Definition

The main purpose of a business is to make a profit, which is the main source of finances for the current activities of the enterprise and its future development. Since profit plays a major role in the company’s activities, it is important for business leaders and owners to know and understand what the level of sales should be below which the organization will lose money and above which it will earn.

It is this level of sales that is considered an acceptable minimum and when the organization will be able to pay for all its expenses and at the same time will not receive either profit or loss. This level is known as a break even point.

The definition of this term can be stated as the volume of sale of services, work, and products at which the income received fully compensates for the costs incurred. Subsequently, each unit produced will begin to bring a certain profit.

The break-even point is the moment in a company when its losses are completely covered, and the activity begins to bring real profits. When this point is surpassed, the company receives a profit, part of which fully covers the costs, and the other part remains at the disposal of the enterprise. If the organization has not reached that level, then it incurs losses.

The break even point calculation results show at what revenue level the profit will be zero and business spendings will be covered. Note that it is about profit, not income: revenue minus expenses is profit. Simply put, before the break even point is reached, the business is working in the red, when you step over the break even point, growth and profitability begin. This indicator is measured both in monetary terms and physical units.

Importance

The break-even point can be used by both internal and external users of the information. For example, internal users include business owners, economists, and financial analysts, directors of production and sales of products or services. External users usually include government agencies, creditors, and investors.

When you calculate the break even point, it will provide you with information necessary to understand:

- when the business pays off, so it makes sense to calculate the break even point before starting a business;

- how much the volume of sales should be increased, what price is optimal for income to grow, and the lowest price for products and services a business can afford;

- the minimum threshold for revenue at which the business will not become unprofitable;

- information for analysis and planning;

- investing attractiveness and the possibility of receiving a loan.

The break even analysis has one main task – to determine the break even point or when a company produces the minimum amount of products that will cover all the company’s expenses. One of the main goals of such analysis is to find out what would happen to the financial results of the enterprise in the event of changes in its production activity.

Calculation

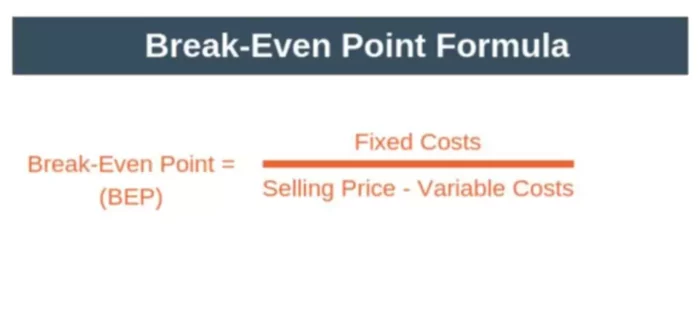

A straightforward equation can be used to find out how many units of goods or services you are trading your business needs to sell to receive just enough revenue to pay for your expenses:

According to this formula, you would take fixed costs, which do not vary over time within a certain relevant range (e.g. plant, property, equipment, and even advertising and insurance) your organization is likely to incur divided by the price your customers will pay for the service/product less variable costs, which vary based upon the number of units produced.