We know that in any organization cash flow is an incredibly important part of business life. The main reason for that is that it is a dynamic and unpredictable part of life for most businesses, especially start-ups, small businesses, and those involved in high-risk operations. Thus, a business wants to be able to at least produce a simple and reasonably reliable cash flow forecast as part of its usual management disciplines.

Cash Flow Projection Explanation

Cash flow is as revenue or expense streams that change a cash account of an organization over a given period. Note that it is not the same as your organization’s profit. Cash flow projection is a crucial business tool. It is your best guess how you think the cash will flow in and out of the company in the coming future. This means that you will have a pretty good idea of how much cash will be in your organization at any time in the future and can plan accordingly. Accordingly, you will use this forecast as a guide for your decisions and activities.

Is cash flow projection the same as the Cash Flow Statement? No. The first one is just your projection for a given time period. The Statement of Cash Flows, on the other hand, shows the cash movement that happened in the previous periods. Thus, the main difference between the two is that the first one is the anticipation of the future and does not have exact numbers, while the second one is about the past and provides exact numbers.

Why Does Cash Flow Projection Matter?

Cash flow difficulties are the main cause for business failures. Regular and reliable cash flow forecasting can address many of the problems. There many good reasons why a cash flow projection should be produced.

- It is really useful as a way of giving management or other stakeholders in the business advance warning of when the cash may run out, whether there may be a shortage of cash based on what the business needs to spend. For example, will the business have enough cash to pay the suppliers, wages, and salaries during the next month or year?

- It is a great way of providing those who invest in the business or lend to a business with some assurance that the organization is being properly managed and it has appropriate financial control.

It is recommended to have the cash flow projection of at least three months or twelve weeks. That way if you are going to have a cash crunch in three months, you can plan ahead and start to do something about it now. For example, you might consider cutting some costs or look for other finance sources for your organization. This makes a huge difference in a business’s financial situation and helps you to sleep peacefully at night.

How to Create a Cash Flow Projection

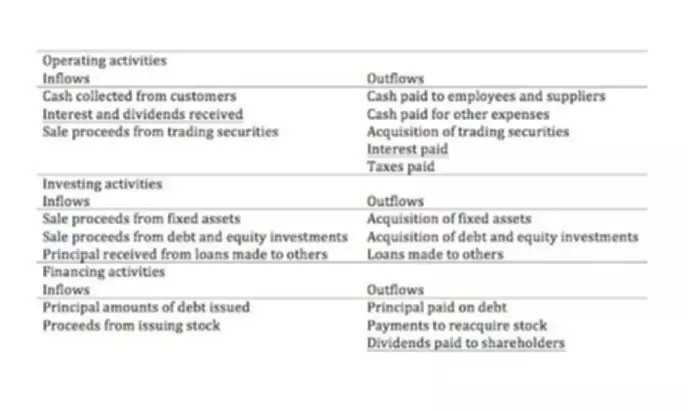

Before we look at a simple example of such forecast, let’s remind ourselves of sources of cash inflows and cash outflows (see illustration above). The key thing with the cash flow projection is to try to work out what the outflows and inflows are going to be for each period and to see what they affected on the forecast net cash balance. If you have an accounting team, it will prepare this projection for you.

Fundamentally, cash flow is about real-time accounting. It is your best guess on when the money is going to flow in your business. Basically, it is the sales or whatever money will come into your business for a particular timeframe minus any expenses, which can be anything from your rent to your cost of goods to wages and anything where money will go out of your business. Then, you would calculate the difference between the two and add it to your current cash balance to get an idea of how much money you are likely to have in that period.

Let’s look at a specific example. In this particular example, we got all the different items of cash received and cash paid out in the first column. Note that you would start with your sources of cash and then proceed to all the ways your business spends this cash. For better prediction of cash balances in the future, so you can take appropriate actions, you would break down your forecast into months.

As you can see, there will be items that will have no changes in some months. Let’s say you expect to receive the Vanguard Society grant only in March and July, while the Smile Trust grant is given every quarter. You can also predict your bank interest for every month in the upcoming year very well. Based on the financial reports for the past year/s, you can tell that you will receive on average $2,000 in sales income, with some months being slower for your organizations.

When you move on to the expenses, you would also use past data to make predictions. You would also base them on the management plans for the upcoming year, such as projects you plan to implement and their estimated cost. You might also know very well that your vehicle needs yearly maintenance, while other spendings, such as gas and tire changes, will be spread out throughout the year. Wages and salaries is another item that you can get a pretty exact amount of.

Your next step would be to calculate net cash flow for each month. Then, for the first month, you would add the money you have at the start of the month to get the ending balance for this month. For the following months, the ending balance for the last month will be your starting balance for the next month. For example, your ending balance for February will be your starting balance for March that you will be adding to the net cash flow for the March.

As you can see, this company predicts that there will be months when it will have a negative balance in their bank and a positive balance. Knowing this, they can set aside or look for additional sources of money for the “bad” periods.