To make any goods, a number of different resources are spent. Manufacturing enterprises convert raw materials and supplies into finished products through the use of labor and plant equipment. The sum of all costs incurred will constitute the cost of production – an important number for any manufacturer.

Definition

The cost of goods manufactured is the cost per unit of product manufactured, work performed or service rendered. Otherwise, it is the price of the resources of your enterprise spent on making the product appear.

If this cost is not calculated correctly, it can break a business. This is because the cost of production often is the starting point in the formation of the selling price of the products, works, or services of the enterprise. This means that it lies at the heart of the pricing policy and, accordingly, affects the revenue.

What can be included in the cost of manufactured products? This term includes many components because it must take into account all the resources spent at the production stage, namely:

- The cost of purchasing raw materials and basic materials

- The cost of electricity and other resources needed for manufacturing

- Salaries of employees of the enterprise

- Costs for internal movement of raw materials and supplies

- Maintenance and repairs of the company’s fixed assets

- Depreciation of equipment and fixed assets.

Inexperienced entrepreneurs can set average market prices for the services or goods they produce. Yet, practice shows that the cost of production is different for everyone. Analysis of the cost of goods or services produced is an effective financial tool for managing the competitiveness of any enterprise. It shows the profitability of production, helps to optimize fixed and variable costs. Calculation of the cost of goods manufactured helps to determine the correct retail and wholesale price, which is some kind of protection against an unjustified reduction in the production costs.

Calculation

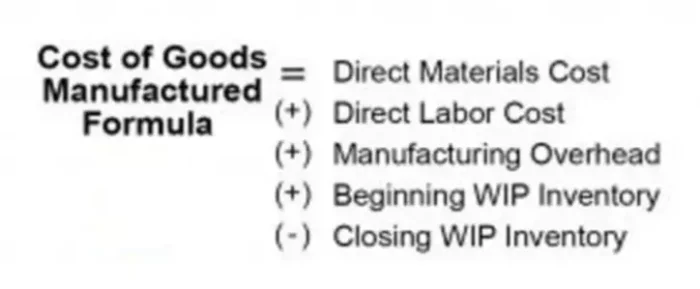

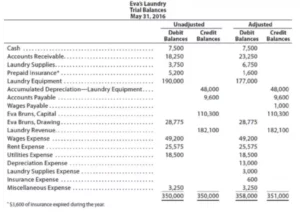

In essence, it is the sum of direct costs of raw materials and supplies, direct labor costs, and general production overheads, which is adjusted for the net change in work in progress for the current accounting period. Let’s say you are presented with the information below.

The calculation of direct materials cost is done by adding purchases of raw materials to the beginning raw materials inventory and subtracting the ending raw materials or $5 + 25 -7 = $23 million. Now, you just need to input all the other data into the above formula: $23 + 36 + 17 + 12 – 16 = $72 million.