In the practice of enterprises, there are often cases when goods and services are not directly sold for cash or prepayment. Instead, the company sends an invoice along with the goods or after selling the product or providing a service. A portion of these amounts receivable may not be collected. This is a fairly common situation, regardless of how thoughtfully the entity sells on credit and how effectively the debt collection mechanism is used.

The fact that the debtor is unable to pay in due time does not mean that this debt will not be paid off. One of the first forerunners of this may be the bankruptcy of the debtor; among other indicators, one can name the liquidation of the debtor’s company, the failure of repeated attempts to collect the debt, as well as the impossibility of legally collecting a debt after collection period is over.

Definition and Advantages

Accounts receivable can sometimes stay on the books for months and even years. The growth of receivables worsens the financial condition of enterprises and sometimes leads to bankruptcy if they are not actually collected. In such cases, organizations can use the so-called write-off provided by law. Under this method, what the company is going to do is as soon as it knows that a customer or other entity is not going to pay, it will write it off to bad debt.

This write-off method has the following advantages:

- It is simpler and easier to directly write-off any bad debts because it does not require any complicated calculations or journal entries.

- This method allows for an accurate reflection of the actual bad debt instead of just estimating it, which might lead to over or underestimated bad debt.

- Although the direct write-off method is not desirable from an accounting point of view, in accordance with tax legislation, entities can only use the direct write-off method for tax calculations. This allows to reduce income and, accordingly, the tax payment.

Despite these advantages, this method is used only by companies with very low levels of receivables. It is not the preferred method under GAAP because it does not match up business debt expense to when it actually makes the sale, and revenue comes into play on the Profit and Loss Statement.

How It Works

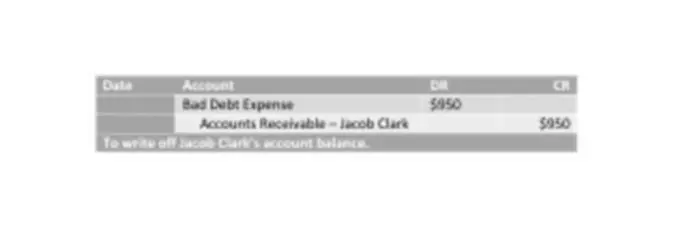

It is easiest to explain how this method works using an example. In our example, our company’s customer, Jacob Clark, has an outstanding balance with the company of $950. Since the company was not able to get the money for the supplies it sent to Jacob after multiple attempts to do so, Jacob’s account needs to be written off. The bookkeeper will make the following entry in the company’s records:

Note that we are simply writing it off as bad debt expenses as we know that the client is not going to pay us and not using the allowance account. In addition, although the company writes off the debt, it does not mean that it forgives this debt. It just does so to more accurately reflect its financial position in order to make better decisions.