Businesses need to know what contra accounts are to keep accurate accounting records. They also allow us to follow the matching principle. Expense accounts have a normal debit balance, which means they increase with debit entries. A contra account reduces an associated account, in our case, the expense account. A contra account will always have an opposite normal balance to its parent account. Therefore, a contra account to the expense will have a normal credit balance. Unlike other contra accounts, accountants do not use contra expense accounts very frequently.

Contra Expense Account Examples

Below are examples of contra expense accounts. These accounts work in the opposite direction of the expense account, and the control account will be Purchases.

- Purchase Returns – Defective, damaged, or otherwise undesirable merchandise returned for credit

- Purchase Allowances – Price reduction for inferior merchandise if the buyer chooses to keep it

- Purchase Discounts – Discounts offered to people to encourage them to pay sooner

Purchase Return, Allowance, and Discount Contra Expense Accounts

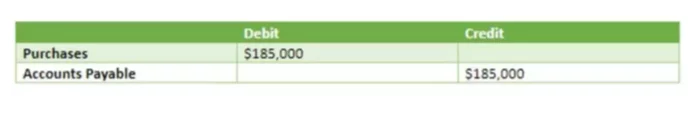

Luxury Lighting sells exquisite chandeliers. The owner ordered new chandeliers worth $185,000 from her supplier. The original journal entry looked like this:

She scrutinizes each chandelier to ensure that she received correct models, and there are no damaged items. If the crystals are broken or chandelier is otherwise damaged, the owner returns the unsatisfactory items to the supplier. If the order comes late or the damage is small and repairable, she might decide to keep the thing in exchange for a purchase allowance.

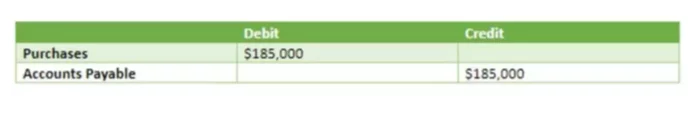

- Purchase Returns and Allowances

When the owner checked the new order, she found that one chandelier had broken crystals. She returned this item and made the following journal entry:

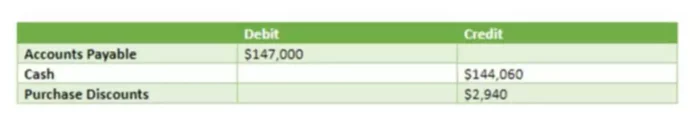

- Purchase Discounts

The supplier also offered a purchase discount to Luxury Lighting with the terms 2/10, n/30. The owner decided to take advantage of the offer and paid for the order within ten days. Note that since the owner returned one item, she now owes less. The owner will record the purchase discount using the following journal entry:

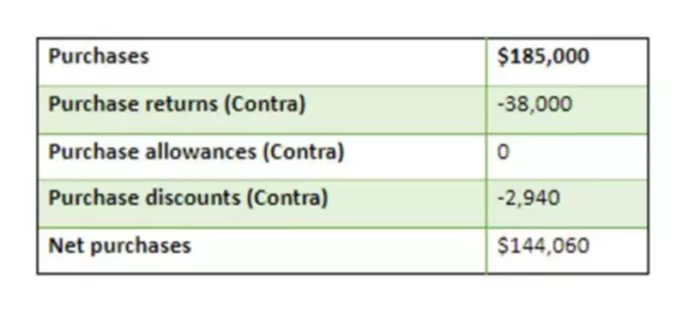

On the income statement, the purchases returns, allowances, and discount accounts are subtracted from purchases. So, an extract from the income statement would look as follows: