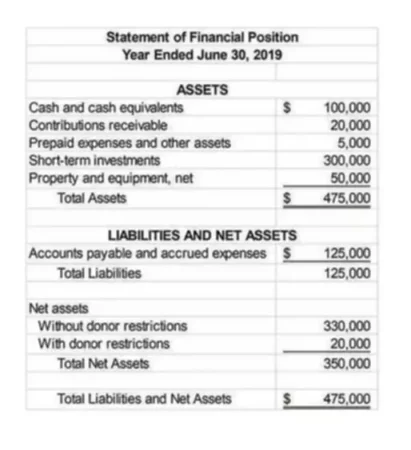

The Statement of Financial Position can be defined as a snapshot of the value of the nonprofit organization at any particular time. Just like balance sheet, it has three sections:

- Assets – something that is owned by an organization.

- Tangible assets – items that have a physical form. They can be current or non-current. Current assets are those assets that can be turned into cash within one year. Non-current assets will take more than one year to be converted into cash.

- Intangible assets – items that have no physical form, e.g. a trademark, copyright, or patent.

- Liability – something that an organization owes.

- Current liabilities – debts that have to be repaid within one year.

- Non-current liabilities – debts that need to be repaid over a time period greater than one year.

- Net Assets – the net worth of the organization or what is left after all liabilities are covered. Theoretically, if all assets are sold to pay off all liabilities, net assets would remain. Since revenue cannot be part of nonprofits, it has to be classified as either unrestricted asset or asset with donor restrictions or designations.

- Unrestricted net assets – funds that can be used for the general benefit of the organization.

- Designated/restricted net assets – funds that are restricted for specific use or passage of time and need to be used according to these restrictions.

A healthy nonprofit will have Assets that are greater than their Liabilities and their Net Assets will have a large surplus to be used to achieve its goals in the future. This is what a typical Statement of Financial Position could look like.

Statement of Activities

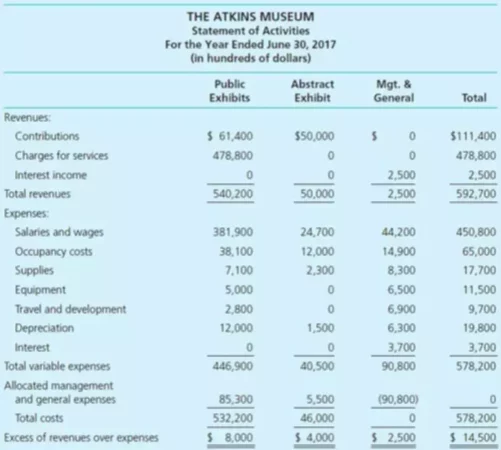

A Statement of Activities focuses on the total organization instead of the funds within the organization. It shows your income less your expenses to get net income, which will tell you if you spent more than you received. Instead of showing how much profit an entity made, nonprofits show their sources of funds (grants, contributions, etc.) and how well they managed this money efficiently operated.

Unlike a for-profit Income Statement, the Statement of Activities must segregate financial activity by revenue classes to identify funds received without donor restrictions and funds with donor restrictions. They also divide expenses between categories – mission-based functions, supporting services, etc.

Statement of Cash Flows

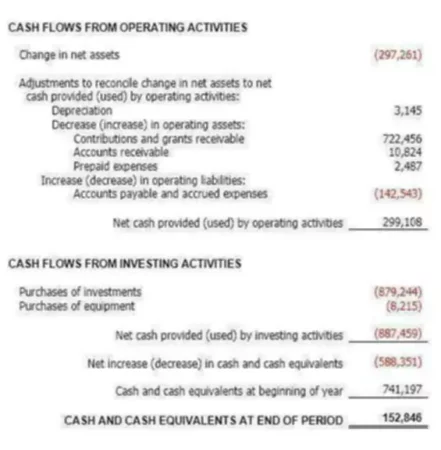

The statement of cash flows for a nonprofit organization is similar to that of a for-profit business. It illustrates the actual flow of money through the company and how much cash is available to pay expenses each month. It helps to see the effect of the organization’s operations on its cash balances and determine problems with liquidity. The statement usually consists of the following parts:

- Operating activities – activities that relate directly to the main mission of the nonprofit organization. For example, these can be fundraising activities that led to the inflow of unrestricted funds.

- Investing activities – cash flows that resulted from long-term investment activities. These can include both the purchase and sale of investments or fixed assets for the organization.

- Financing activities – cash flows that resulted from the receival of cash from donors or creditors or cash payments to creditors. These inflows or outflows lead to changes in permanently restricted funds.

Statement of Functional Expenses

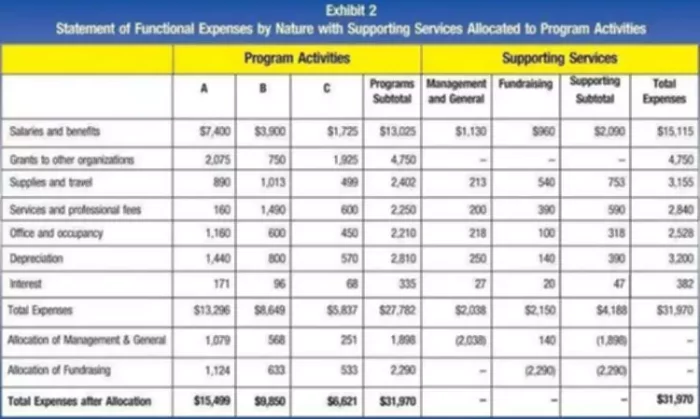

This is where the accounting for nonprofits cash flow statements really begins. The Statement of Functional Expenses shows how much money you spent and received across the entire entity over all of your functions. For instance, you can know what your total administrative cost was for the year, but you can also see how much the supplies cost was for your general function, supporting function, etc. It helps to show what money is spent on (e.g. program costs, operations support, fundraising costs) and how much money and time the organization spent on each of the categories. This ensures that the organization properly allocates its money between different expense categories and can make appropriate changes in the future.