Definition

Selling products and services on credit is almost a must these days if you want to have more customers and generate more money. Unfortunately, making a sale is only half of the work. The other half is making the buyer actually pay you for the purchase. To learn how long it takes on average for you to receive the payment for the purchase from a customer after a credit sale has been made, you would compute days sales outstanding. In other words, it is how long you wait before the revenue is actually on your bank account.

It represents the amount of time that passes between the invoice issuance date and the invoice payment date, which depends on your credit sales policy as well as many other factors. No matter if you see it referred to as DSO or average collection period, it is part of the cash conversion cycle and belongs to the efficiency ratios category.

Importance

This value is important for every business because even though you sold a significant amount of goods or provided services to numerous customers, you might not be getting any cash. Your profit will be only on paper, but you will have no cash and your business might go bankrupt. Thus, it is very important to know how long it is taking for your buyers to pay you.

It is a great metric to measure your collection effort. If your average is getting higher over a longer period of time, then your business is likely going to struggle with cash flow. Knowing this ratio, you can tell whether or not your business should outsource collections or simply improve your current collection strategy and rules.

Knowing this value is critical because of what your business can do with this cash received from customers in your bank account. Although every business should strive to improve their cash flows, small businesses often can never quite get enough cash flow simply to stay afloat. While the number of days sales outstanding is affected by the payment terms an entity extends to its clients, there are numerous other steps you can take to try to drive it as low as possible.

The easiest way to reduce DSO is to send the invoice to your customer as soon as you make the sale. After all, the more you wait to send the invoice, the longer it will take you to reсeive your cash. Nowadays, this can be easily achieved with the help of numerous bookkeeping and accounting software that allows businesses to send invoices in just a couple of clicks, automated billing, and set automatic reminders for customers to make the payment.

Businesses who have their accounting in order and implement such systems effectively into their operations can get the cash a whole month earlier than they used to. So, keep in mind that in most cases timely billing translates into timely payments, and sometimes, you have to let bad customers go. The more you pay attention to your customers the more likely they are going to pay, so make sure you send some friendly reminders. So, build good relationships with customers and if you are selling expensive services or products, consider doing background checks to make sure they can pay you and do it on time.

An effective way to make your customers pay sooner is to actually make good products and provide good services. People usually tend to remember to pay for things they actually enjoy. You might also want to get people to pay a deposit upfront, which will get them on a hook and throw at least a portion of the payment into your cash flows. Finally, you can go the other route and add late fees and penalties to your credit policies, which will force many to pay you within the time specified in the contract. There are a number of other different ways, such as offering discounts to those who pay early, that you can use to further cut down this time.

As a result of all these efforts, your company will increase its cash flows. Better cash flows always mean that you have more money to go around to pay your own bills, invest in the development of new or better products, and so on. This in turn will increase your profits and increase the value of your business on the market, giving you better chances to have good investors and sell your business at a higher price when the time comes. Finally, seeing that your business is well off in terms of cash will give you peace of mind.

Formula

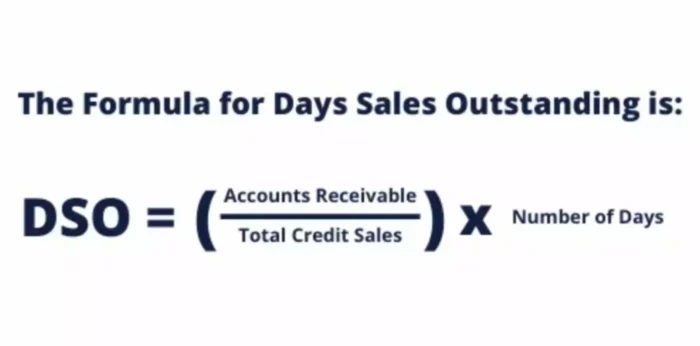

The first thing you do is take the amount in the Accounts Receivable from the last period, which serves as the beginning balance for the current period. In the denominator, you will input the amount of revenue your business has earned during that particular period. Then, you will multiply it by the number of days in the period.

Example

It is possible to get the number for the accounts receivable from the financial statements of the company. Let’s say your business has $200,000 balance on the Accounts receivable account. This is the money that customers owe you and have not yet paid you. Last month, your business had a Revenue of $50,000. Taking the formula above, you would input the numbers you have.

First, you will divide $200,000 by $50,000, which gives you 4. Let’s assume the last month had 30 days in it, so you would multiply 4 by 30 to get 120 days. This means that it takes about four months for your company to get paid if it sells something on credit. Is this good or bad? It depends a lot on the industry you work in. However, there is a possibility to cut down this time for every business if you start implementing some of the ways to collect on goods you have already sold faster.

If you can cut this time down by 10% or have the customers pay you within 108 days, you will have a huge difference in terms of cash flows at your business. To be more specific, you will get $200,000 x 10% or $20,000 additional cash in your bank account. This means that you might not need to take that loan to buy your supplies or pay your bills while you are waiting for your buyers to give you the money for goods or services you provided to them earlier.