Definition

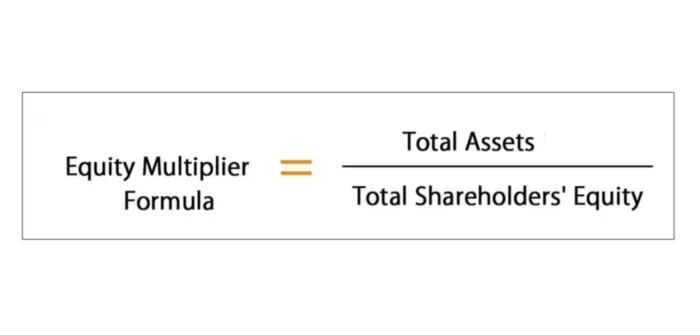

The equity multiplier, which represents what part of all of the company’s available assets were acquired thanks to the equity. It shows how well a company is doing in regards to its debt management strategy. To find the value of equity multipliers, just look at the financial records for total assets and calculate what portion of it is the shareholder’s equity. After doing some simple arithmetic, you will get a direct measure of total assets per dollar of equity.

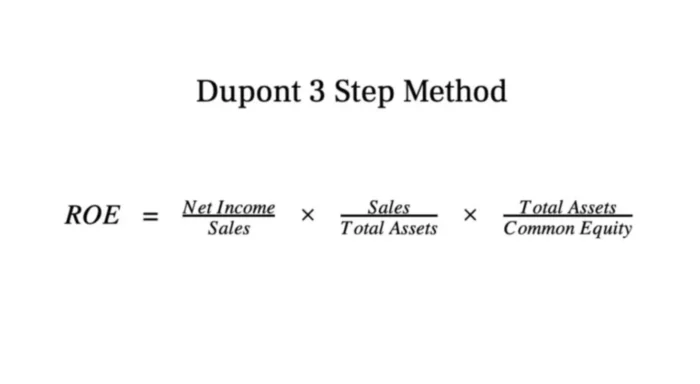

This is one of the first liquidity and financial leverage ratios entities that want to invest into the business or those that want to evaluate the level of risk they will take if they loan money to this particular company. Management and other internal users, of course, are also interested in this number. When doing a financial assessment of a business using the DuPont factor analysis method, the equity multiplier plays an important role in it, as you can see from the ROE formula below.

The methods of factor analysis will help to assess the degree of influence of each factor on the growth of business efficiency. The DuPont System of Analysis method was first used by DuPont company at the beginning of the 20th century and is factor analysis, that is, highlighting of the main factors that affect the efficiency of an enterprise.

The purpose of the financial analysis carried out by the company is to find ways to maximize the return on invested capital for owners and shareholders. The profitability of the enterprise and the growth of its value for shareholders are reflected in the profitability ratios. Enterprise profitability management is becoming a key challenge for all management levels. DuPont proposed a simple way to manage profitability by decomposing the profitability ratio into factors reflecting various aspects of the enterprise’s activities. One of such factors is the equity multiplier, which is the last portion of the ROE equation shown above.

Meaning

The larger the capital multiplier, the higher the leverage ratio representing the external financing of the company, and the greater the risks are. In general, a lower equity multiplier is desirable because it means that creditors funded less assets than investors (or the owner). A high equity multiplier is not a guarantee that a company is a poor investment option or that it is destined for a financial crash; it only points to a likelihood of such events.

However, if the company’s operations are going in the right direction, a higher equity multiplier may instead create higher returns for the company. It can also be said that by increasing the potential of a business to create more revenue, the company is also increasing its share price.

At the same time, a higher equity multiplier indicates that the company has more liabilities, which usually results in a higher leverage ratio and greater financial risk. Businesses that rely too heavily on debt to finance their operations will have high interest payments and all the other associated fees. Accordingly, the business should have a good cash flow to cover all these costs.

When managing an enterprise, it is necessary to look for the optimal capital structure to ensure that the company is not missing out on any of the opportunities and not risking too much that it can find itself bankrupt.

Example

Home Connect is a local internet provider. The owner is looking for additional finances to take the company to a next level and wants to take a big loan in the next couple of years. In order to be successful, the management has to make sure the Home Connect equity multiplier ratio is favorable. When looking at this company’s financial statements, you can see that the total assets add up to $700,000, while the total equity is equal to $620,000.

To calculate this financial indicator for Home Connect, you would simply take the values from the financial reports and put them in the formula or divide $700,000 by $620,000. This would give you an equity multiplier of 1.13. What does this result tell you?

By simply looking at the number, you can tell right that the debt levels are extremely low. Only slightly more than 10% of the assets are financed by getting money through loans or another type of debt. The remaining 90% of everything the Home Connect company owns is financed by investors.

As far as creditors are concerned, the company is very conservative about taking debts. A financing institution will most likely see this as a good sign because this means that the company has no other significant obligations before other parties and can make its loan payments. Of course, the creditor will also look at the past years and see how well the company is doing in general to make the final decision, but as far as the equity multiplier goes, Home Connect business is likely to be approved for the loan it wants to get.