Meaning

An invoice is a document that a seller creates and then sends to the buyer. It relates to a transaction that already took place or will take place and lists the products or services the buyer receives, quantities, along with agreed prices for products or services. The purpose of this document is to request payment for these goods/services from the customer.

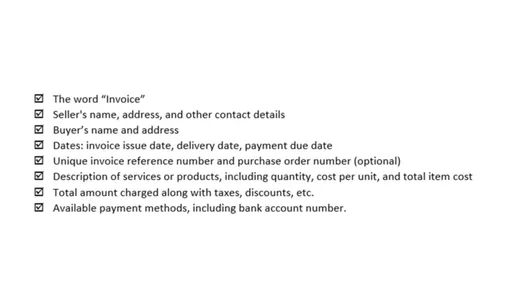

Essential elements

Let’s review important information businesses should add to customer invoice to make it look professional. It should include at least the following elements:

Template

Now, let’s walk through the process of creating an invoice template and describe how customer invoice should look. It is possible to scribble all the information on a piece of paper by hand or even print out a template and fill out the appropriate fields. We suggest creating a template in a word or spreadsheet program, using online invoice generators, or even downloading an app, unless you have bookkeeping software that has a customer invoicing feature.

- Add a logo of your company in addition to the name and contact details, such as where you are located, phone, email, and maybe a website. These will go in the top left corner.

- Right under contact info, add a “Bill To” line and enter the customer’s name along with the contact info of the buyer.

- At the top right corner or center of your invoice, add the title– “Invoice”, making sure it is clear what the document is all about the first moment the buyer sees it.

- Invoice number, the date the invoice has been issued, payment terms, the due date along with reference to the purchase order number are typically listed at the top right corner of the document.

- The next section is formatted as a table positioned right under all the information discussed above and takes up most of the page. It has several columns: item description, quantity, unit price, and amount.

- In the end, include a total for all the items. You can also list any discounts the customer received, taxes, if applicable, and the final amount to be paid.

- A friendly “Thank you” message at the bottom or any other notes, such as late payment penalty and policy, as well as payment options, are a good addition to your document.

How and when to issue an invoice

Although invoices are typically issued after the customer receives the goods, it is also possible to create invoices based on sales orders or before the business sends any goods to the buyer or provides services. Companies can also choose to create the invoice along with the packing list to ensure that the buyer gets the invoice while they still remember what they bought and your company gets paid as soon as possible.

Many bookkeeping software allow businesses to create the invoice for a project by pulling time and materials previously recorded under the project to bill the customer for them. The invoice can also be sent to the customer after the work or purchase is completed, just be sure not to wait too long to send it.

The invoice can get printed and included along with the packing list or mail it the old way. You can email a digital copy of the customer invoice either manually or use bookkeeping software that will automate a big portion of the process.

Common invoicing mistakes

Catching mistakes before an invoice is sent to a customer is easier and reduces risk of late or no payment from customer. Here is how to avoid major invoicing mistakes.

- Keep the document simple. No complicated confusing business terms and conditions should be on there.

- Send invoices promptly. If you are not sending them on time, you will not get paid on time.

- Double-check for correctness. Sending the invoice to a wrong person or incorrect/incomplete invoices is unacceptable.

- Include enough details. The invoice should list all the items not just a total so the buyer knows what they pay for.

- Provide popular payment methods. Making it inconvenient for the receiver to pay is a way to getting no payment at all or receiving it late.

- Include PO reference. A common reason for invoice disputes is invalid or missing purchase order information.

- Provide valid contact data. If the customer cannot reach the company to resolve an issues, no payment is going to be sent.

- List due dates. The invoice should clearly state when it is due.

- List late fees. The customer should already know about these, but having them right on the invoice helps to get paid on time.

- Keep track of unpaid invoices. If business client does not pay on time, send friendly reminders or make a call.

Quick payments depend on accurate, professional, and timely invoices, so the customer know how to react accordingly.