Introduction

Profit (contribution) margin is the difference between sales revenue and variable costs. Moreover, both of these indicators – revenue and costs – are taken for a specific volume of production. We can also say that marginal profit is the part of the proceeds that remains with the enterprise to cover fixed costs and in the end, receive a profit. Recall that fixed costs do not depend on the volume of production, while the variable change according to the number of products or services produced.

One of the key parameters of business valuation by owners, investors, creditors is its profitability. This makes a contribution margin ratio essential when doing business. With its help, you can determine the profitability of selling a particular product, as well as the degree to which profits will change with a sudden increase or decrease in sales.

Definition

As part of management accounting, a special financial indicator is used to assess and analyze profitability – contribution margin ratio. The contribution margin ratio is a coefficient that represents the difference between the company’s revenue and the sum of its variable costs. It acts as part of the proceeds that go to cover the fixed costs of the company.

Meaning

This ratio shows how efficient and sustainable the company’s activities are: whether its revenue is able to cover variable costs and ensure profit. A positive indicator value is considered optimal for a business. The positive dynamics of the ratio indicate an improvement in the company’s financial position. If it is negative, the business is suffering losses.

The calculation of the ratio plays a key role in assessing the array of products to identify unprofitable products and eliminate them. The division of business costs into fixed and variable when doing the calculation of contribution margin ratio allows one to analyze the impact of the volume of production on the size of the company’s profit. In addition, it can be used to compute how much a business needs to sell to reach a break-even point.

Formula and Example

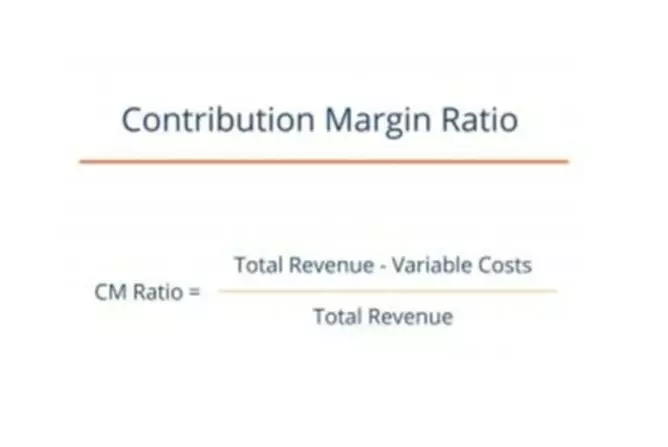

Contribution margin divided by total sales revenue yields a percentage. It can also be calculated on a per-unit basis, where you will take the contribution margin per unit and divide it by the selling price per unit. The result is a portion of each dollar of money coming from sales that contributes toward fixed costs and profit.

For instance, a business is launching a new line of swimsuits. A swimsuit will sell for $230 and costs $144 in variable costs to make. Let’s compute the contribution margin ratio for 10 swimsuits. The total revenue will be $2,300 and variable costs add up to $1,440. Thus, our contribution margin is $860 (per 10 units). The contribution margin ratio, accordingly, will equal to $860 divide by $2,300 or 0.37 or 37%. This means that for every 10 swimsuits a company sells, 37% of the sales revenue is available to cover fixed costs and provide a profit.