Double-entry accounting, also known as double-entry bookkeeping, is a set of accounting rules. It serves as the foundation of accounting rules across the globe. Double-entry is an accounting principle that ensures that the accounting equation remains balanced at all times. This means that Assets should always be equal to Capital plus Liabilities.

- Assets are the resources used by a business. In effect, assets are what the organization owns. Examples of assets would include office furniture, computers, cash, accounts receivable, etc.

- Liabilities consist of money owed by the business. This can include loans, money owed for goods supplied, or money owed for expenses.

- Capital is what the owner(s) invests in the business, whether in the form of cash or other assets, such as motor vehicles, premises, etc. In its simplest form, capital means the funds brought in to start a business by the owner(s) of a company.

The double-entry system has an account for every asset, every liability, and capital. Double-entry literally means that every accounting transaction has two entries, and it will impact two different accounts to maintain that balance. This means that for every transaction, there will be a credit and debit entry. These entries can both be on one side of the accounting equation or on different sides. See Cheat Sheet below for better understanding.

Double-entry vs. Single-entry Bookkeeping

Single-entry accounting is what the world did before the double-entry accounting was invented. How does it work? With this method, you just write down all the transactions that happen in a business in order as they happen in a big list.

There are really no rules as with double-entry accounting. Its history starts back from 3,000 BC when civilizations learned to write. This is what some start-up businesses still use today to keep a record of their business transactions.

However, single accounting has some issues because it is hard to use if you need information quickly – information is not categorized and is compiled in a big overwhelming list. The double-entry bookkeeping was invented in Italy around 1,200 AD and slowly spread around the world afterward.

Why is Double-Entry Bookkeeping Important?

Double-entry is the foundation that every developed country in the world uses for the accounting they use in their businesses. Most major businesses use this accounting method, and most popular accounting software programs are based on the concept of double-entry accounting. There are many benefits to using this accounting system:

- A complete record of transactions: both sides of a transaction are recorded when using this bookkeeping method. It is a complete record at it results in depicting correct income or loss, assets, and liabilities.

- Accuracy check: it ensures the arithmetical accuracy of the book of accounts because, for every debit, there is a corresponding and equal credit. Using this system, the accuracy of the bookkeeping work can be established by preparing a Trial Balance.

- Establishment of profit or loss: the profit earned or loss incurred during a period can be established by preparing the Profit and Loss statement.

- Knowledge of financial position: the financial position of the business can be ascertained at the end of each period by preparing the financial statements.

- Full details for control purposes: the system permits accounts to be maintained in as many details as necessary and, therefore, provides significant information for the purpose of control, etc.

- Fraud minimized: this system also prevents and minimizes fraud because it will create a disbalance in the system. This also helps to detect fraud early.

- Data for decision making: the management is able to obtain information to make decisions and evaluate past decisions.

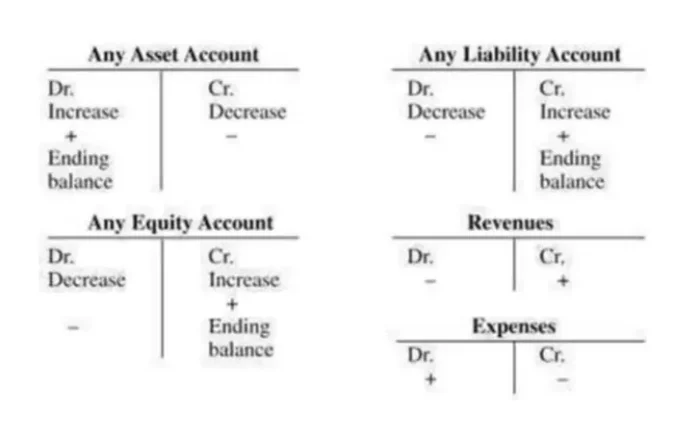

A double-entry accounting cheat sheet

Debits – things are coming into your business, such as money, assets, and purchases. These are on the left.

Credits – things are going out of your business, such as money and sales. These are on the right.

To ensure that the balance in the accounting equation is maintained, each account has a “normal” balance, which can be either a debit or credit. All you need to remember is the following:

- To record an increase in an Assets or Expenses account, you will make a debit entry and to decrease – a credit entry.

- To record an increase in a Liabilities, Equity, or Income account, you will make a credit entry, and to decrease – a debit entry.

Example of Double-Entry Bookkeeping

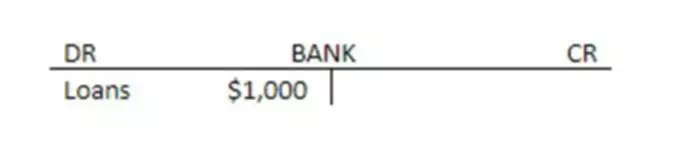

For every debit entry, there has to be a credit entry. For example, your friend lent you some money to start your business. You have some money coming in, so you are going to put it on your Bank account debit side. Note that these records would also have a date, but we are just going to omit it for now.

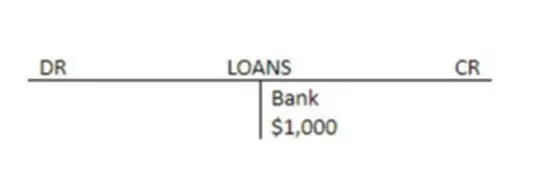

However, do not forget to record the IOU you gave your friend! Now, you are going to credit your Loans account with the same amount.

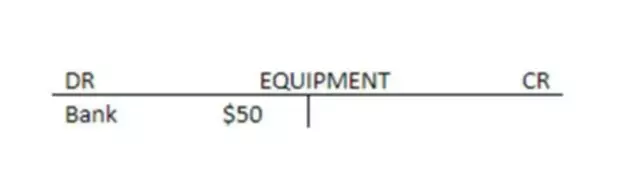

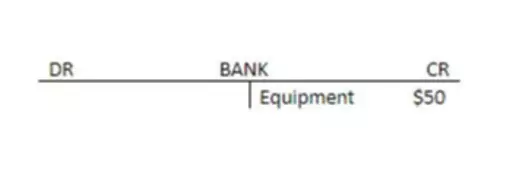

Now, let’s say you bought some equipment. The money is going out, so you are going to credit your Bank account.

You received your equipment, so you are going to debit your Equipment account.