What is a Completed Contract Method?

The completed contract method is very conservative. There is going to be no revenues recognized, no expenses recognized and certainly, no gross profit recognized until the contract is entirely complete. There is no spacing of revenues or expenses or gross profit.

If we look at an accounting timeline, there will be nothing happening for two, three, five, or even ten years (in comparison to the percentage of completion method). Then, there will be a spike of expenses, revenue, and gross profit. It creates this distortion of earnings for management, so it is considered not the best method. At the same time, this is a much easier method in comparison to the percentage of completion method to keep record of and do all the calculations for.

When is a Completed Contract Method Used?

The completed contract method was designed for long-term construction projects. It is only used, though, in the case where there is great uncertainty about the contract prices, great uncertainty about the costs, and great uncertainty about the collectability.

At the same time, if a business has to adhere to the International Financial Reporting Standards or it is a public company, then it would have to use a percentage of completion method or a cost recovery method. This method is allowed under ASPE/PE and GAAP if you have a long-term contract with unreliable costs and uncertain collectability.

Completed Contract Method Example

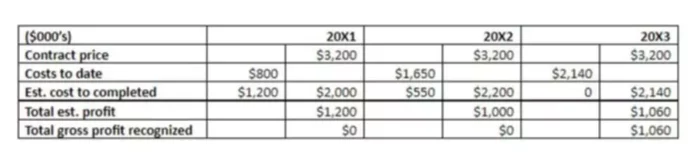

Let’s review an example of a three-year contract project. Our focus, though, will be on the end period when we complete the contract. We do still have to deal with the costs on the contract form year to year. As you can see the contract price will be the same every year. Each year we would have to determine our cost to date and estimated cost to complete, which would give us the total costs on this contract. Next, would be the calculation of estimated profit.

If we look at year 20X1, we can see that our costs to date equal to $800 plus we estimated that there will be an additional $1,200 in spending to complete the project. The total estimated cost to complete is thus $2,000, which would give as a profit of $1,200 ($3,200 -$2,000). Note that no gross profit is recognized at this point. It will be only recognized when we complete the contract and deliver it to the customer.

When we look at the second year, the same calculation will be done. We will have a total estimated cost of $2,200 and, accordingly, an estimated profit of $1,000. Note that as the project progressed, our estimated costs have increased, reducing our estimated profit. This is normal and often happens in real life. Once again, despite the fact that the majority of the project is completed, we do not recognize any gross profit in our accounting records.

Now, we come to the end of the contract period. We can now tell all the costs incurred to date and subtract them from the contract price. Since we have completed the project, the total estimated profit will be the total gross profit we would recognize in our accounting records.

As you can see, we calculated that our costs to date equal to $2,140. If we subtract it from the contract price, the gross profit will equal $1,060. Once again, notice that it is somewhat higher than what we estimated last year, although it is still lower than what we expected to receive at the beginning of the project. The management should be prepared for some variation in expected and actual costs in long-term projects.