Cash Flow Forecasting Explained

Managing your cash flow and cash flow forecasting is so essential in a business. A cash flow forecast is a tool that businesses use to estimate cash inflows and cash or the movement of money into and out of your bank account over a period of time. So, sales revenue, owner’s personal investment, and bank loan are typical examples of inflows. Typical outflows might be your rent, employee salaries, cost of sales, and inventory purchases.

Note that cash flow is not the same as profit and even profitable companies can be short on cash. Why is this so?If your company, for example, buys inventory or any other asset, the cash is going out of your company. At the same time, your profitability is not reduced on your Profit and Loss Statement.

Another example is your Accounts Receivable account. If you do not receive payment from your clients right away, your Cash account stays the same, but your Revenue account will reflect a sale, increasing your revenue on your Profit and Loss Statement. As you can see, you need to look at cash flows separately from your profits.

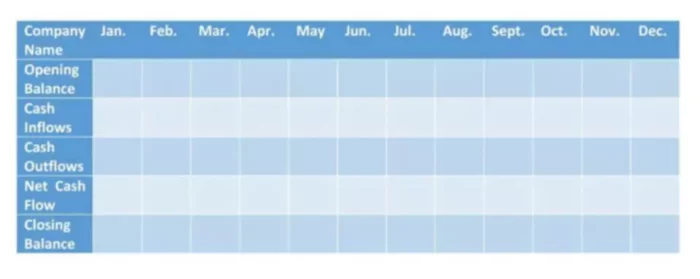

Cash Flow Forecast Example

Once the cash flow forecast has been prepared, it provides them with something known as a balance. A closing balance is an estimate of the bank balance at the end of each period calculated, which is normally shown on a per month basis. The net cash flow plus opening balance will be your closing balance (end balance). An opening or starting balance, accordingly, will show what your balance is in your bank at the start of the month you are forecasting for.

Importance Cash Flow Forecasting

There are two types of net cash flow outcomes you can receive:

- Positive net cash flow – if cash inflows are greater than cash outflows. This is a good sign for your business because you are predicting that your company will have more money coming in than you will need to pay out in the coming period.

- Negative net cash flow – if cash inflows are lower than cash outflows. This means that you are predicting that your company will pay out more money than what it will receive during the forecasting period. If the business has long periods of negative cash flow, this may lead to financial difficulty and closure of the business.

As you can see, cash flow forecasting is a very crucial tool for any business. Let’s have a look at some other key reasons for businesses to do a cash flow forecast.

- Helps to prevent insolvency. If the business was run out of cash, it becomes insolvent, which means that the business can’t pay its debts. This, in turn, means that the company is in danger of being closed down. Therefore, being able to predict cash shortages provides the business with the time to be proactive and resolve the situation before it arises.

- Helps to obtain external financing. Businesses can use cash flow forecasting to help them obtain external finances. For example, if a business wanted to take out a bank loan, the bank is likely to want to see historical cash flows and future forecasts before approving the financing.

- Helps to predict if they can pay employees and suppliers.Being able to pay them is absolutely crucial for any business. For example, imagine if you were a supplier and a business did not pay you for the stock you sold them. Would you supply them again? Likely, you would not. More importantly, if you were an employee and did not get paid, imagine how you would feel? You would be unmotivated at the very least but may also refuse to work or leave the business completely. Therefore, with a cash flow forecast, a business can be confident that they will have sufficient cash to ensure all payments are made on time or you can make arrangements to generate more cash if this is required.

- Helps to set targets to compare their actual income and expenses against forecasts over time. These can become targets for the business which you can monitor and compare your actual income and expenses against over time, allowing you to assess your performance.

- Helps to plan for the future. Once the cash flow forecast has been completed, it provides the business with key information and data, which businesses can then use to support its plan for the future, helping them to answer key questions, such as “Can we afford to employ more staff?”, “Can we afford to expand and open a new store?”, and “Can we afford to pay a bonus?”.

It is very important to recognize that the cash flow forecast is just a prediction of what a business thinks will happen in the future. It is not an exact science. Therefore, you should use this as a guide rather than assuming that this is what will happen.