The business structure is associated with many factors that are an integral part of a successful business. Choosing the most suitable business structure creates legal recognition of your trade. It gives you the best approach to resolving all tax liabilities. In addition, you understand all your duties and responsibilities as a business owner.

A corporation, also called C-Corporation or Regular Corporation, is a legal form of organization of persons and material resources registered by the State for the purpose of conducting business. Its main advantage is that corporations exist separately from their owners.

A corporation can have an unlimited number of shareholders and can be private or public. Therefore, it is suitable for high-class investments that need money for start-up or expansion capital. Typically, corporation shares are held by founders, board members, and private investors, such as venture capitalists, who may or may not sit on the board of directors.

How is a C Corporation Formed?

All businesses that incorporate are automatically C Corporations unless they elect otherwise. In the United States, corporations are formed under the laws of a state. The policies, articles, cost, and regulations for forming the C Corp vary from state-to-state. The basics of forming and maintaining the C Corp include:

- Register your Business Name;

- File a Certificate of Incorporation, which will specify business name and address, classes and number of share, designate incorporator and assigns initial powers of the Board of Directors and right to amend.

- Request a Corporate Charter and pay a Charter Fee;

- Draft corporate bylaws, hold a Stockholders’ Meeting, and have a corporate secretary to record minute meetings;

- Maintain a corporate structure and have each undertake actions appropriate with authority:

- Shareholders – These are the owners of the business, who vote and elect the members of the Board of Directors.

- Directors – They make major decisions, set the objects and goals of the business, and assign the officers.

- Officers – The individuals manage daily operations in an attempt to achieve the stated organizational objectives and goals.

- Employees must receive compensation. Directors and officers receive a salary, and shareholders are compensated through dividends.

- The corporation must adhere to corporate tax laws and regularly report and pay taxes.

- A corporation may be liquidated either voluntarily or involuntarily. This can be involuntary when creditors want all the debts to be repaid.

Advantages of C Corporations

For a long time, double taxation made the C Corp very disfavored because obviously, no one wants to pay that much more money in taxes. However, there are a few reasons to reconsider the C Corporation:

- A 2017 Tax Reform presented new tax rates. It used to be that corporations were taxed at a top marginal rate of 35%, which, when you stack 35% onto your personal tax rates can add up to as much as 39%. That tax rate is now lowered to a flat 21% rate.

- Ability to control when you take out the income in the form of the dividend or other distribution. So, if you have made a certain amount of money in a given year, and you do not want to get any more this year because it will be taxed at a higher rate, you can leave that money with the C Corporation.

- Qualified Small Business Stock Treatment is another often overlooked benefit of forming or buying the C Corp. If you buy a part of the C Corporation, you buy some shares directly from the C Corp and the company is worth less than $50 million after you acquired those shares, you have qualified small business stock.

- If you sell that stock after five years, the IRS lets you exclude up to 50% of the gain from that sale, meaning that you get a huge tax advantage when selling that interest. Moreover, losses are not considered a capital loss, so you can use it to offset your income from almost any other source.

- Ability to limit liability. If the corporation is sued, shareholders are liable to the extent that they invested in the corporation. This way, your assets are not on the line when creditors make claims.

- Unlimited growth potential. The ability to give stock options is critical when you are a growing company if you are a start-up. There is a widespread acceptance of C Corporations by venture capitalists and other investors.

- No shareholder limit as far as the IRS (tax code) is concerned. There are also no restrictions on who can hold the shares.

- Continuity. Corporations have complete continuity. A shareholder can pass their shares on to someone else unless there is some restriction in the shareholder agreement.

- Tax deductions. C Corporations have the ability to enjoy tax-deductible business expenses.

