Definition

There are many reasons why accounting is important. Bookkeeping is a system in which every business transaction is reflected in a specific record. Summarizing all business operations, a complete picture of the company’s activity is created. Everything is based on strict rules, the entries are arranged in chronological order and presented in the form of a summary reflecting the financial history and development of the company.

From a business perspective, accounting is an important management function. On the basis of timely and reliable accounting information, timely decisions can be made to discontinue operations and prevent future losses. Business owners can decide whether the additional investment is worth making and so much more.

In comparison to calculus and other math subjects, bookkeeping is rather simple and does not require any complex calculations. The best thing about bookkeeping is that math always balances, which keeps one on track and reassures the accuracy of all the work. The topic of debits and credits serves as the basis for the accounting process. Bookkeepers use debits and credits as a way of saying they are increasing or decreasing an account. We will explain this more in-depth in just a moment.

Double-Entry Basics

A person known as Luca Pacioli is considered to be the first to suggest that every business financial activity should be recorded with both a debit and a credit in the exact same amount to different accounts. Why? Because any transaction in the enterprise always causes two simultaneous events. Consider the following examples:

Transaction 1. Payment by the buyer for the goods:

- Repayment of the buyer’s debt (reduction of the receivables).

- Receipt of money.

Transaction 2. Production of finished products:

- Write-off of the cost of manufactured products from the work-in-process account.

- Receipt of finished products at the warehouse.

Transaction 3. Payment of tax:

- Decrease in money on the Cash account.

- Decrease in debt before the government.

That is, any operation leads to a simultaneous change in two or more accounting indicators. Therefore, each activity must be taken into account by writing down the same total amount on the debit of one or more accounts and entering the same total amount on the credit side of other account(s).

The essence and purpose of the principle of double-entry are providing an interrelated reflection of economic activity in accounting. In addition, this principle provides a control function, since the totals of the entries in the accounts must be equal.

Rules of Debits and Credits

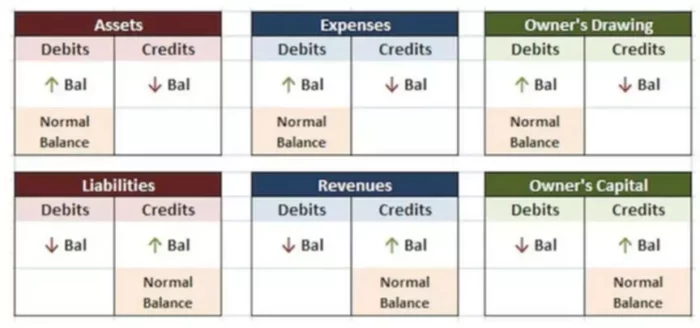

There are simple rules you need to remember to interpret debits and credits correctly. A business may hold numerous accounts which record and sort the different transactions that are conducted by the business.

Before the business starts recording transactions, it sets up a chart of accounts for recording different transactions. As you might already know, these accounts can be classified as the Balance sheet or Income statement accounts. Within each of these accounts, there are subaccounts that fall under the Assets, for instance, or Revenue.

Asset accounts always have a debit balance. So, if you have $5,999 in your bank account, your books will record that as an Asset with a $5,999 debit. Liabilities and equity have credit balances or you would write the amount on the right side of the account to show that a company has more liabilities or equity.

You can add up all the Liabilities and Equity balance and do the same for Assets and the totals of Asset debits and the totals for credits will be the same. Note that while you cannot have a negative Asset account or a positive Liability account, you can have a positive or a negative Equity.

The two types of accounts you would see on the Profit and loss report are Revenue/Gains and Expenses/Losses. There is usually one main account under Revenue which reflects all the earnings of the company, although you might also see interest earned and gains from the sale of fixed assets. To reflect that a business made money you would use a credit entry.

When it comes to expenses, you will realize that every company has numerous Expense accounts. However, no matter if it is a rent expense, depreciation expense, salary expense, or any other expense, the bookkeeper will enter the amount using a debit entry if the company incurred more expense, and will record a credit entry to reflect the payment of a particular expense.

As you can see, debits and credits are much simpler than they seem to be at first. There are only a couple of rules you need to memorize and while you are doing that, you can use a cheat sheet, such as the one shown above, as your guide.

Analyzing Transactions

To record a transaction in the books of the business and be able to apply the rules you just learned, you need to analyze the transaction in four steps.

- What is being exchanged? For example, an office desk is purchased for cash.

- What accounts are affected? You need to know under which category of accounts the affected accounts fall. In our case, you would have an account named Furniture, for instance, and a Cash account. Both of these accounts are considered to be Asset accounts.

- Once you know which accounts are affected, you need to know which ones are increasing or decreasing. You can easily tell that there is more furniture after you purchased an office desk, so the Furniture account is increasing. Since you had to give cash, the amount of money in your Cash account decreased.

- Finally, you would determine whether these amounts are debits or credits and accordingly debit or credit the respective amounts to the appropriate accounts.

Now, you know when to use debits and when to use credits and can apply these rules to real transactions.