What is the contribution margin?

There are two ways to look at contribution margin. One way would be that it is the money that is used to pay off fixed costs. Another way to look at it is that contribution margin is the part of the company’s sales revenue that remains after compensation for the variable costs the company happened to incur during that period. Afterward, this margin will go to finance fixed costs and profit.

How to calculate it?

The calculation of this indicator implies a mandatory division of costs into two groups: variable and fixed. The cost division procedure is determined by the accountant based on the business specifics and the industry.

Sometimes bookkeepers assume that production costs are variable, and non-production costs are fixed. However, this is not the case. For example, production costs include depreciation and equipment maintenance costs, which are constant in nature, and non-production costs include sales bonuses as a percentage of sales, and they are definitely variable.

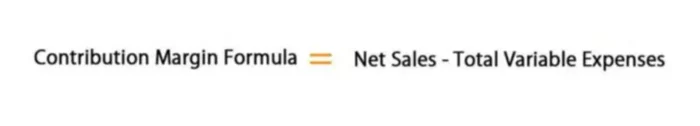

The equation shown below will help you to determine the contribution margin.

Why only use variable costs? After all, a business has to cover both the variable and fixed. This is because the contribution margin is used to make the decisions for the future, so you will be working with estimates. While variable costs per unit do not change much as the production increases or decreases, the fixed costs do change significantly and can vary depending on the volume of production.

Let’s apply this formula in an example. If a company sells 60 units of kids’ toys for $900 and the variable costs for making these toys added up to $150, then the total contribution margin for this business is equal to $900 – 150 or $750.

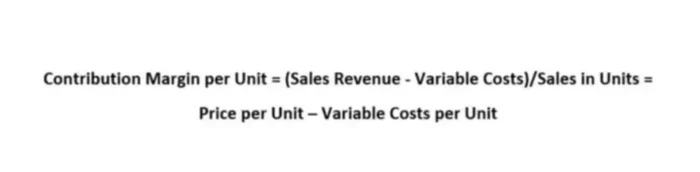

If you need to determine its value per unit of production, then use this formula:

If we use the data from the example above, then the CM per toy would be $750/60 units or $12.5.

In addition, contribution margin can be calculated as a ratio, in which case you would do the following calculation:

Once again, using the data for our toy company, we can calculate this ratio as ($900 – 150)/$900, which would give us a ratio of 0.83.

Why is Contribution Margin Important?

Although a very simple concept, the contribution margin is a key concept when making many internal decisions and one that you should always take into account when making any type of product-related decisions.

Different products have different contribution margins per unit. It is useful to know this information for analysis of how attractive each product is. Contribution margin per unit tells how much money a business adds to its profits every time it sells a unit. When calculated as a ratio, it represents the portion of each dollar the sales generate that contributes toward fixed costs and profit.

High contribution margins and low fixed costs are the goal of every business owner because low fixed costs are paid quickly with a little volume of sales, but few companies enjoy such a situation. High contribution margin industries (e.g. airlines, hotels, and theaters) usually also have high fixed costs, which means that they need to sell a high volume of products or services to achieve great profits.

This financial indicator is also used in the calculation of a break-even point. The break-even point is the moment from which the proceeds from the sale of the goods fully compensate for the production costs. Beyond this point, the production and sale of each subsequent unit of goods begin to make a profit. As might guess, this a crucial number for every business owner.