Definition and Explanation

Bookkeeping is a subject with many rules, principles, and regulations guiding every move of the business as a whole as well as the work of a bookkeeper. Closing entries are part of the bookkeeping basics, so it is important to know what they are.

Accounts that bookkeepers close at the end of each month, but more typically year, are called temporary accounts. These usually fall either under revenues or expenses, but they also include withdrawals. All these accounts can be found on the Statement of Owner’s Equity.

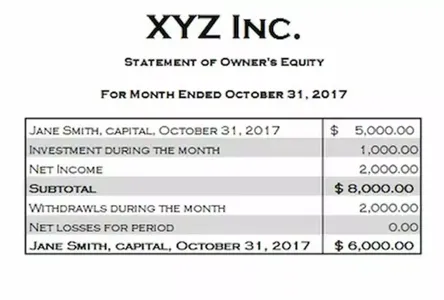

If you look at the sample report presented above you can see that we add investments and net income to Jane Smith, Capital and subtract withdrawals and if there were any losses, we take these into account as well. That gives us a closing balance at the month-end (or year).

Further examining the sample report, we can tell that the Jane Smith, Capital is obviously already part of the final capital amount, so no closing entries are necessary. The same goes for the Investments, which is part of the capital. There is no separate account for Investments we would need to close. So, what are we closing? We are closing the following accounts:

The reason why closing entries are a step that should not be skipped is that investors, owners, and management want to know the net income for a year (or another time frame), so we need to start at zero from the start of the next period to be able to draw a clear line between expenses and income of the current period and income and expenses of the other periods. Otherwise, these accounts will keep on growing forever. Thus, one of the main points of closing entries is to get the net income amount to appear in the books.

The other objective of closing entries is to update the Capital, which you will see a better demonstration of once we go over an example. Finally, this process is an important step in the overall accounting cycle and makes sure temporary accounts stay temporary and do not become a permanent part of the bookkeeping records.

Example

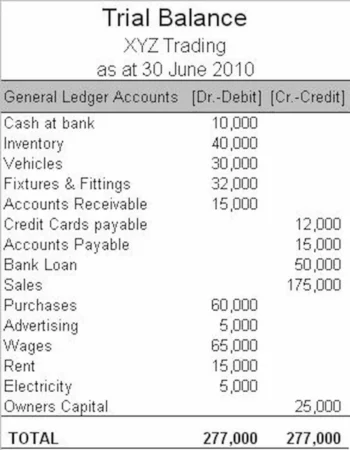

Let’s do some closing entries using the data from the XYZ Trading Trial Balance. We would need to take the balance of the temporary accounts and make opposite entries to bring the balance to zero. Let’s start closing entries with the Sales Revenue account. It has a credit balance, so we will make a debit entry. A balancing entry will be made to the owner’s capital account. Here businesses can go two routes.

Some businesses can choose to set up a separate Income Summary account. As funny as it may sound, this is also a temporary account. However, it combines all the other temporary accounts. Next, the final balance of the Income Summary account is transferred to the Owner’s Equity account known as Retained Earnings. Others skip this extra altogether and use the Retained Earnings when closing entries. Let’s go the first route, so all the steps become clear.

| Date | Account | DR (in thousands) | CR (in thousands) |

| Sales | $175 | ||

| Income Summary | $175 |

Next, we will deal with the expenses. There are several expense accounts for which you can make separate entries or group them together in one closing entry. Expense accounts, as you know, typically have a debit balance, so we will add credit entries to these accounts. To know how much you should enter under the Income Summary, you simply need to add up all the expenses recorded in the journal entry.

| Date | Account | DR (in thousands) | CR (in thousands) |

| Income Summary | $150 | ||

| Purchases | $60 | ||

| Advertising | $5 | ||

| Wages | $65 | ||

| Rent | $15 | ||

| Electricity | $5 |

Now, we are going to look at what the Income Summary has as a result of these entries. From the first entry, we have a credit balance of $175K. Then, we added a debit of $150K. This gives us a final credit balance of $25K. The last step is to take this $25K and finally move them to the Owner’s Capital, closing the account we used solely for the closing purpose along the way.

| Date | Account | DR (in thousands) | CR (in thousands) |

| Income Summary | $25 | ||

| Retained Earnings | $25 |

Fortunately, XYZ Trading company received a profit for that period. However, this is not always the case. In such situations, the closing entry will look somewhat different. When there is a loss, the Income Summary account will have a debit balance. Accordingly, we would need to add a credit entry to bring its balance to zero. The capital account will be debited for the same amount, which would bring the final balance of the capital account down.

It looks like the owner/s did not make any withdrawals, so we are not going to make a closing entry for that account. Otherwise, withdrawals typically have a debit balance, so we would add a credit entry under Withdrawals, but in this case, we are not going to add an entry on the debit side of the Income Summary because it does not show up on the Profit and Loss Statement. Instead, it is going to go straight to the capital account.

Now, we have made all the closing entries and the bookkeeper and move on to the next step in the well-known accounting cycle.