Definition

The main task of early payment discounts is to reduce the maturity of accounts receivable and accelerate the turnover of the company’s working capital. Therefore, this commercial instrument can be attributed to a greater extent to the field of financial management than the actual pricing. However, since such discounts are set in relation to prices, then traditionally they are determined by price managers together with financial managers and accountants.

Early payment discounts are a measure of reducing the standard selling price, which is guaranteed to the buyer if he pays for the purchased batch of goods earlier than the contractual deadline. The early payment discount has three elements:

- the actual amount of the discount (usually expressed as a percentage);

- the period during which the buyer has the opportunity to use such a discount;

- the period within which the payment of the entire amount owed for the delivered service or goods must be made if the buyer does not exercise the right to receive an early payment discount.

Accordingly, in a contract for the supply of goods and invoice, such a discount can be written in the following form: “2/10, n30”. This will mean that the buyer is obliged to make full payment for the goods delivered to him or her within 30 calendar days from the date of receipt. Although, if he makes payment within the first 10 days of this period (known as a discount period), then he or she has the right to automatically reduce the amount of the payment by 2%, i.e. take advantage of a discount for faster payment.

Purpose

The amount of the early payment discount is usually determined by two factors:

- the level of such rates traditionally prevailing in this market;

- the level of bank interest rates for loans for the replenishment of working capital.

The connection between the early payment discounts and the interest rates is quite logical. If companies cannot achieve acceleration in the repayment of accounts receivable, then they have to replenish their working capital mainly through loans. Accelerating payment for goods or services reduces the need to raise funds and allows companies to save by reducing the amount of interest payments.

Therefore, with the help of the early payment discounts, a business is trying to create a situation where it is more profitable for the buyer to take a loan from the bank in order to pay the supplier more quickly and thereby benefit from the difference between the cost of bank loans and a commercial loan.

Sometimes, when discussing the logic of such a discount, the question arises: “Isn’t it easier for the supplier himself to take money from the bank and wait for the debt to be paid within the terms established by the contract instead of bothering oneself and the buyer with discounts?”. In this regard, it should be noted that efforts to stimulate the fastest repayment of receivables are justified by the large positive effect that accelerated payment has on the financial condition of the business. This effect occurs due to the fact that early payments:

- accelerate the flow of cash to the seller’s account and improve the structure of the balance, which is essential for obtaining loans and also affects the assessment of the position of the company by investors (including the price of its shares on stock exchanges);

- reduce credit risks associated with accounts receivable and increase the reliability of financial planning;

- reduce the costs of the company for organizing the collection of receivables.

Example

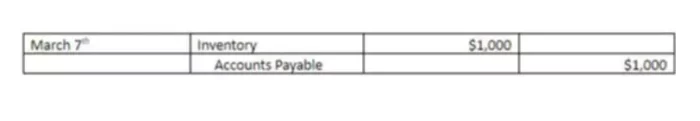

Our guide on early payment discounts will not be complete without an example. On March 7th, the ABC Co. purchased $1000 merchandise on credit. The terms were 5/10, n3.

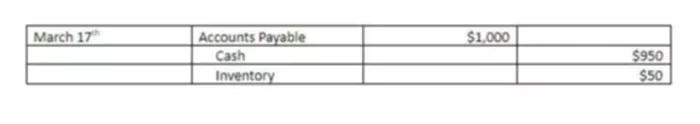

On March 17th, the ABC Co. settled the amount due for the 3/7 purchase. Since March 17th is within the discount period, it will receive the discount. The discount amount will be equal to $1,000 x 5% of the invoice or $50. Thus, the company will pay cash of only $950. The discount will reduce the overall cost of the inventory, so it will be credited to the Inventory account.