Cash Disbursement Journal is a special journal used to record all payments of cash, also called Cash Payment Journal. This is a journal that we could use if we were to set up the accounting process by hand rather than having a computer system, like QuickBooks. The Cash Disbursement Journal will work best when there are just a few transactions that happen repetitively, like if the business is buying something consistently.

If we are setting up the process by hand, we may want to use special journals so we can record normal transactions. The special journal will be shorter than recording journal entries for every transaction at the end of the period (month, week, day). This way, our General Ledger will not be as cluttered.

The Cash Disbursement Journal will work best when there are just a few transactions that happen repetitively, like if the business is buying something consistently. Although it is usually used for a manual-based system, it is good to know how the Cash Payment Journal works for two reasons:

- It is a type of journal that could be in a similar format for reports we would want to be running within any accounting system, including an automated one.

- It is good to know how different accounting systems work, so we can see the similarities and the differences that are helping us to understand whatever system we are using.

Information Listed in the Cash Disbursement Journal

The Cash Disbursement Journal records all cash outflows of the business. Everything that is going to decrease cash will be recorded in this journal. This means that it will be a credit to cash, reducing cash. Such transactions might include:

- Expenses paid

- Assets bought

- Payments made to creditors

- Drawings

- Loan repayments

- GST paid

The format of the Cash Disbursement Journal is similar to the Cash Receipts Journal. The two are sometimes joined into one Cash Books. The Cash Payment Journal has the following columns:

- Date – the date of each cash payment

- Details – the name of the other ledger account affected (for creditors write the creditor’s name)

- Check Number – issued by the business (run in sequential order)

- Bank – the total amount of cash paid, which will be allocated to one or more columns on the right

- Creditor control – a column on the right reflecting the total amount deducted from the creditor’s account

- Stock control – a column on the right reflecting the cost of the stock purchased with cash

- Special columns – these will vary depending on the nature of each business (Advertising, Wages, Drawings, Discounts Received, etc.)

- GST – the goods and services taxes paid on transactions

- Other columns – for anything that does not fall into specific categories.

At the end of the period (usually a month), a Total Payment row will be added to the Cash Payment Journal, showing the total amount for each column. The accountants use data in this journal to make a posting in General Ledger and the subsidiary ledgers.

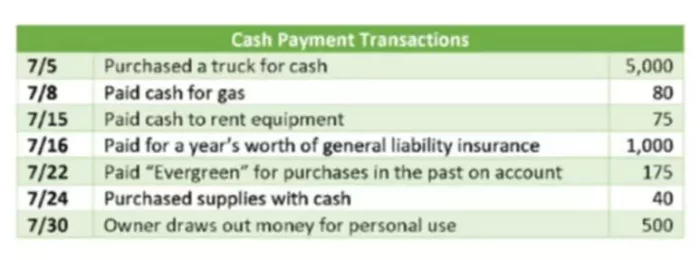

Cash Disbursement Journal Example

In this example, we will enter financial transactions for a landscaping company into the Cash Payment Journal. Then we will use that information to update Subsidiary Ledger and General Ledger

1.Record Information in the Cash Payment Journal

Our first step is to record the transactions into the Cash Payment Journal.

Since the cash is decreased, we will need the other account besides our Cash account to reflect it. In other words, this will be the debit side of the cash disbursement transaction. Since the four transactions are not something a company has regularly, we will record them under the Other column. If, for example, gas is a regular expense, it might make sense to break down the Other column and add a Gas expense column.

We record the payment to the Evergreen under the Accounts Payable because purchases on account might be something that is done regularly. If the company purchased supplies with cash regularly, such transactions might fall under the Landscaping Supplies.

At the end of the month (or another period), we can then sum these up. We will receive the total Disbursement for this time and can see which categories it was broke out too.

2.Update Subsidiary Ledger

Our next step would be to update the Subsidiary Ledger. For example, we will update the two subsidiary ledgers as follows:

3.Update General Ledger

Now, we will use the Cash Payment Journal totals to update the General Ledger accounts, making sure that debits equal credits.

Cash Payment Journal and Discounts Received

Some companies include discounts received column in the Cash Payment Journal. So purchase from a supplier will be recorded in the accounts payable ledger by crediting Cash and Discounts allowed accounts and debiting the Accounts payable.

Cash Disbursement Journal Proof of Postings

To ensure that everything was posted to the journal correctly, the total in the Bank column must equal the total of all other columns. For example, Bank = Creditors Control + Stock Control + Other Special Columns + GST. We usually check this at the end of the period. If this is not true, and you have added all the numbers correctly, then some transaction was not allocated correctly to all the columns. Another way to check that everything was transferred right is to see if the total debits are equal to the total credits in the general ledger.