Disadvantages of a C Corporation

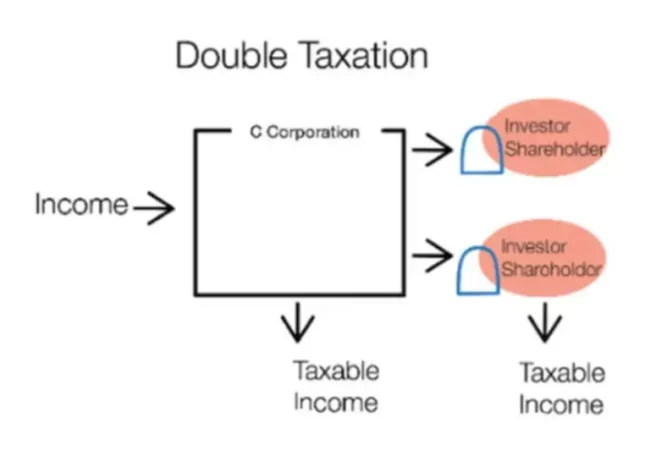

- Double-taxation. The C Corporation is known for a few things, mainly for double taxation. This means that when money goes to the corporation, the C Corporation pays taxes on that money at the standard corporate tax rate. Then, when that corporation gives that money back to its owners, which is treated as a dividend, that money is taxed again at the shareholder’s personal rate. The corporation is taxed whether it makes a dividend distribution or not. Only some working capital is allowed to be held, and it will not be taxed.

- Complicated formalities and legal requirements. There are many legalities, and it can be more expensive to start C Corp than an LLC. Moreover, you have to hold a formal board and shareholder meeting and keep accurate meeting minutes, even if you are a sole shareholder. Otherwise, you might lose your limited liability advantage. In addition, there are many tax forms to fill out, often requiring an accountant.

- Registration with the SEC. According to the corporate code, once you reach 500 shareholders and $10 million in assets, you are required to register with the SEC.

What Are the Differences Between an S Corp, C Corp, and LLC?

First, we need to clear that an LLC and an S Corp are both actually LLC’s. In other words, the LLC does not exist for tax purposes. It is a legal entity, and you choose how you want to be taxed: as a Sole Proprietor or as the S Corp. Below are just some of the differences between these structures.

- LLCs may be managed more informally than the Corporation. Corporate laws require a board of directors, meetings, minutes, and other management “formalities” that are not required for LLC.

- LLCs have great flexibility in deciding how to share their financial interests. The LLC can distribute its income to each member equally, based on their capital investments or in many other ways. The corporation distributes its earnings among shareholders based on a share percentage in the company.

- The LLC and S Corp are a pass-through tax organization. This means that their profits, unlike Corporation, are taxed only at the shareholder level through filing individual tax returns.

- The Corporation is more respected and popular among banks, investors, and counterparties.

- Corporations can issue an unlimited number of shares (S Corporations are restricted to 100 shareholders) to attract external capital.

- It is easier for Corporations to obtain external financing from venture capitalists and private equity funds, as well as to conduct an initial public offering of shares for several reasons mentioned earlier.

How Are Profits and Taxes Handled With a C Corp?

The C Corp is a separate taxpayer, with income and expenses taxed to the corporation and not owners. If you are the C Corporation, the tax rates for your business will be as follows:

- Income Tax Rate – A flat 21% tax rate on net business income;

- Dividend Tax Rates – A tax rate for qualified dividends (if you’ve held onto the underlying stock for at least 60 days) ranges between 0% to 20% depending on the income. A tax rate for unqualified/ordinary dividends is equal to the shareholder’s regular income tax rate.

As was mentioned before, the portion of the dividend is taxed twice because the corporation pays taxes on profits, and then this profit is taxed at a personal level (shareholders) as stock. Since the corporation is not obligated to distribute dividends, the shareholders do not have to pay taxes if they do not receive the dividends.

The cost of fringe benefits is deductible by the corporation and not considered taxable income to the employee. So, the more fringe benefits you have, the better. Tax breaks are possible if about 70% of the employees are to use the benefits. Thus, for most small businesses, it is not an advantage.

Nonetheless, taxation is very complicated. There are situations where even the double taxation regime gives a lower income tax liability for individuals involved than pass-through taxation. So, a professional must help the corporation and shareholders to plan and file their taxes.