Overview

Cash includes coin, paper money, checks, and money orders. Money on deposit with a bank and other financial institutions that are available for withdrawal is also considered cash. Cash is the asset most likely to be stolen or used improperly in a business. Thus, a business has to maintain solid financial control mechanisms to make sure that cash is accounted for in every single point that cash changes hands.

When the cash is counted at the end of the day or accounting period and there is a shortage or, on the contrary, an excess of cash, a special account is created – Cash Short and Over. This is where the accounting department will make entries to record any differences in the balance between actual cash and cash that is supposed to be in the business. It has the following properties:

- New general ledger account

- Used whenever a cash fund is over or short

- May have either a debit or credit balance

- Reported as expenses or revenue on the Income Statement depending on ending balance.

Cash Register Example

When you establish a change fund, for instance, to have $250, you will credit the Cash account and debit the Change Fund for this amount to move the money into the Change Fund. Now, you have the drawer that has $250 when you start the day. At the end of the day, the cash register records show that you made $887 in sales.

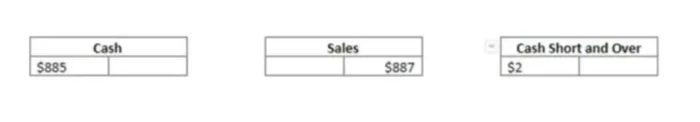

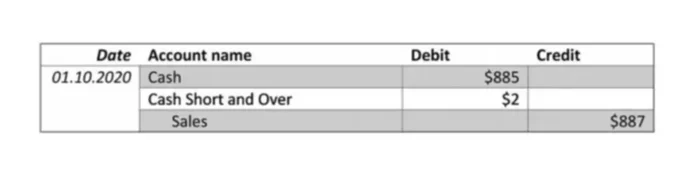

You will have a Cash account and Revenue (Sales) account that would be affected. Since your sales for the day were $887, this is what you will record under the Sales. Then, you count your cash drawer and come up with $1,135. Yet, you should have $1,137 in your drawer because you initially had $250 plus you made $887. How do you record it in your accounting books?

Since you are $2 short, it means that you only took in $885 in cash. Next, you would need to create a Cash Short and Over account and record those $2. As you can see, you will have a debit of $885 plus $2 or $887 and a balancing credit of $887. Note that you are not going to do anything with the $250 because it was already accounted for when you established the change fund.

Petty Cash Example

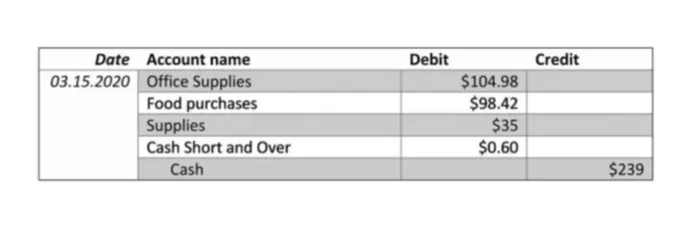

Assume that a petty cash custodian has a petty cash fund for $250. An employee presented an invoice of $104.98 for buying office paper. The petty cash custodian released $105 as she had no change. Another employee presented a receipt for buying food for a meeting for $98.42. The custodian released $99 as she had no change. An additional receipt for $35 spent on cleaning supplies was received.

As the petty cash fund is almost depleted, the custodian begins to prepare for replenishment. All the invoices and receipts add up to $238.40. If we add $11 of remaining cash, the fund will be 60 cents short. The custodian will receive $239 to return the fund to its normal balance and create the following journal entry.